By Joel Dresang

At our last review, our investment advisor asked my wife and me if we had a budget. We said no.

We used to be mindful of every dollar we spent. We were vigilant about where our money went and how much would remain. My wife, bless her, would balance the checkbook each month.

Over time, our incomes improved, and our lifestyle didn’t keep pace. We continued to scrutinize our expenses – discussing whether we could afford an outing or a vacation or a piece of furniture. But gradually, we came to trust without looking. Instead of worrying about what we could afford, we had a sense of what we couldn’t afford.

Kyle Tetting says he has a lot of clients in similar circumstances: They no longer need to budget the way they did when they were younger. As they near retirement, though, he recommends creating a budget again.

“That is part of the conversation transitioning to retirement,” Kyle said in the May 10 Money Talk Podcast. “In order to give you some confidence that it’s OK to spend a little bit of this, maybe we should spend those last three months of your working life putting down on paper where the money’s going.”

Learn more

Investor, you need a budget, by Tom Pappenfus

Make a budget, worksheet from the Federal Trade Commission

Retirement: Thinking about spending, by Joel Dresang

Safe investment withdrawals for retirees, a Money Talk Video with Art Rothschild

Retirement 101: Having a plan, a Money Talk Video with Tom Pappenfus

Mint, the Budgeting App, Is Going Away. Here Are Some Alternatives, from The New York Times

Want to Stick to a Budget? Some Advisers Say Skip the Apps, Wall Street Journal video

I get it. When eventually we retire, it’ll be more like when we began our household together. We’ll need to get used to unfamiliar financial variables.

But it’s the reverse of when we started out. Then, our incomes were more predictable than our expenses. We needed to watch what we spent and adjust accordingly. When we retire, though, we’ll have to look at how we’re spending and figure out where we’ll get the money to support it.

“It’s very much about understanding where (the money’s) going so that you can then piece together what you have to work with,” Kyle explained.

My aim isn’t to set a budget that specifically dictates our spending priorities. That’s more useful in the early days of a household. We just want a good idea of how much we are spending so we can inform our expectations of how we’ll cover those costs in retirement.

To track where our money is going, we’ll still have to go through the process of recording each of our expenditures and assigning them to various categories.

Fortunately, unlike our early days, we spend less cash, so creating our budget won’t entail handling a lot of receipts. Likewise, we hardly ever write checks. Almost all of our outlays are reflected on our credit card statements – as well as my Venmo and PayPal records.

As Tom Pappenfus suggests in a Money Talk article about budgeting, a variety of online tools are available to aid in tracking expenses. I decided to combine a worksheet from the Federal Trade Commission with the monthly budget template from Google Sheets. The FTC worksheet is straightforward, not too detailed and yet hits all the major expense categories.

Yes, I know there are apps that will automate my efforts – to record and even categorize our transactions. But I’m just not in the mood of sharing access to our various accounts with an online tool. Some evidence suggests I’ll learn more by gathering our information and entering it manually in a spreadsheet.

And though this exercise is meant to track our expenses rather than to prioritize how we should be spending, it is providing us a look at our financial choices, which might prompt us to tweak how we use our money.

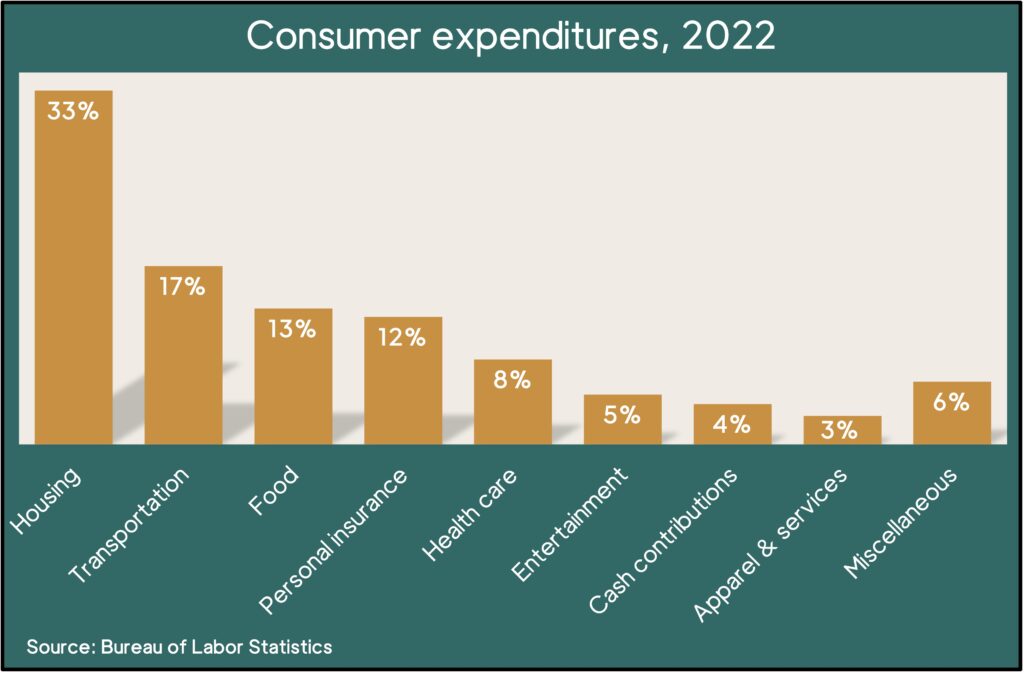

To be able to compare our spending with the average American, I found this information from the Bureau of Labor Statistics.

Now, it’s a matter of data entry. I plan to go through the last six months of credit card statements and entries in our checkbook and payment apps. Judging from some advice I’ve read, that may be more thorough than I need to be, but if I divide everything by six, it should give us – and our advisor – a fair estimate of what expenses we can plan for in retirement.

“The single most important thing we do really is help our clients realize what their money is for,” Art Rothschild said in an archived Money Talk Video. “And there’s nothing more important than talking to them about how much they can spend.”

Joel Dresang is vice president-communications at Landaas & Company, LLC.