By Joel Dresang

Our insurance agent emailed us last month to explain why our homeowner premium jumped 20% from a year ago. Part of his explanation: “the rapidly increasing inflation rate.” I responded with a polite correction. I thought he should know that his wording was misleading.

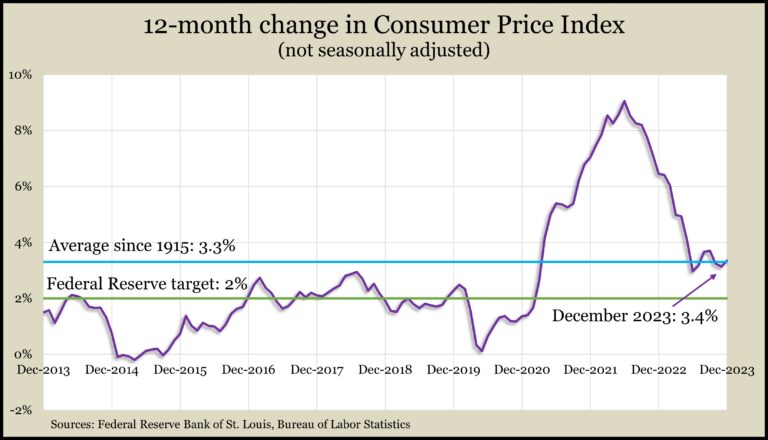

“Respectfully, you shouldn’t say the inflation rate is rapidly increasing,” I wrote. “Inflation almost always goes up, but it’s now less than half the rate it was a year ago. Even saying rapidly increasing inflation would be inaccurate because at around 3% a year, it’s near average historically.”

I suggested that saying just “increasing inflation” would convey rising prices as a source of escalating insurance premiums. And it would be accurate.

Regular listeners of the Money Talk Podcast have heard this before. How we talk about inflation matters. It makes a difference in how we feel about the economy and our place in it. It can affect our willingness to spend – which collectively accounts for two-thirds of the gross domestic product. It can affect our expectations and whether we feel our incomes – from work or from investments – are keeping up.

Inflation is a sustained increase in the price level of goods and services.

Disinflation is a decrease in the rate of inflation.

Deflation is a sustained decrease in the price level of goods and services.

Reflation is a government policy aimed to curb the effects of deflation.

Stagflation is the combination of a stagnant economy and high inflation.

Sources: Federal Reserve Bank of St. Louis, Investopedia

Inflation affects investors. When the inflation rate hit a four-decade high in mid-2022, the S&P 500 sank into a bear market. Wall Street has pounced on inflation reports as hints of what the Federal Reserve might do next.

“The market’s reaction is fascinating to me,” Art Rothschild said in a recent Money Talk Podcast. But the S&P barely budged when the Consumer Price Index for December came in higher than analysts expected: 3.4% vs. 6.5% in December 2022 and 9.1% in June 2022.

“If this would have happened six months or a year ago, the market would have been clobbered. Or there would have been concerns that the Fed is going to have to raise interest rates,” Art said. Instead? “It’s a yawn this week, which suggests to me we’re closer to the end of this having to talk about inflation.”

And while rising prices can inform consumers’ spending plans and fuel Fed speculation, Kyle Tetting noted that inflation also provides opportunities for companies to adjust their pricing.

“Investors need to remember the businesses they’re buying are price takers,” Kyle said on the podcast. “They’re looking at the market and saying, ‘What will the market bear?’”

Raising prices helps companies protect their bottom line from the rising cost of doing business. But at some point, critics question whether companies have crossed the line between passing along costs and padding profits. And at some point, customers push back, as the French retailer Carrefour did recently when it challenged PepsiCo’s efforts to increase prices by shrinking products.

With overall inflation slowing, Kyle said, many more companies will reach limits on how much they can increase prices – but not every company.

“From an investing side, I think there’s still plenty that can” raise prices, Kyle said. “And those are the businesses you want.”

Which isn’t to say that our insurance company was inflating premiums unreasonably. I give our insurance guy the benefit of the doubt. He probably got the wording from someone else anyway. In fact, he thanked me for my message.

The point is that how we talk about inflation can make a difference. For months, economists have been baffled by polls showing consumers sour on the economy – unduly so, given objective measures indicating higher earnings, increased stock prices and greater home values.

On the other hand, trends in spending, credit card debt and retail sales suggest individuals have not let their low opinions keep them from consuming. Also, the most recent polls suggest consumers may be starting to worry less about inflation and its consequences.

One challenge economists have found is that – more than ever and increasingly – political partisanship is influencing how we feel about the economy. Other factors include a progressively negative tone in economic news reports, especially on social media.

Particularly in a high-stakes election year – as facts get distorted and accuracy spurned – it’s important for investors to be careful what information they pick up and pass along and, most of all, how they let it affect them. It helps to have a long-term plan that separates personal financial interests from political beliefs and partisan passion. Investors benefit from having firewalls between their portfolios and the news they consume in general, Art explained in a previous Money Talk Video.

“If you’re acting immediately to some news item, you’re quite likely potentially going to be making a mistake. So, you shouldn’t react or act too quickly, to any information, regardless of whether you think it’s true or whether it might be false,” Art said.

“Don’t do anything that will, on a short-term basis, negatively impact your long-term investment plans.”

Joel Dresang is vice president-communications at Landaas & Company, LLC.

Learn more

What Is Inflation and How Does Inflation Affect Investing? Investopedia

Inflation: Prices on the Rise, International Monetary Fund

Inflation can cut both ways for retirees, by Joel Dresang

Investor upsides as interest rates rise, a Money Talk Video with Kendall Bauer and Kyle Tetting

Inflation: Nuances matter for investors, by Kyle Tetting

Stocks offset fears of inflation over time, by Joel Dresang

Making financial sense of “breaking news,” a Money Talk Video with Art Rothschild