By Joel Dresang

The slowdown in overall U.S. inflation means slimmer raises for Social Security recipients in 2025.

If you haven’t already, set up a free, secure, personalized Social Security account online https://www.ssa.gov/myaccount/

Learn more

Social Security benefits not going away, by Joel DresangFrequently Asked Questions, from the Social Security Administration

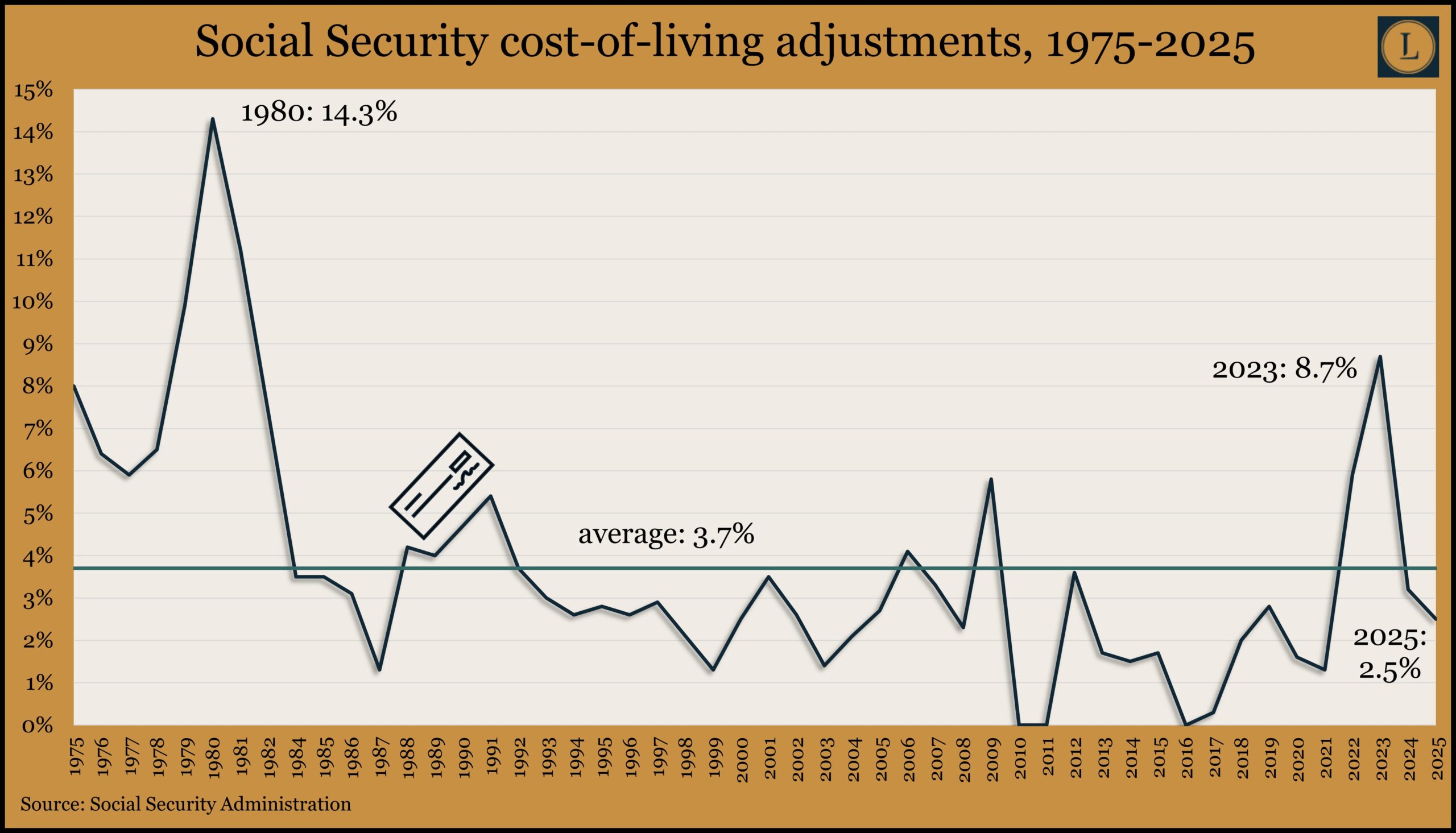

The Social Security Administration says beneficiaries will get a raise of 2.5% beginning in January. That’s down from the 3.2% increase in 2024 and the whopping 8.7% boost in 2023. Since cost-of-living adjustments began in 1975, the average has been 3.7%.

Social Security’s annual cost-of-living adjustment (COLA) is based on a version of the federal Consumer Price Index, which measured broad inflation at 2.4% in September. That was down from a four-decade high of 9.1% in June 2022. The Federal Reserve Board had been raising short-term interest rates to try to get inflation closer to its long-range target of 2%. It began cutting rates again in September.

Social Security said the average recipient can expect an added $49 in their benefit checks come January. For the average retired couple, with each spouse receiving benefits, the monthly check would go up by $75 to $3,089.

Also, Social Security has updated the individualized COLA statements it sends out to beneficiaries.

“The simplified COLA notice is now only one page, uses plain and personalized language, and provides exact dates and dollar amounts of a person’s new benefit amount and any deductions,” the administration said.

Social Security is making other inflation adjustments, including raising the income limits on how much retirees receiving benefits may earn without forfeiting up to half of their government checks.

Joel Dresang is vice president-communications at Landaas & Company, LLC.