Roth trivia

William V. Roth Jr. was a longtime U.S. senator from Delaware who was said by President Biden to be “the person I trusted most in my public life.”

Known as a champion of tax cuts, the five-term Republican is the namesake for the Roth IRA, which was part of the Taxpayer Relief Act of 1997. The traditional IRA, which unlike the Roth allows tax deductibility for retirement contributions, was included in the Employee Retirement Income Security Act of 1974. The employer-sponsored 401(k) retirement account came after the IRA via the Revenue Act of 1978.

Our Roth will afford us flexibility when we seek cash in retirement.

By Joel Dresang

It snowed on our way up to the family cottage this spring. I was glad I was wearing hiking boots that were waterproof and ankle-high. The next day, the skies cleared, the sun beamed and the temperature rose to the 60s. Then I was glad I had my tennies along so I could be more comfortable.

I know that snow’s a likelihood Up North in late March. I know too that it can get unseasonably warm. By considering the possibilities, I packed footwear for both occasions.

Similarly, my wife and I have been funding a diversity of accounts for our retirement.

For as long as I could, I have been funneling part of my pay into an employer-sponsored 401(k). We also made annual contributions to my wife’s IRA up until a few years ago. Then we shifted those yearly IRA deposits to a Roth IRA.

Both the 401(k) and the Roth have tax advantages aimed at encouraging us to invest for retirement. In both, investments grow tax-free. The chief difference is the point at which the money we put in is subject to income taxes.

For our Roth deposits, we already paid taxes, which means we’ll face fewer conditions on our withdrawals. Contributions to my 401(k) come out of my paycheck before taxes, which lowers our taxable income at the time but includes more strings attached when we take the money out.

I’m familiar with the importance of diversifying investments — not putting all our eggs in the same basket. The principle applies not only to how assets are allocated (the mix between stocks and bonds, for instance) but also for how our retirement money is treated for tax purposes. It’s not all the same to the IRS.

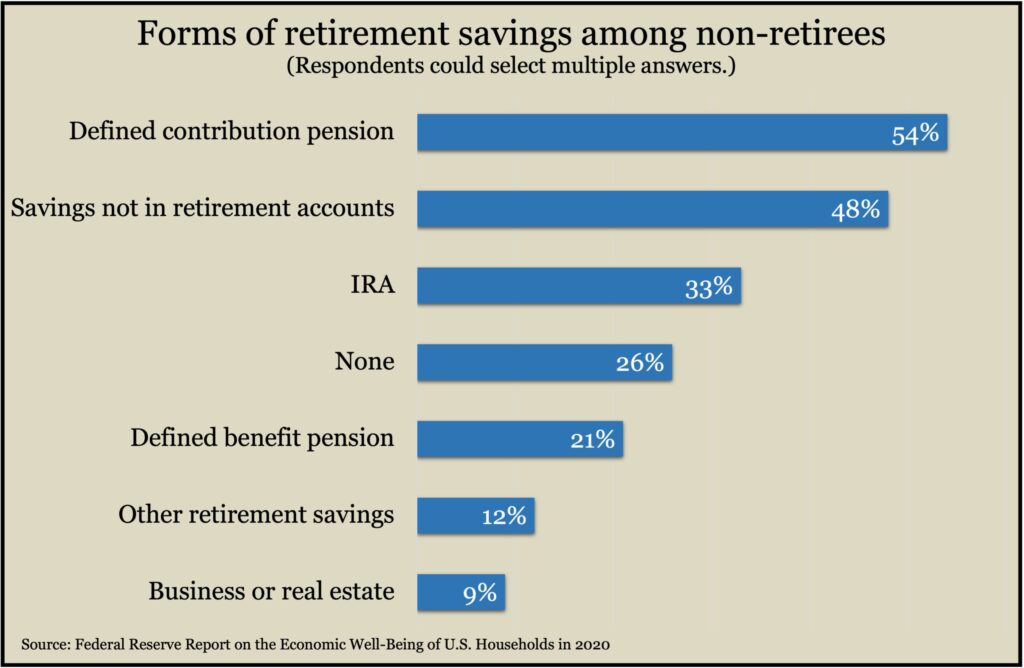

Defined-contribution plans like 401(k)s are the most popular way to save for retirement, used by 54% of Americans who are setting aside retirement money, according to the Federal Reserve. The second-leading retirement account is the IRA, used by 33% of those who are saving and not yet retired.

The Fed survey doesn’t distinguish between traditional IRAs and Roths, but the Investment Company Institute estimates that Roths accounted for less than one-tenth of the $12.2 trillion held in all IRAs at the end of 2020.

So, it’s fair to say that most retirement money is based on pre-tax contributions, which let investors lower their taxable income in the years they contribute. They still pay taxes on the money when they’re required to take it out in retirement, but if their tax bracket is lower then, they’ve saved.

Using my tax return and looking at IRS tax brackets, I see that our taxable income currently puts us in the 22% marginal tax rate. Back-of-the-envelope projections on our retirement income — including pensions, Social Security benefits and proceeds from our investments — falls in the 12% marginal rate.

In other words, we’re avoiding 22% income taxes on 401(k) contributions for which we can expect to pay 12% when we withdraw them later. So, it makes sense for us to continue accumulating in our 401(k). But it’s also wise for us to keep adding to our Roth.

“Don’t be focusing on just one thing,” Art Rothschild advises.

“Anyone with excess cash flow accumulating money for retirement should consider the Roth,” Art says. “They’ll have all these pockets to get different money out of, with different consequences.”

Unlike our 401(k) and IRA, we’ll be able to take money from our Roth without the withdrawal being considered taxable income, which can also affect the taxability of Social Security benefits. Also, Roths are not subject to required minimum distributions, so we don’t even have to touch that money if we don’t want to. Between 2007 and 2016, only 6% of Roth account holders took withdrawals, according to the Investment Company Institute, as opposed to 22% of IRA owners in their 60s and 79% of those 70 and older.

The point is, the Roth gives us another option for cash in our retirement arsenal, and it’s ours tax-free. In fact, because we’ve had the Roth account for more than five years, and because we’re older than 59½, we have access to the money even before retirement without penalties.

How much to fund a Roth vs. a 401(k) or traditional IRA depends on individual circumstances, Art says. For instance, if we expected to be at a higher marginal tax rate in retirement, we’d want to lean more on our Roth. Both contributing to and withdrawing from a Roth entails informed forethought — another reason to keep in touch with investment advisors and tax professionals.

We plan ahead and get prepared because we never know for sure what’s going to happen. We could be slogging through snow or walking in sunshine. Saving for retirement with both pre-tax and nondeductible contributions gives us more flexibility for handling the uncertainties of retirement when we get there.

Joel Dresang is vice president-communications at Landaas & Company.

Learn more

Deciding which retirement accounts to tap, a Money Talk Video with Dave Sandstrom

Safe investment withdrawals for retirees, a Money Talk Video with Art Rothschild

Retirement investing: Where to begin, a Money Talk Video with Kyle Tetting

IRAs 101: What you need to know, from the Financial Industry Regulatory Authority

When should I …take my required minimum distribution?by Chris Ever