Podcast: Play in new window | Download

Advisors on This Week’s Show

Kyle Tetting

Adam Baley

Kendall Bauer

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Sept. 23-27, 2024)

Significant Economic Indicators & Reports

Monday

No major releases

Tuesday

Housing prices reached another all-time high July, according to the S&P CoreLogic Case-Shiller home price index. Although prices peaked for the 14th month in a row, the pace of increase slowed to 5% above the year-ago level, down from 5.5% in June. That was the fourth monthly deceleration since February, when prices were up 6.5% from the year before. Of the top 20 housing markets, 18 showed weaker pricing, including eight that had decreases from June. An S&P analyst said houses in lower price tiers continued to gain the fastest.

The Conference Board said its consumer confidence index fell in September by the widest margin in more than three years. The business research group said more consumers expressed concerns about labor conditions, although fewer worried about recession, which the Conference Board had warned about through much of 2023. Prices and inflation still ranked as top economic fears, even though the group noted that price gains overall have been ebbing.

Wednesday

The seasonally adjusted annual rate of new home sales fell nearly 5% in August, although it remained above the pre-pandemic level. The Commerce Department reported the sales rate was up nearly 10% from the same time last year and the median price was down almost 5%, as lower-priced houses made up a greater share of the sales. The sales pace of 716,000 houses in August compared to a recent high of nearly 1 million in late 2020 and an all-time peak of 1.4 million in 2005. The supply of new houses for sale outpaced the pre-pandemic level for the 39th month in a row.

Thursday

The Commerce Department said orders for durable goods were unchanged in August following a 10% increase in July and a nearly 7% decline in June. A swing in large orders for commercial aircraft affected the month-to-month totals. Excluding transportation equipment, demand for durable goods rose 0.5% in August. Compared to August 2023, orders declined 1.3% for all durable goods but rose 1.2% not counting transportation. Core capital goods orders, a proxy for business investments, rose 0.2% from July and were up 0.3% from the year before.

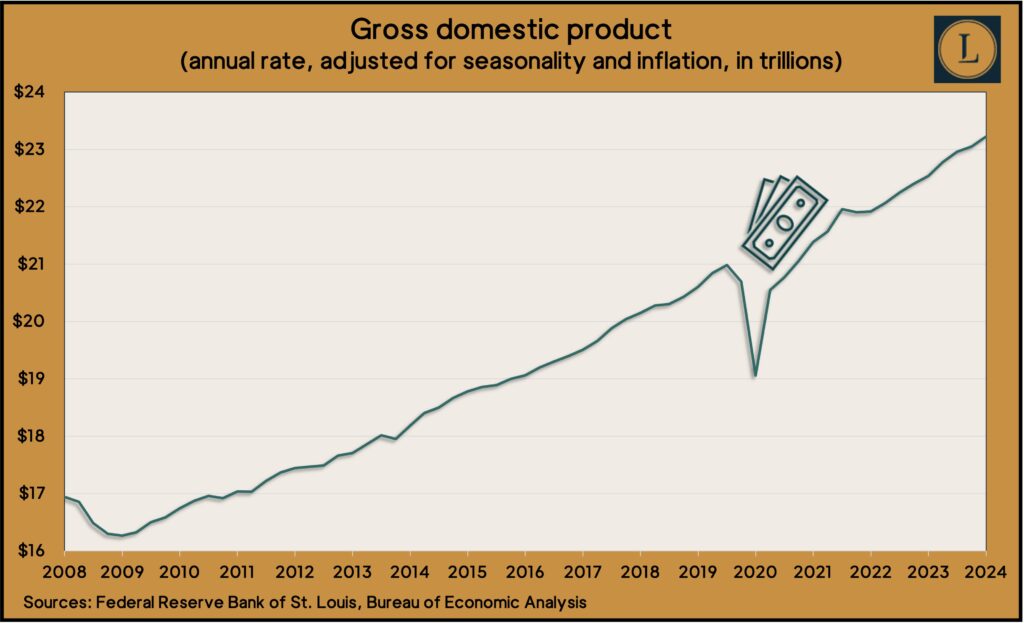

The U.S. economy grew at an annual pace of 3% in the second quarter of 2024, according to a final estimate of the gross domestic product. The rate was unchanged from a previous estimate by the Bureau of Economic Analysis and improved from 1.6% in the first quarter. Consumer spending, which drives more than two-thirds of the economy, was slightly slower than initially estimated but still a steady 2.8% annual rate.

The four-week moving average for initial unemployment claims dropped for the sixth time in seven weeks, falling to the lowest level since early June. The average was down 38% from its 57-year average, highlighting employers’ continued reluctance to let workers go. The Labor Department said nearly 1.7 million Americans were claiming unemployment compensation in the latest week, down 2% from the week before.

The National Association of Realtors said its index on pending home sales rose 0.6% in August after reaching a record low in July. The indicator of housing demand ticked up as slightly lower mortgage rates have helped improve affordability, the trade group said. Plans to buy houses were down 3% from the year before. According to the index, pending home sales are about 70% of what they were in 2001.

Friday

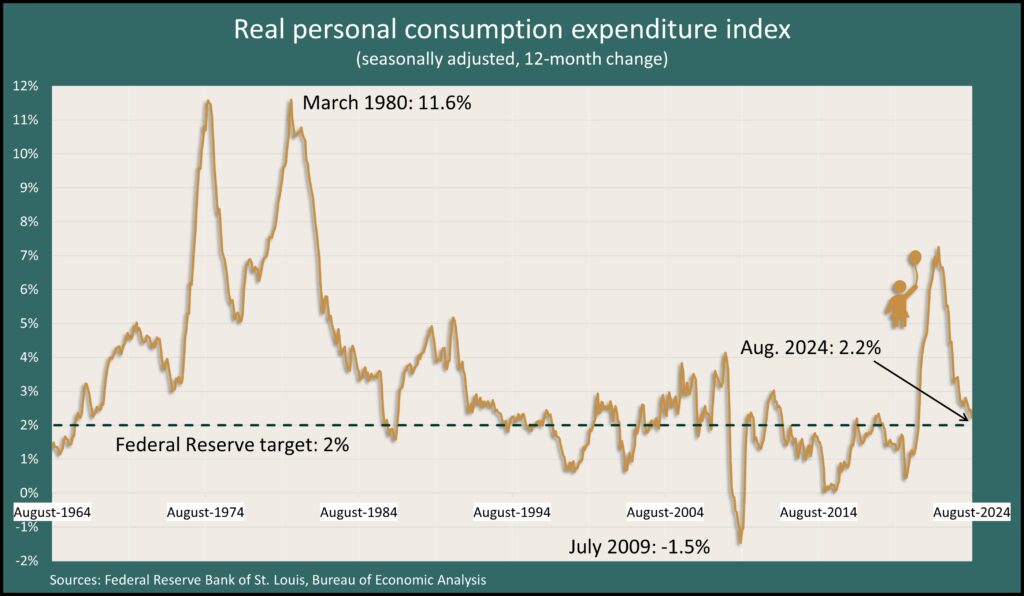

Consumer spending increased 0.2% in August, in line with gains in income for the month but at the slowest pace since January. Corrected for inflation, spending was up 0.1%, according to the Bureau of Economic Analysis. Spending rose only in services, led by housing, financial services and insurance. Spending on goods declined. The Federal Reserve’s favorite inflation gauge – the personal consumption expenditure index – edged down to 2.2% from the same time last year, the smallest increase in three and a half years. The rate reached a four-decade high of 7.1% in June 2022. Just before the 2020 pandemic, it was at 1.6%.

The University of Michigan’s consumer sentiment index rose 3% in September on broad improvements in both expectations and assessments of current conditions. Though still below historic averages and held back by concerns about prices, consumers’ overall outlook reflected recognition that inflation overall has been moderating. The director of the survey said sentiment appears to be building momentum even while many consumers say they’re tying their expectations to the results of the presidential election.

Market Closings for the Week

- Nasdaq – 18120, up 171 points or 1.0%

- Standard & Poor’s 500 – 5738, up 36 points or 0.6%

- Dow Jones Industrial – 42313, up 250 points or 0.6%

- 10-year U.S. Treasury Note – 3.75%, up 0.02 point