Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, engineered by Jason Scuglik)

Week in Review (Sept. 9-13, 2024)

Significant Economic Indicators & Reports

Monday

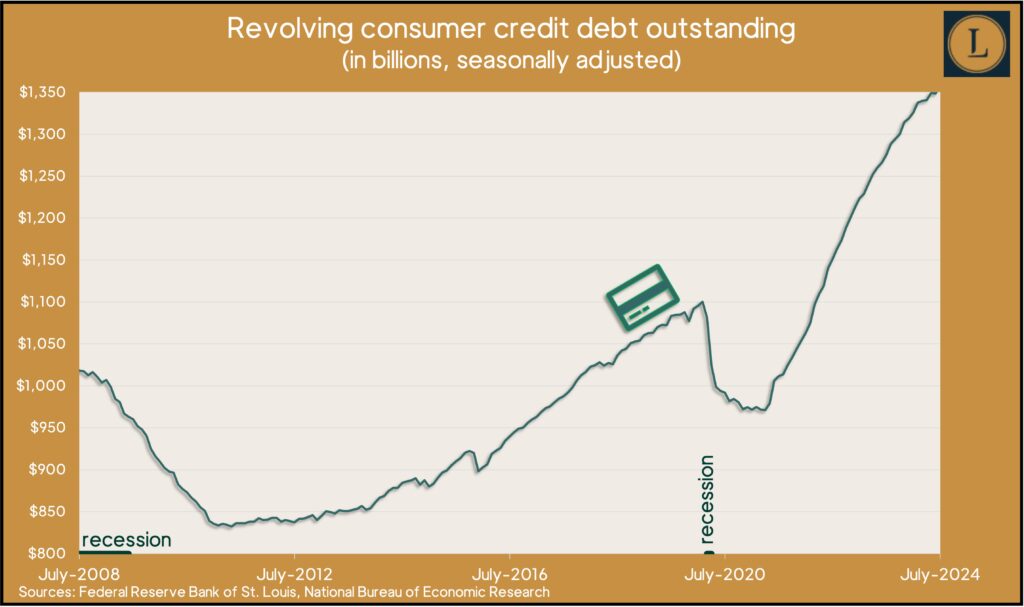

In a sign of resilient consumer spending, the Federal Reserve Board reported another rise in consumer credit debt outstanding in July. Total debt rose at a 6% annual rate, and more significantly, revolving credit climbed at a clip of 9.4%. Revolving credit is mostly consumer credit card debt, and its advance in July was the 38th in 39 months, following a slight decline in June. Rising credit card use suggests consumers’ confidence in their spending, which accounts for more two-thirds of U.S. economic activity.

Tuesday

No major announcements

Wednesday

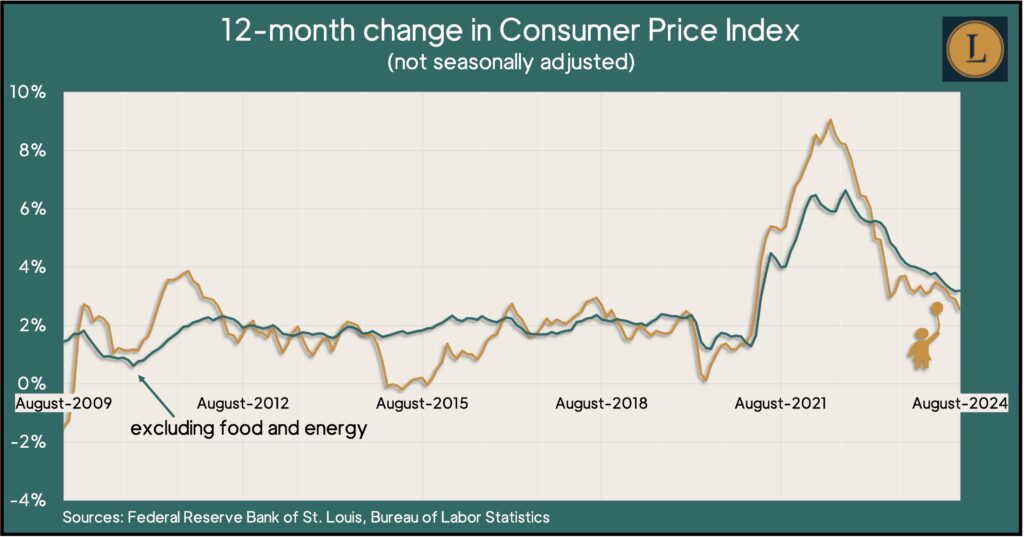

The broadest measure of inflation reached its lowest level in three and a half years in August. The Consumer Price Index rose 0.2% from the month before, led by a 0.5% increase in shelter costs, according to the Bureau of Labor Statistics. Compared to the same time last year, the inflation rate edged down to 2.5%, the slimmest margin since February 2021. The core CPI, which excludes volatile prices for food and energy items, rose 3.2% from the year before, tied with July as the lowest since April 2021. The Federal Reserve Board has used higher interest rates to dampen inflation since 2022, when the CPI hit a four-decade high of 9.1%. Analysts expect the central bank to beginning cutting rates this month as inflation has neared the long-range target of 2%. The average annual CPI since 1914 was 3.3%.

Thursday

The Bureau of Labor Statistics said its Producer Price Index, a measure of wholesale inflation, rose 0.2% in August. It marked only the second gain in four months, with no change in May or July. Costs of services made up the entire increase because good prices overall were level. Since August 2023, the PPI rose 1.7%, the lowest in six months. Excluding food, energy and trade services, the core PPI rose 0.3% from July and was up 3.3% from the year before.

The four-week moving average for initial unemployment claims rose for the first time in five weeks. According to Labor Department data, the average moved to 230,750 new applications, 37% below the average since 1967. Just over 18 million Americans claimed jobless benefits in the latest week, down more than 2% from the week before and 3% higher than the year before.

Friday

The University of Michigan reported preliminary results of its September consumer sentiment index. The longstanding report is based on surveys of consumers, whose spending drives more than two-thirds of U.S. economic activity.

Market Closings for the Week

- Nasdaq – 17684, up 993 points or 6.0%

- Standard & Poor’s 500 – 5626, up 218 points or 4.0%

- Dow Jones Industrial – 41394, up 1048 points or 2.6%

- 10-year U.S. Treasury Note – 3.65%, down 0.06 point