Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl and Joel Dresang, engineered by Jason Scuglik)

Week in Review (Nov. 4-8, 2024)

Significant Economic Indicators & Reports

Monday

Reflecting weak demand for manufacturing goods, the Commerce Department said the value of factory orders fell in September for the second month in a row and the fourth time in five months. Sales of commercial aircraft led the decline. While orders overall dropped 0.5% from August, commercial aircraft fell 22%. Compared to September 2023, total orders were unchanged, but excluding the volatile transportation category, orders rose 1.3%. Demand for core capital goods, a proxy for business investments, rose 0.7% from August and were up 0.3% from the year before.

Tuesday

Imports rose while exports slumped in September, thus widening the U.S. trade gap by 19% to $84.4 billion. The value of exports declined by 1.2% from August, led by drops in pharmaceutical products, commercial aircraft and crude oil, the Bureau of Economic Analysis reported. Imports rose by 3%, possibly as U.S. companies anticipated higher tariffs. Through the first three quarters of 2024, the trade deficit widened nearly 12% from the same time in 2023, with exports gaining nearly 4% and imports growing more than 5%. Trade deficits detract from gross domestic product, the broadest measure of overall economic growth, and held back third-quarter gains by more than half a percentage point.

The service sector of the U.S. economy grew in October for the fourth month in a row and at the fastest rate since July 2022. The Institute for Supply Management said its services index showed business activity and new orders growing, though at a slower pace, while hiring expanded after previously contracting. The trade group said its survey of purchasing managers suggests the overall economy was growing at an annual rate of 2.3%. Survey respondents expressed concerns about political uncertainty as well as the hurricanes and port strikes that occurred in October.

Wednesday

No major releases

Thursday

The Bureau of Labor Statistics said the annual rate of worker productivity rose in the third quarter by 2.2%, as economic output advanced at a 3.5% pace and hours worked grew by 2.2%. Measuring year to year, third-quarter productivity rose 2%, exceeding the 1.8% average annual pace since the current business cycle began at the end of 2019, just before the COVID pandemic. That’s better than the 1.5% during the previous cycle that began with the Great Recession at the end of 2007. Since 1947, productivity has averaged 2.1% a year. The same report showed labor costs rising at a 1.9% pace in the third quarter and up 3.4% from the same time last year.

The four-week moving average for initial unemployment claims fell for the second week in a row to its lowest level in five weeks. Data from the Labor Department showed the four-week average down 41% from its 57-year average, reflecting continued reluctance by employers to let workers leave amid a relatively tight hiring market. More than 1.6 million Americans were claiming jobless benefits in the latest week, down 0.5% from the week before and up 2.7% from the same time in 2023.

As expected, the Federal Reserve Board eased short-term interest rates in its efforts to preserve the labor market amid softening inflation. The Fed’s policymaking board – the Federal Open Market Committee – lowered the benchmark fed funds rate by a quarter percentage point to a range of 4.5% to 4.75%. The cut followed a half-point reduction in September, the Fed’s first cut after more than two years of increasing interest rates to combat decades-high inflation.

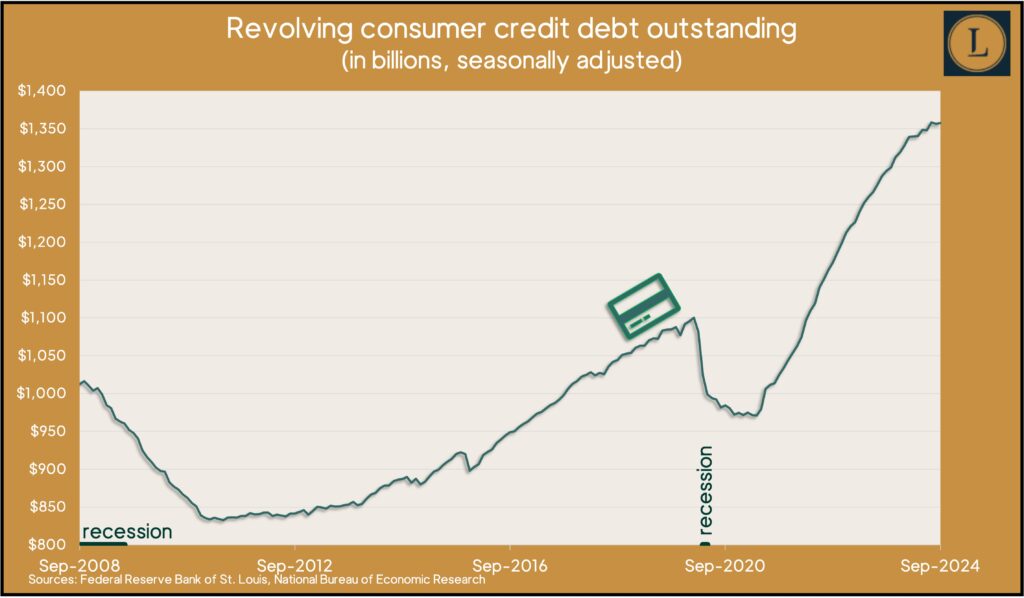

The Federal Reserve reported that revolving consumer credit rose at an annual rate of 0.9% in September. Following a 1.9% decline in August, the increase suggests consumer spending – which drives about two-thirds of the U.S. economy – remained resilient. The pace of credit card debt reached 2.8% in the third quarter, up from 2.6% in the second quarter but down from a 6.3% annual rate in the first quarter. Credit card borrowing took two years to recover from its pre-pandemic peak. In contrast, it took a decade to recover from the financial collapse and the Great Recession.

Friday

The University of Michigan said consumer sentiment is rising for the fourth month in a row to its highest level since May. Consumers surveyed in the university’s preliminary November report registered their highest expectations for the economy and their personal finances since July 2021. Overall sentiment was up 50% from its historic low in mid-2022 but remained below pre-pandemic levels. Expectations for long-term inflation were “modestly elevated” from where they were just before the pandemic. Economists follow sentiment surveys for possible signs of consumer spending trends.

Market Closings for the Week

- Nasdaq – 19287, up 1047 points or 5.7%

- Standard & Poor’s 500 – 5996, up 267 points or 4.7%

- Dow Jones Industrial – 43989, up 1937 points or 4.6%

- 10-year U.S. Treasury Note – 4.31%, down 0.05 point