Podcast: Play in new window | Download

Advisors on This Week’s Show

Kyle Tetting

Kendall Bauer

Tom Pappenfus

(with Max Hoelzl and Joel Dresang, engineered by Jason Scuglik)

Week in Review (May 13-17, 2024)

Significant Economic Indicators & Reports

Monday

No major releases

Tuesday

Inflation on the wholesale level registered a 2.2% annual increase in April, the highest in 12 months. The Producer Price Index was down from as high as 11.2% in mid-2022, but stayed above the Federal Reserve’s 2% long-term inflation target. The Bureau of Labor Statistics said the index rose 0.5% from March, mostly because of higher prices for services, led by portfolio management fees, but also due to an increase in the cost of gasoline. The core rate of wholesale inflation, stripping out volatile prices for food, energy and trade services, rose 0.4% for the month and was up 3.1% from April 2023.

Wednesday

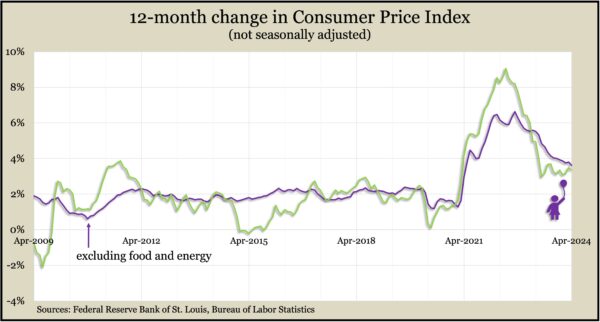

Broad inflation slowed in April after stalling a couple of months. The Bureau of Labor Statistics reported that its Consumer Price Index rose 3.4% from April 2023, still outpacing the Fed’s 2% target but down from a four-decade high of 9.1% in mid-2022. Shelter costs and gas prices accounted for 70% of the monthly rise in the index. Excluding volatile costs for food and energy, the core CPI rose 3.6% from the same time last year. That was the slightest gain in three years.

Retail sales also slowed in April, according to a report by the Commerce Department. Advanced sales by retailers and food services were unchanged from March. Among 13 major categories, six increased sales from the month before, including gas stations, which benefited from higher prices, and bars and restaurants. Car dealers and online retailers were among the seven categories with lower sales. Adjusted for inflation, retail sales rose 0.2% in April. Economists follow retail signs as an indication of consumer spending, which drives two-thirds of the U.S. economy.

Thursday

The four-week moving average for initial unemployment claims rose for the second week in a row, rising to its highest level since February. Still, the measure of employer reluctance to let workers go was 41% below the 57-year average, suggesting a continued tight labor market. According to Labor Department data, total jobless claims fell less than 1% from the week before to just under 1.8 million applications, which was nearly 5% higher than the year before,

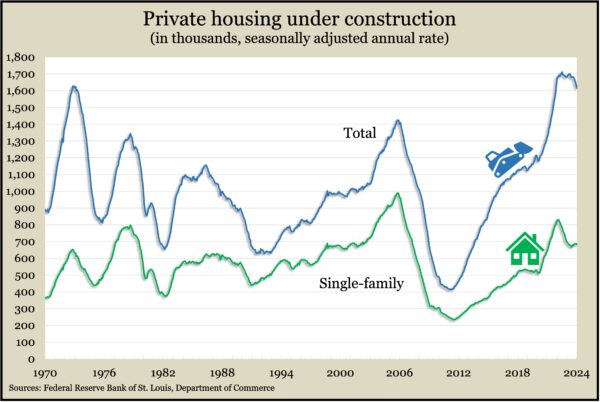

Housing construction in April stayed in a relatively narrow band that has accompanied higher interest rates since mid-2022. A Commerce Department report on building permits and housing starts showed the indicators on par with levels just before the Great Recession in 2008. The number of houses under construction remained near record highs, especially for multi-family housing. Economists have blamed a lack of inventory for years of escalating housing prices.

The Federal Reserve said its industrial production index was unchanged in April, dipping to a slight decline from the year before. Lower output from manufacturers dragged down total production. Manufacturing retreated by 0.3% from its output in March and was down 0.5% from April 2023. The broad manufacturing drop-off was led by a 2% decline among automakers. Industry’s capacity utilization rate fell marginally to 78.4%, staying below the 40-year average of 79.6%. Manufacturers were using 76.9% of their facilities, down from a long-time average of 78.2%.

Friday

The Conference Board said its leading economic indicators shrank 0.6% in April, following a 0.3% decline in March. The business research group said the index contracted by 1.9% since October, which was shallower than the 3.5% decrease in the previous six months. Among the indicators contributing to the April slide were consumer confidence, yield spread, factory orders, building permits and stock prices. Although the Conference Board is no longer forecasting a recession for the U.S. economy, it’s seeing annual growth slowing to less than one percent.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 16686, up 355 points or 2.1%

- Standard & Poor’s 500 – 5303, up 81 points or 1.5%

- Dow Jones Industrial – 40004, up 492 points or 1.2%

- 10-year U.S. Treasury Note – 4.42%, down .08%