Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (March 3-7, 2025)

Significant Economic Indicators & Reports

Monday

A two-month expansion of the manufacturing sector slowed in February amid uncertainty over the consequences of federal trade policies. The Institute for Supply Management said its survey-based manufacturing index signaled the second consecutive month of growth after 26 months of contraction. “Demand eased, production stabilized, and destaffing continued,” reported the trade group, which said the index suggested the overall U.S. economy was growing at an annual rate of 2.2%.

Extraordinary weather might have influenced a slight decline in construction spending in January. The Commerce Department said the average annual rate of such spending dropped 0.2% from December to nearly $2.2 trillion. Spending was 3.3% ahead of the year-ago pace. Residential construction, which made up more than 40% of the total spending, fell 0.5% from December because of a drop in multi-family housing expenses. Spending on housing rose more than 3% from January 2024, though it fell 12% for multi-family.

Tuesday

No significant reports

Wednesday

A lift in commercial aircraft demand sent U.S. factory orders higher in January for the first time in three months. The Commerce Department said orders overall rose 1.7% from December and were 13.5% ahead of their level the year before. Excluding volatile orders for transportation equipment, demand rose 0.2% for the month and was up 2.3% from January 2024. Core capital goods orders, a proxy for business investments, rose 0.8% for the month and were up 2.2% from the year before.

The service sector of the U.S. economy expanded in February for the eighth month in a row and at a slightly faster pace. The Institute for Supply Management said the four most impactful index components rose together for the third month in a row, the longest streak in nearly three years. The ISM’s survey of supply managers reported anxiety over tariffs and federal spending reductions.

Thursday

The Bureau of Labor Statistics said worker productivity rose at an annual pace of 1.5%, in the fourth quarter of 2024, revised from 1.2% in an earlier estimate. The rate resulted from the annual pace of output rising 2.4% in the last four months of the year while hours worked increased at a 0.8% pace. Productivity advanced 2% over the last four quarters. Average annual productivity was up 1.9% since the end of 2019, compared to 1.5% in the previous business cycle, dating back to 2007. The average annual productivity gain since 1947 has been 2.1%.

The U.S. trade deficit widened 34% in January to a record $131.4 billion. Exports grew by 1.2%, led by commercial aircraft, and imports rose 10%, led by industrial supplies, pharmaceuticals, computers and cellphones. The Bureau of Economic Analysis reported that compared to January 2024, the trade gap expanded by 96%, with exports rising 4% and imports up 23%. Economists consider trade deficits a detraction from overall economic growth.

The Labor Department reported the four-week moving average for initial unemployment claims dropped for the third week in a row. It remained 42% below its average since 1967 and was 2% above its level just before the COVID-19 pandemic. Total claims for the latest week declined marginally from the week before to 2.1 million. That was 10.5% higher the year before.

Friday

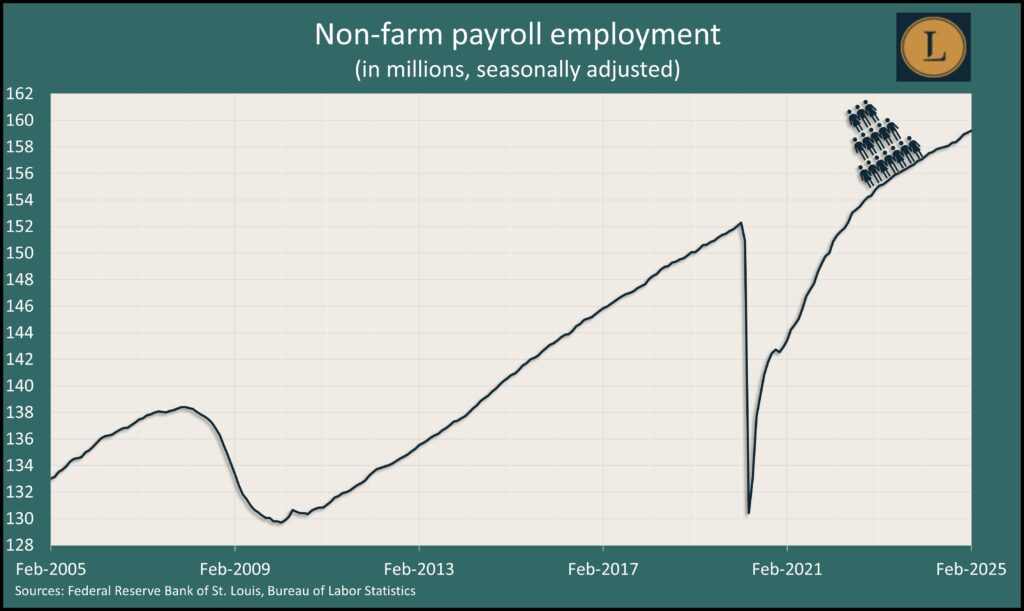

Employers added 151,000 jobs in February, and the unemployment rate edged up to 4.1%. The Bureau of Labor Statistics’ monthly jobs report, combining payroll data and household surveys, showed the pace of hiring rise below the 12-month average, but its 50th straight month of growth was the second-longest streak in data back to 1939. The average hourly wage rose 4% from February 2024, outpacing broad inflation since last May. The report included a couple of signs of labor market strain:

- Temporary help employment, considered a harbinger of hiring trends, fell to 20% below its 2022 peak.

- The average workweek remained at the lowest level since the onset of the pandemic, which was the lowest since just after the Great Recession.

- The U-6 measure of underemployment reached 8%, the highest since October 2021 and above the pre-pandemic level for the 16th month in a row.

Market Closings for the Week

- Nasdaq – 18196, down 651 points or 3.5%

- Standard & Poor’s 500 – 5770, down 184 points or 3.1%

- Dow Jones Industrial – 42802, down 1039 points or 2.4%

- 10-year U.S. Treasury Note – 4.32%, up 0.09 point