Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (March 17-21, 2025)

Significant Economic Indicators & Reports

Monday

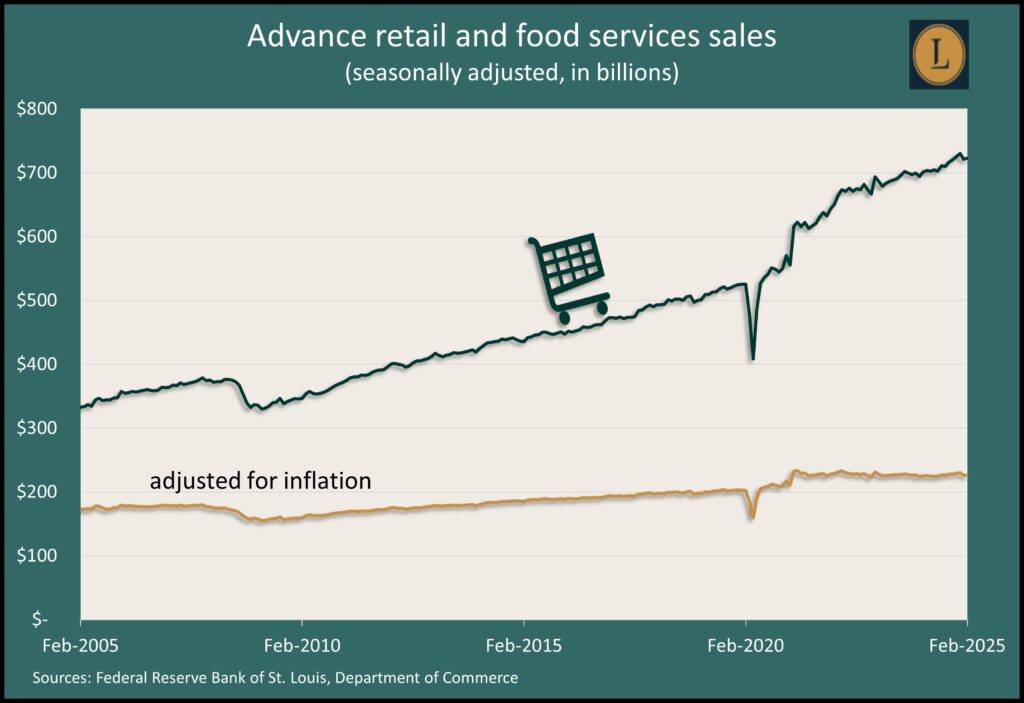

Following a deeper decline in January, retail sales gained a mere 0.2% in February, the Commerce Department reported. Of 13 retail categories, only five improved sales for the month, led by online vendors. Decliners included gas stations, which were affected by lower prices, and bars and restaurants, where sales fell for the first time in 11 months. Car dealers experienced lower sales in February after weather-related setbacks in January. Retail sales represent most of the nation’s consumer spending, which accounts for about 70% of U.S. economic activity.

Tuesday

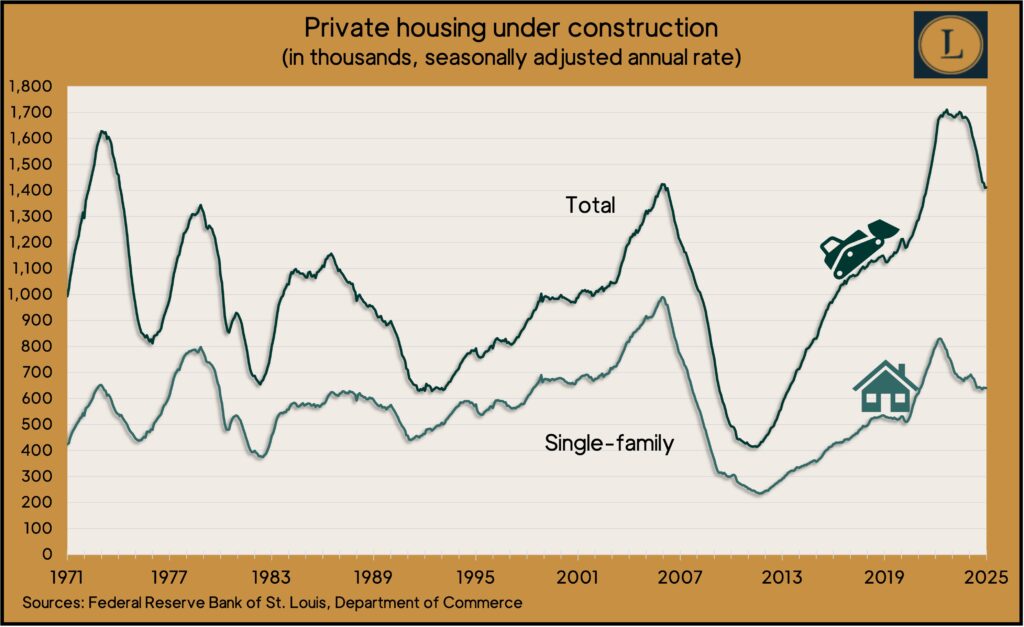

The pace of housing starts rose 11% in February, though it was 3% behind the year before, the Commerce Department and Department of Housing and Urban Development reported jointly. Permits for new housing declined slightly at a seasonally adjusted annual rate. Amid longstanding low inventories, the rate at which new houses are being completed is finally reaching levels not seen since before the Great Recession. Also, housing under construction kept declining but remained among the highest levels since 1970.

U.S. industrial production rose 0.7% in February, the third gain in a row, according to the Federal Reserve. Manufacturing led the way with a 0.9% increase from January. Auto manufacturing production rose 8.5%, but even without auto makers, industrial output rose 0.4%. Compared to the year before, total output from all industries was up 1.4%. The capacity utilization rate, considered a leading indicator of inflation, increased in February for the third month in a row but stayed below its 52-year average.

Wednesday

No major announcements

Thursday

The four-week moving average for initial unemployment claims rose for the fourth straight week to its highest level since November. But the Labor Department indicator stayed 37% below the 58-year average, suggesting continued reluctance among employers to let workers go. Total jobless claims dropped 3.7% from the week before to just under 2.2 million, which was 3.6% ahead of the same time in 2024.

The annual rate of existing home sales rose 4.2% to nearly 4.3 million in February, the National Association of Realtors reported. The pace picked up for the fifth month in a row while ending 2024 at the lowest level in 30 years. February’s pace was more than 1% below where it was the year before. The median sales price was $398,400, up almost 4% from the year before, the 20th increase in a row. The trade association said home values collectively rose $1.3 trillion in the last year.

The Conference Board’s index of leading economic indicators fell 0.3% in February, led by drops in consumer expectations and factory orders. The business research group said its index declined 1% in the six months since August, an improvement from a 2.1% fall in the previous six months. The group cited increased uncertainty over federal government policies in downgrading its economic forecast. It projected growth of 2% in the U.S. gross domestic product in 2025, below its 2.5% prediction in February.

Friday

No major announcements

Market Closings for the Week

- Nasdaq – 17784, up 30 points or 0.2%

- Standard & Poor’s 500 – 5668, up 29 points or 0.5%

- Dow Jones Industrial – 41985, up 497 points or 1.2%

- 10-year U.S. Treasury Note – 4.25%, down 0.06 point