Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (March 11-15, 2024)

SIGNIFICANT ECONOMIC INDICATORS & REPORTS

Monday

No major announcements

Tuesday

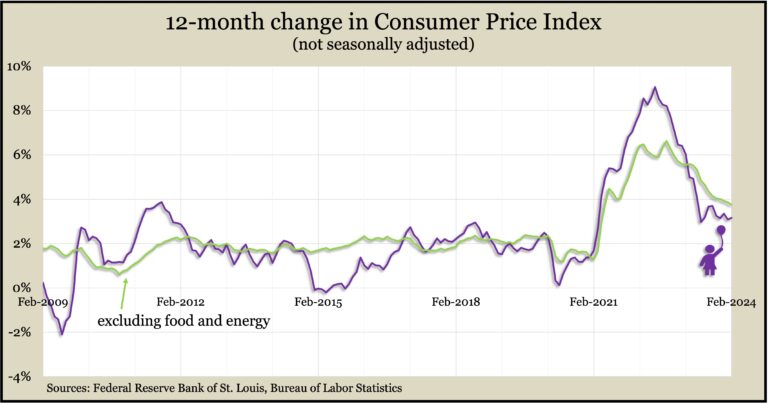

The broadest measure of inflation nudged up narrowly in February, reinforcing sentiment that it’s too soon for the Federal Reserve to start cutting interest rates. The Bureau of Labor Statistics reported the Consumer Price Index rose 3.2% from February 2023, unadjusted for inflation. That was up from 3.1% in January but down from a four-decade high of 9.1% in 2022. Higher prices for gasoline and shelter accounted for 60% of the CPI’s one-month gain of 0.4%, which was the highest since September. The core CPI, excluding volatile food and energy costs, was up 3.8% from the year before, the smallest 12-month rise in almost three years.

Wednesday

No major announcements

Thursday

Wholesale inflation ticked up in February, led by higher energy prices. The Bureau of Labor Statistics said its Producer Price Index rose 0.6% from January, the largest advance since August. Excluding volatile prices for food, energy and trade services, the core PPI rose 0.4%, down from a 0.6% increase in January. Year to year, the headline PPI rose 1.6% in February, the highest rate in five months.

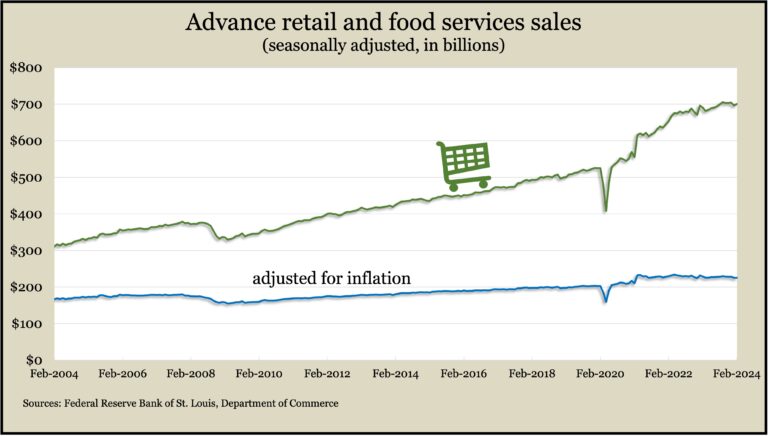

The Commerce Department said retail sales gained 0.6% in February, only the second gain in five months, but another sign that consumers are keeping the economy growing. Car dealers, gas stations, home-and-garden centers and appliance stores led the list of retailers reviving sales from a 1.1% decline in January. The sales represent most of the consumer spending that accounts for about two-thirds of U.S. economic activity. Adjusted for inflation, retail sales advanced in February for the first time in five months.

The four-week moving average for initial unemployment claims fell for the fourth week in a row, dipping 43% below the 57-year average. Data from the Labor Department continued to suggest a tight job market in which employers are reluctant to let workers go. Some 2.1 million individuals were receiving jobless benefits in the latest week, up 1% from the week before and up 7.2% from the year before.

Friday

U.S. industrial production rose 0.1% in February after weather-related declines January. The gain was the first in three months, according to the Federal Reserve. Compared to the year before, output was down 0.2%. Manufacturing production advanced 0.8% from January and was down 0.7% from February 2023. Capacity utilization, considered a leading indicator of inflation, remained at 78.3% in February, below the long-term average for the 10th month in a row.

The University of Michigan said consumer sentiment essentially was on hold pending the November election. The preliminary measure of expectations in March was little changed from February, putting it midway between historic lows during the inflation peaks of 2022 and the level of sentiment just before the COVID-19 pandemic. Economists rely on sentiment as an indicator of consumers’ appetite for spending.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 15973, down 112 points or 0.7%

- Standard & Poor’s 500 – 5117, down 7 points or 0.1%

- Dow Jones Industrial – 38715, down 8 points or 0.0%

- 10-year U.S. Treasury Note – 4.30%, up 0.22 point