Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Feb. 26-March 1, 2024)

Significant Economic Indicators & Reports

Monday

While a relatively small part of the total housing market, new home sales showed signs of improvement in January. The C0mmerce Department said the seasonally adjusted annual rate of sales reached 661,000 units in January, up 1.5% from December and 1.8% ahead of the year-ago pace. As opposed to new houses, the annual sales rate of existing houses was 4 million. Inventories reached 8.3 months’ worth of new houses for sale, remaining above the pace just before the pandemic and well ahead of the average of 6.6 months’ since 1963.

Tuesday

The Commerce Department said durable goods orders fell 6.1% in January, the biggest decline in the volatile indicator since a 19.3% drop in April 2020. An expected plunge in commercial aircraft orders accounted for the bulk of the January setback. Excluding the transportation industry, demand for long-lasting manufactured items was down just 0.3% from December and was up 1.8% from the year before. Core capital goods orders, a proxy for business investments, rose 0.1% from December but were 0.2% below January 2023.

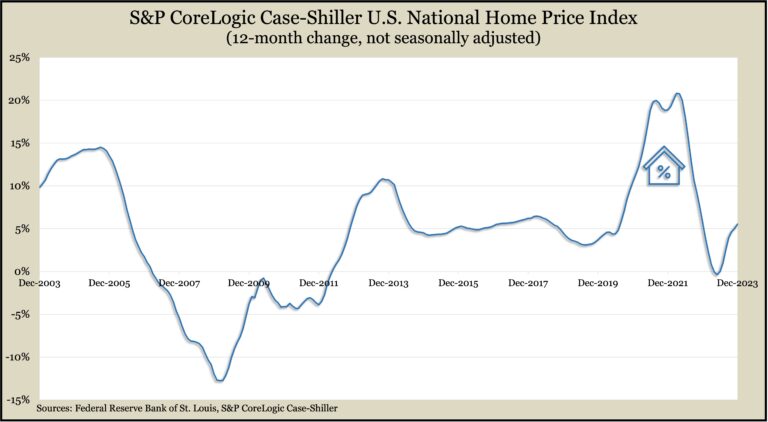

Housing prices continued to accelerate in December, according to the S&P CoreLogic Case-Shiller home price index. Compared to the year before, the index rose 5.5%, as opposed to a 5% increase in November. It was the seventh consecutive gain. An analyst for S&P described broad-based pricing gains, with all composite city indexes advancing for the first time in 2023. Despite increased mortgage rates over the past year, S&P reported solid and steady growth in housing prices.

The Conference Board said its consumer confidence index declined in February for the first time in four months. Consumers said they worried less about inflations, although it remained their chief concern. They registered greater unease about the labor market and political environment. The business research group characterized the slip in confidence as broadly based, with drops both in current assessments and expectations. Since consumer spending drives about two-thirds of U.S. gross domestic product, confidence suggests how willing consumers are to fuel the economy.

Wednesday

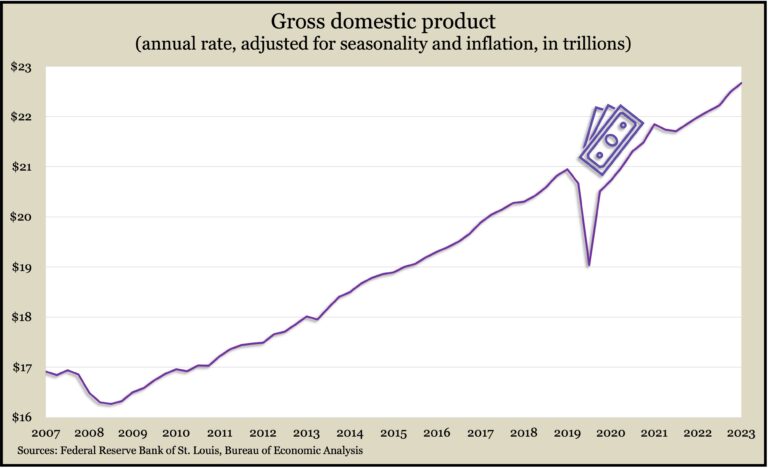

The U.S. economy grew at a 3.2% annual pace in the fourth quarter, slightly slower than initially estimated, according to the Bureau of Economic Analysis. Expansion of the gross domestic product was down from the previous report of 3.3% growth, which was down from 4.9% in the third quarter. The government said the updated figures showed less inventory buildup than previously estimated, partly offset by a faster pace of consumer spending. Consumer expenditures rose at an annual rate of 3% in the fourth quarter, compared to the initial report of 2.8%.

Thursday

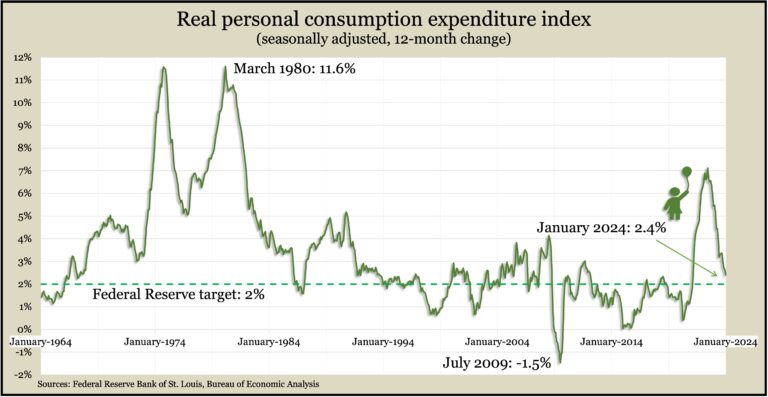

The Federal Reserve Board’s preferred measure of inflation dipped to its lowest level in nearly three years, according to a report from the Bureau of Economic Analysis. The Personal Consumption Expenditure index rose 2.4% from January 2023 to January 2024, down from a 2.6% increase in December and a four-decade high of 7.1% in June 2022. The rate remained above the Fed’s long-range target of 2%. The report also showed consumer spending slowing in January even as personal income accelerated, led by a 3.2% increase in Social Security benefits.

The four-week moving average for initial unemployment claims declined for the second week in a row, falling to the lowest level in four weeks and 42% below the 57-year average, signifying the historically strong job market. The Labor Department reported that total jobless claims declined 2% in the latest week to 2.1 million, up more than 8% from the year before.

Commitments to home ownership slipped in January, according to the pending home sales index of the National Association of Realtors. The trade group said demand dropped 4.9% from December and was 8.8% lower than in January 2023 – despite a solid job market and record wealth due to higher stocks prices and home values. The Realtors cited steeper mortgage rates for increased reluctance among home buyers. Although rates have receded from around 8% in November, the average rate for a 30-year fixed-rate loan has been just under 7% recently, compared to under 4% two years ago.

Friday

The manufacturing sector contracted for the 16th month in a row in February, according to the Institute for Supply Management. The trade group’s index showed manufacturers easing up on production amid slower demand. Hiring receded for the fifth month in a row, and at a steeper pace. Based on past experience, the ISM said, its index suggested the U.S. economy is growing at a 1.5% annual rate.

The annual pace of construction spending fell slightly in January, dropping for the first time since the end of 2022. The rate was still up nearly 12% from its level in January 2023. Residential construction spending, which made up 43% of the total, rose marginally from December and was 12.5% ahead of its year-ago pace. The amount manufacturing spent on construction rose more than 36% since January 2023.

Consumers in the U.S. expected further declines in inflation rates while also seeing the overall economy hold steady, the University of Michigan reported. The university’s longstanding consumer sentiment survey fell slightly in February, but most of its components were near three-year highs after hitting an all-time low in mid-2022. The overall index was about 8% below the 46-year average.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 16275, up 278 points or 1.7%

- Standard & Poor’s 500 – 5137, up 48 points or 0.9%

- Dow Jones Industrial – 39087, down 44 points or 0.1%

- 10-year U.S. Treasury Note – 4.18%, down 0.08 point