Podcast: Play in new window | Download

Landaas & Company newsletter June edition now available.

Advisors on this week’s podcast

Kyle Tetting

Adam Baley

Dave Sandstrom

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (June 19-23, 2023)

Significant Indicators & Reports

Monday

Markets closed in observance of Juneteenth Day

Tuesday

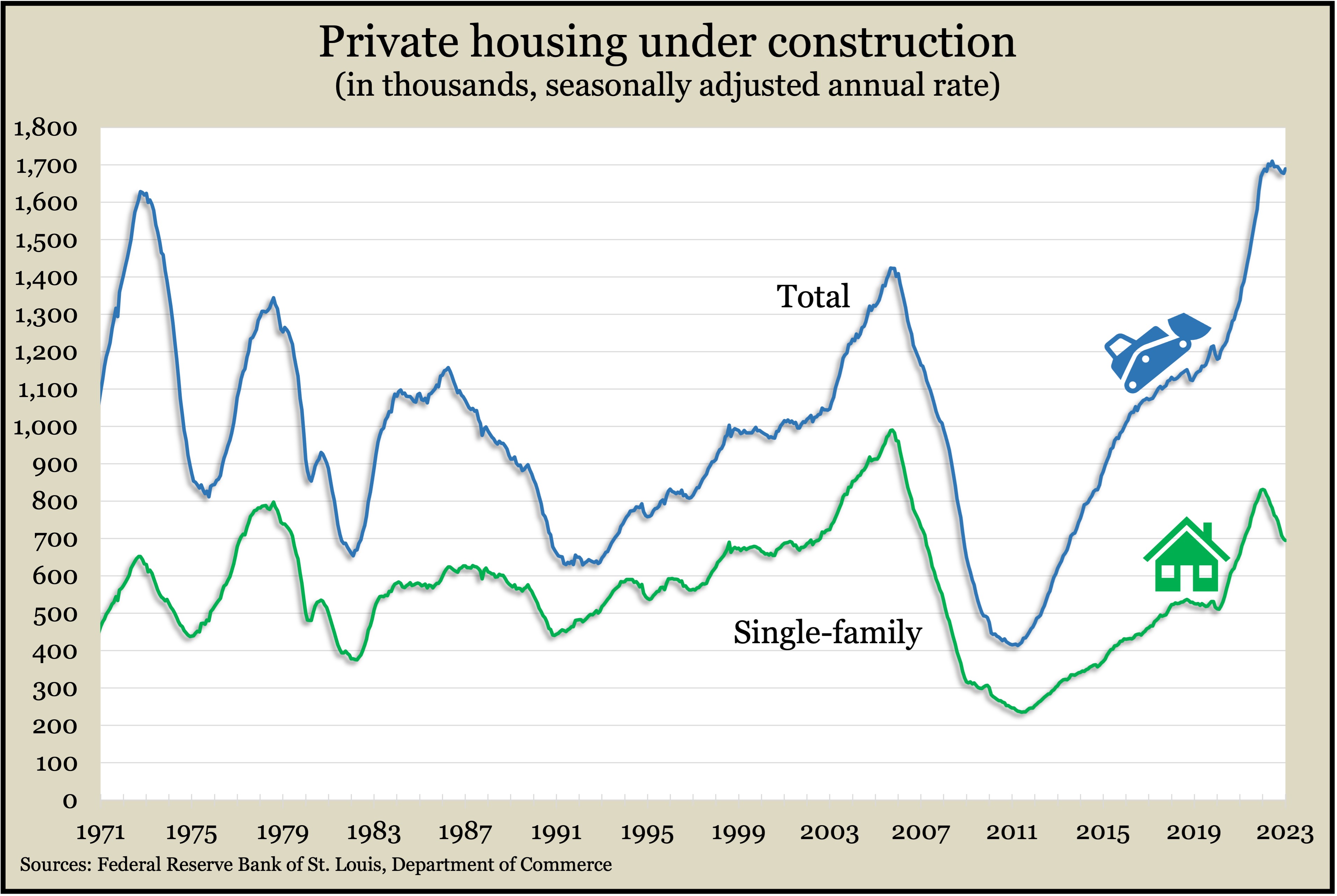

The annual pace of housing starts and building permits suggested the construction industry was picking up in May. A joint report from the departments of Commerce and Housing and Urban Development showed new construction rising nearly 22% from April’s pace while permits rose 5%. Permits were at their fastest pace since September, despite being 13% below their level the year before. Housing starts, led by multi-family units, were the highest since April 2022, which marked the fastest pace since 2006. The number of houses under construction in May hovered near record heights, based on data going back to 1970.

Wednesday

No major reports

Thursday

The four-week moving average for initial unemployment claims continued to rise, up for the third week in a row and the fourth time in five weeks. The Labor Department reported that the average level of new claims was at its highest point since November 2021. Though still 30% below the 56-year average, the measure of employer reluctance to part with workers was 23% above its low just before the COVID-19 pandemic. Nearly 1.7 million Americans claimed unemployment insurance benefits in the latest week, up 3% from the week before and up 29% from the same time last year.

The National Association of Realtors said steady mortgage rates helped existing home sales grow marginally in May. The seasonally adjusted annual rate of 4.3 million houses sold was up 0.2% from April’s pace but down 20% from the year before, when conventional mortgage rates were nearly a full percentage point lower. The trade association pointed to low inventory as an ongoing hindrance to sales, noting that the number of houses for sale were about half the level in 2019. Weakened demand resulted in the median sales price sinking 3% from May 2022 to $396,100.

The Conference Board’s index of leading economic indicators fell 0.7% in May, for the 14th consecutive decline. The business research group cited a negative yield spread and drops in consumer expectations, factory orders and credit conditions for the monthly setback. Since November, the index was down 4.3%, compared to a 3.8% decline over the prior six months. The Conference Board forecast marginal growth for the economy in the second quarter followed by recession toward the end of 2023 and into the beginning of 2024.

Friday

No major reports

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 13493, down 197 points or 1.4%

- Standard & Poor’s 500 – 4348, down 61 points or 1.4%

- Dow Jones Industrial – 33729, down 571 points or 1.7%

- 10-year U.S. Treasury Note – 3.74%, down 0.03 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.