Podcast: Play in new window | Download

Landaas & Company newsletter July edition now available.

Advisors on This Week’s Show

Art Rothschild

Adam Baley

Dave Sandstrom

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (July 3-7, 2023)

Significant Economic Indicators & Reports

Monday

Shrinking in the manufacturing sector accelerated slightly in June, according to the Institute for Supply Management. The trade group said its manufacturing index showed contraction for the eight month in a row, sinking to its lowest level since May 2020. As the slowing economy stifled demand, more manufacturers reported layoffs, with more expected. The ISM said the manufacturing index suggested that the overall U.S. economy is receding at a 0.1% annual rate.

The Department of Commerce said construction spending rose in May for the eighth month in a row. The $1.9 trillion annual pace was up 0.9% from April and 2% above the May 2022 rate. Spending on housing, which makes up about 45% of total construction spending, rose 2% for the month but was down 11% from the year before. Spending on manufacturing construction led the gains in both periods.

Tuesday

Markets and government offices closed for Independence Day

Wednesday

Demand for commercial aircraft helped manufactured goods post a steady gain in May, as factory orders rose 0.3% from April, the fifth increase in six months. However, excluding volatile transportation orders, new contracts declined 0.5%, according to the Commerce Department. Total orders rose 1.1% from May 2022; excluding transportation, they declined 0.5%. Core capital goods orders, a proxy for business investments, was up 0.7% from April and rose 2.8% from the year before.

Thursday

The U.S. services sector continued expanding in June, according to the Institute for Supply Management. The trade group’s services index showed the sixth consecutive month of growth and the 36th gain in 37 months. Purchasing managers surveyed by the ISM said they saw stable business conditions but still had concerns about inflation and the economic outlook. The ISM said the services index suggested the overall economy is growing at a 1.4% annual pace.

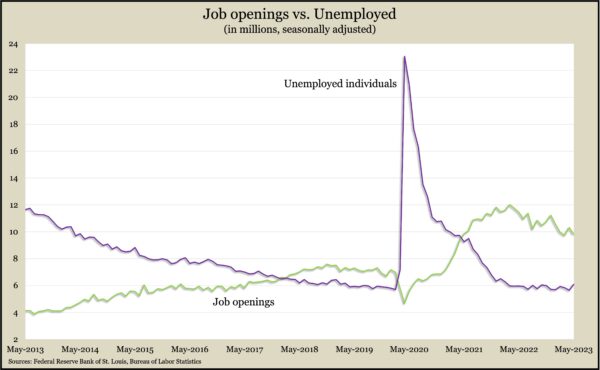

U.S. employers posted 9.8 million job openings in May, down the fourth time in five months, though still ahead of levels just before the pandemic. The Bureau of Labor Statistics reported steady numbers for hiring and dislocations compared to April. More than 4 million workers voluntarily quit their jobs in May, the first gain in four months for quits, which is an indicator of worker confidence. In May, job openings outnumbered unemployed job seekers by 3.2 million, the lowest such gap since September 2021.

The four-week moving average for initial unemployment claims fell for the first time in five weeks. Considered an early indicator of joblessness, the measure was 31% below the 56-year average for claims; it was 21% above the low going into the COVID-19 pandemic. The Labor Department said 1.7 million Americans were receiving unemployment benefits in the latest week, up 0.1% from the week before and 29% above the level of 1.3 million at the same time in 2022.

Imports declined more than exports in May to narrow the U.S. trade deficit to $69 billion. The trade gap fell 7.3% from April. The Bureau of Economic Analysis said exports contracted 0.8% in May, led by lower sales of soybeans and industrial fuels, offset slightly by a rise in automotive exports. Imports declined 2.3% with lower U.S. purchases of pharmaceutical preps and cellphones, although computer imports rose. Compared to May 2022, the trade deficit narrowed by nearly 23% with exports rising almost 4% and imports falling more than 3%. Trade deficits count against the gross domestic product.

Friday

U.S. employers added 209,000 jobs in June, and the unemployment rate inched down to 3.6%, the Bureau of Labor Statistics reported. The gain in jobs was the lowest in 30 straight months of increases but continued to suggest a resilient labor market despite Federal Reserve efforts to slow the economy. The average hourly wage rose 4.4% from the year before, in line with increases in April and May, and down from nearly 6% in the spring of 2022. The 3.6% unemployment rate, based on household surveys, stayed near the lowest level in 50 years. The rate has ranged between 3.4% and 3.7% since March 2022.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 13661, down 127 points or 0.9%

- Standard & Poor’s 500 – 4399, down 51 points or 1.1%

- Dow Jones Industrial – 33735, down 671 points or 2.0%

- 10-year U.S. Treasury Note – 4.05%, up 0.23 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.