Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl and Joel Dresang, engineered by Jason Scuglik)

Week in Review (July 22-26, 2024)

Significant economic indicators & reports

Monday

No major releases

Tuesday

The National Association of Realtors reported continued declines in existing home sales in June but said conditions are slowly shifting to a buyers’ market. The median sales price hit a record high for the second month in a row, reaching $426,900. The trade group said the annual rate of sales slipped 5.4% from May to under 3.9 million houses. Inventory rose to a supply of 4.1 months’ worth at current sales rates – the highest since May 2020. The Realtors said the higher inventory has meant sellers are starting to receive fewer bids, and more buyers are insisting on home inspections and appraisals.

Wednesday

The annual rate of new home sales fell in June, dropping to the slowest pace since November. The pace was down 13% from the level heading into the COVID-19 pandemic four years ago. The Commerce Department reported that the inventory of unsold new houses rose to the highest rate since October 2022. The median price of new houses was $417,300, nearly the same as the year before.

Thursday

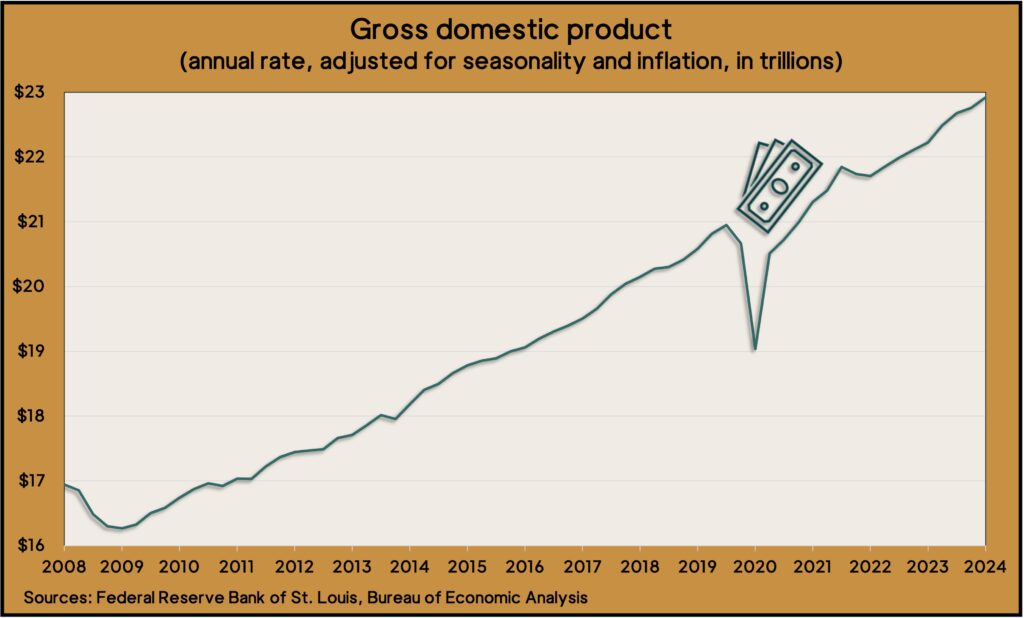

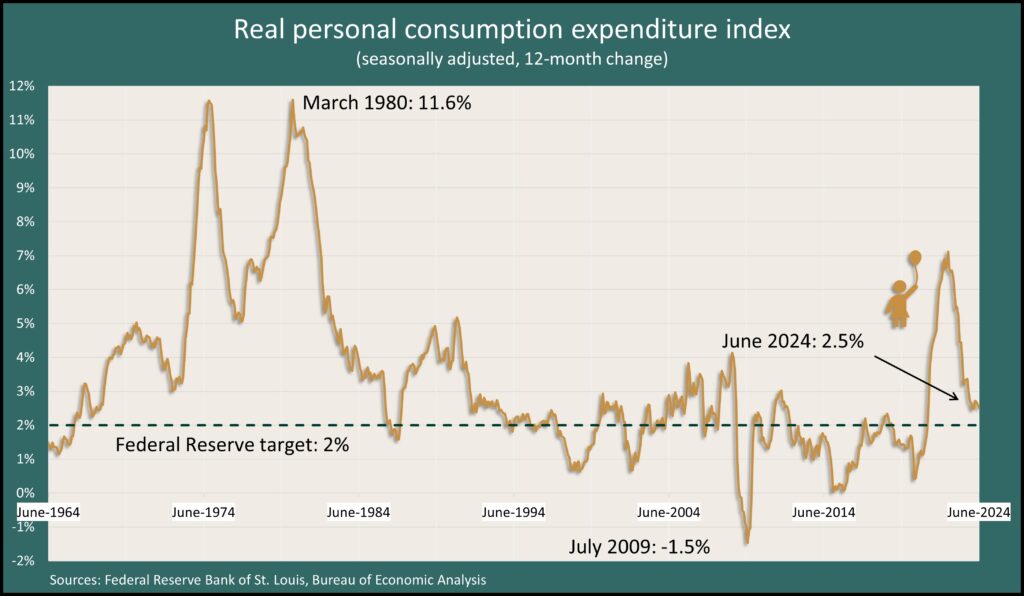

U.S. economic growth accelerated in the second quarter of 2024, exceeding analyst expectations. According to an advance report on gross domestic product from the Bureau of Economic Analysis, the economy expanded at an annual rate of 2.8% from the first three months of the year, doubling the 1.4% pace in the first quarter. Faster growth was attributed to increased consumer spending and businesses investing more in their operations and building inventory. The PCE inflation index rose 2.6% from the second quarter of 2023, the same pace as in the first quarter and the lowest in three years.

The four-week moving average for initial unemployment claims rose for the sixth time in seven weeks, suggesting a marginally weaker labor market. Data from the Labor Department showed the moving average was still 35% below the 57-year average, but it was up 13% from just before the pandemic. In the latest week, nearly 2 million Americans claimed jobless benefits, up 8% from the week before and up 3% the same time last year.

Manufacturing demand declined in June for the first time in five months, with durable goods orders plummeting 6.6% from May. A steep fall in orders for commercial aircraft accounted for much of the setback. Excluding transportation, orders rose 0.5%. Compared to June 2023, total orders were down 2% but rose 1.3% excluding transportation. The Commerce Department reported that core capital goods orders, a proxy for business investment, rose 1% from May and increased 0.3% from June 2023.

Friday

The Bureau of Economic Analysis said consumer spending – which accounts for about two-thirds of GDP – rose 0.3% in June, down from a 0.4% gain in May. Spending outpaced personal income, which rose 0.2% in June. Adjusting for inflation, spending rose 0.2%, led by consumption of services, particularly international travel. The personal consumption expenditures index, which the Fed follows for inflation, rose 2.5% from June 2023, tied with February for the lowest inflation rate since early 2021. Two years ago, the PCE index reached a four-decade high of 7.1%.

Often a pre-cursor to spending, consumer sentiment sank a little more in July. The University of Michigan said its survey-based index declined insignificantly from June and has been in a holding pattern. While high prices are dampening the mood of consumers, election uncertainty could generate more volatility. For the second month in a row, consumers’ expectations for inflation dropped.

Market Closings for the Week

- Nasdaq – 17358, down 369 points or 2.1%

- Standard & Poor’s 500 – 5459, down 46 points or 0.8%

- Dow Jones Industrial – 40589, up 302 points or 0.7%

- 10-year U.S. Treasury Note – 4.20%, down 0.04 point