Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl and Joel Dresang, engineered by Jason Scuglik)

Week in Review (July 15-19, 2024)

Significant economic indicators & reports

Monday

No major releases

Tuesday

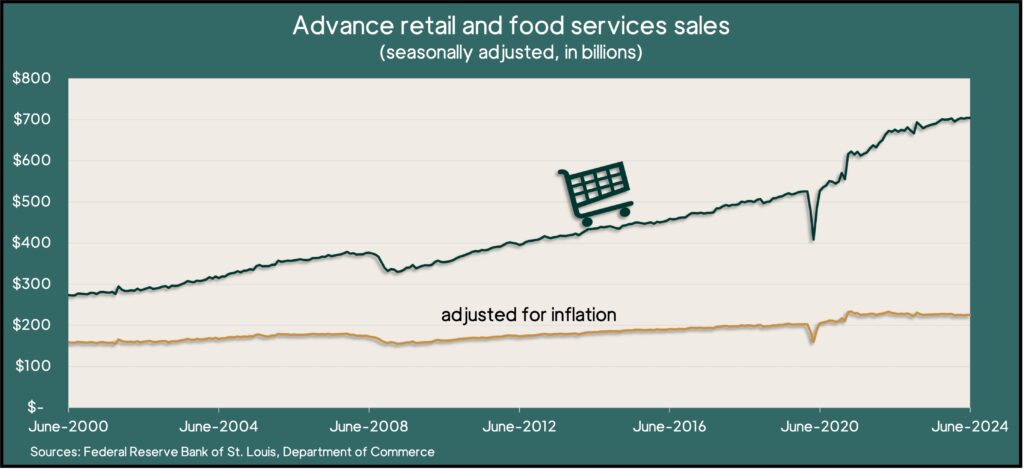

A key measure of consumer spending held steady in June, even as analysts expected it to decline. Retail sales were unchanged from May, the Commerce Department reported. Of 13 categories of retailers, 10 had higher sales, including online vendors, home-and-garden centers and restaurants and bars. Decliners for the month were led by car dealers and gas stations, where lower prices affected revenue. Not counting cars and gas, retail sales increased 0.8% in June.

Wednesday

The U.S. housing market remained weaker in June than it was two years ago, when the Federal Reserve Board began raising interest rates. The Commerce Department reported that the annual pace for both housing starts and building permits picked up slightly from May but only because of increased activity around residential buildings with five or more units. Single-family housing permits and new construction continued to lag behind their pace in mid-2022 and hover near or below where they were just before the COVID-19 pandemic.

The Federal Reserve said industrial production rose in June for the second month in a row. Output from manufacturing, mining and utilities added 0.6% and was up 1.6% from June 2023. The gains were broadly based across industries except for declines from makers of business equipment and construction supplies. Meantime, industrial capacity usage – which can indicate future inflation pressure – rose to 78.8%, its highest level in nine months but still comfortably below its 50-year average for the 19th consecutive month.

Thursday

The four-week moving average for initial unemployment claims rose for the fifth time in six weeks, the Labor Department reported. The measure of employers’ plans to let workers go was 36% below the all-time average dating back to 1967. It was up 12% from its mark just before the pandemic. In the latest week, total claims dropped 1.4% to 1.8 million, which was up 4% from the same time last year.

The Conference Board said its index of leading economic indicators slipped 0.2% in June. The gauge from the business research group fell 1.9% in the first half of 2024, an improvement from a decline of 2.4% in the second half of 2023. The group blamed weak consumer expectations, factory orders, interest rate spread and jobless claims for the June decline. It forecast a growth rate of 1% for the U.S. economy in the third quarter.

Friday

No major announcements

Market Closings for the Week

- Nasdaq – 17727, down 672 points or 3.6%

- Standard & Poor’s 500 – 5505, down 110 points or 2.0%

- Dow Jones Industrial – 40287, up 287 points or 0.7%

- 10-year U.S. Treasury Note – 4.24%, up 0.05 point