Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl and Joel Dresang, engineered by Jason Scuglik)

Week in Review (Feb. 3-7, 2025)

Significant Economic Indicators & Reports

Monday

The manufacturing sector expanded in January for the first time in more than two years, according to the Institute for Supply Management. The trade group’s index, based on surveys of manufacturing supply managers, showed growth after 26 months of contraction. New orders rose for the third month in a row, at an accelerating pace, a sign that demand is reviving. Reports of staffing reductions slowed while components tied to production and supplies strengthened. The ISM said the index suggested the U.S. economy is growing at an annual pace of 2.4%.

The Commerce Department said construction spending rose in December for the third month in a row. The seasonally adjusted annual rate of such expenditures increased 0.5% from November and more than 4% from the year before, led by housing, which accounted for 43% of all construction spending. Manufacturing, which represented nearly 12% of the $2.2 trillion spent on construction remained steady from November but was up more than 11% from the end of 2023.

Tuesday

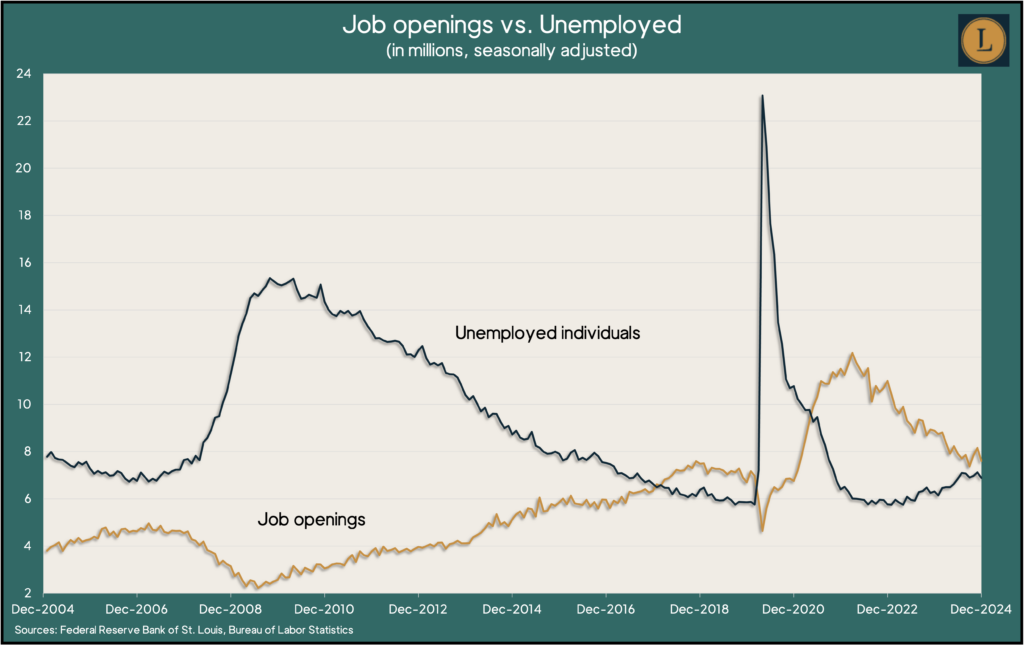

Employers’ demand for workers eased in December, with job openings falling for the first time in three months, narrowing the gap between supply and demand for workers. The Bureau of Labor Statistics said openings dropped to 7.6 million, the second-lowest level in nearly four years. That’s down from a peak of 12 million in 2022 yet still above the 7 million registered just before the COVID-19 pandemic. The number of workers quitting their jobs – a sign of worker confidence – remained below the pre-pandemic level for the 13th month in a row. Still, employers were reluctant to let workers go, as job separations stayed below pre-pandemic levels for the 18th month in a row.

A drop in demand for commercial aircraft and parts sank factory orders in December. The Commerce Department reported that total orders declined 0.9%, the fourth setback in five months. Demand for manufactured goods was unchanged from the end of 2023. Excluding volatile orders for transportation equipment, orders rose 0.3% for the month and were up 1.5% from the year before. Core capital goods orders, a proxy for business investments, rose 0.4% from November and were up 0.6% from December 2023.

Wednesday

The largest segment of the U.S. economy showed continued expansion in January but at a slower pace. The Institute for Supply Management’s service index indicated growth for the seventh months in a row and the 23rd time in 25 months. Slower growth in two key components – business activity and new orders – lowered the index from its December reading. The trade group said supply managers reported challenges from bad weather in December and repeated concerns about tariffs.

The U.S. trade deficit expanded in 2024, as the value of imports outpaced exports. The Bureau of Economic Analysis reported that the 2024 trade gap was $918.4 billion, up 17% from the year before. Exports grew 3.9% in the year while imports rose 6.6%. Trade gaps detract from economic output, as measured by the gross domestic product. The deficit was 3.1% the size of GDP, up from 2.8% in 2023. In December, the gap widened nearly 25% from November as exports declined and imports increased.

Thursday

Worker productivity increased at a 1.2% annual rate in the fourth quarter, slowing from 2.3% in the third quarter, the Bureau of Labor Statistics reported. The latest gain came on 2.3% higher output from workers putting in 1% more hours. Year to year, productivity rose 1.6%. Unit labor costs rose 2.7% over the last four quarters, with compensation increasing 1.5%, adjusted for inflation. In the current business cycle, which began at the end of 2019, productivity has been growing at a 1.8% annual pace, compared to 1.5% during the previous cycle, which started in 2007. The average productivity rate since 1947 is 2.1%.

The four-week moving average for initial unemployment claims rose for the second time in three weeks but remained low historically. Data from the Labor Department showed the latest four-week average was 40% below the all-time average, dating back to 1967. As an early measure of layoff trends, new jobless claims have suggested employers’ reluctance to let workers go in a tight labor market. Total claims fell 3.3% from the week before to 2.2 million, which was 0.7% lower than the year before.

Friday

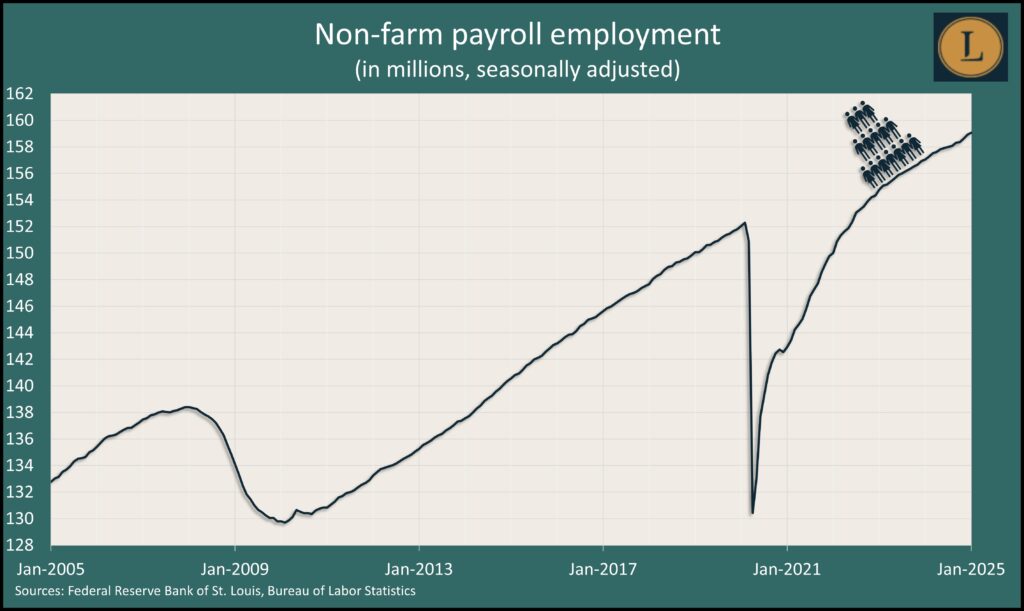

U.S. employers added 143,000 jobs in January, suggesting a slower growth in the labor market, according to the employment situation report from the Bureau of Labor Statistics. The additions were down from the 166,000 average during 2024 and marked the 49th consecutive month of job gains. The unemployment rate dropped to 4%, the lowest since May, after months of ranging between 4.1% and 4.2%. The U-6 underemployment rate remained above the pre-pandemic level for the 14th month in a row. Employment in temporary help services – often a harbinger of job conditions – stayed below the pre-pandemic mark for the 20th month in a row.

The University of Michigan said a preliminary measure of its consumer sentiment index dropped for the second month in a row, driven by concerns about possible effects from U.S. tariff policies. Expectations for inflation showed an unusually high increase, the university said. Declines in sentiment were “pervasive” across consumer demographics.

Market Closings for the Week

- Nasdaq – 19523, down 104 points or 0.5%

- Standard & Poor’s 500 – 6026, down 15 points or 0.2%

- Dow Jones Industrial – 44303, down 241 points or 0.5%

- 10-year U.S. Treasury Note – 4.49%, down 0.08 point