Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, engineered by Jason Scuglik)

Week in Review (Feb. 24-28, 2025)

Significant Economic Indicators & Reports

Monday

No major reports

Tuesday

Housing prices continued to accelerate in December, reaching a record high for the 19th month in a row, according to the S&P CoreLogic Case-Shiller home price index. Compared to the year before, the index rose 3.9%, compared to a 3.7% increase in November. And though housing kept outpacing overall inflation, S&P described the growth as “below trend.” The average annual increase in home prices since 2020 was 8.8% with a peak of 18.9% in 2021.

The Conference Board said its consumer confidence index dropped more in February than it has since mid-2021. And, for the first time since June, expectations dipped below a level that historically signals imminent recession. The business research group characterized the slip in confidence as broadly based across age groups and income levels. A key measure showed optimism in employment at a 10-month low.

Wednesday

Sales of newly constructed houses slipped in January, as the annual pace dropped 10.5% from December to 657,000 houses. New home sales were down 1% from the year before, as the rate dipped below the pre-pandemic level for the third time in five months. The median sales price rose 4% from Jan. 2024 to $446,300. The inventory of unsold new houses exceeded nine months’ supply for the second time in more than two years, compared to less than six months’ just before the pandemic.

Thursday

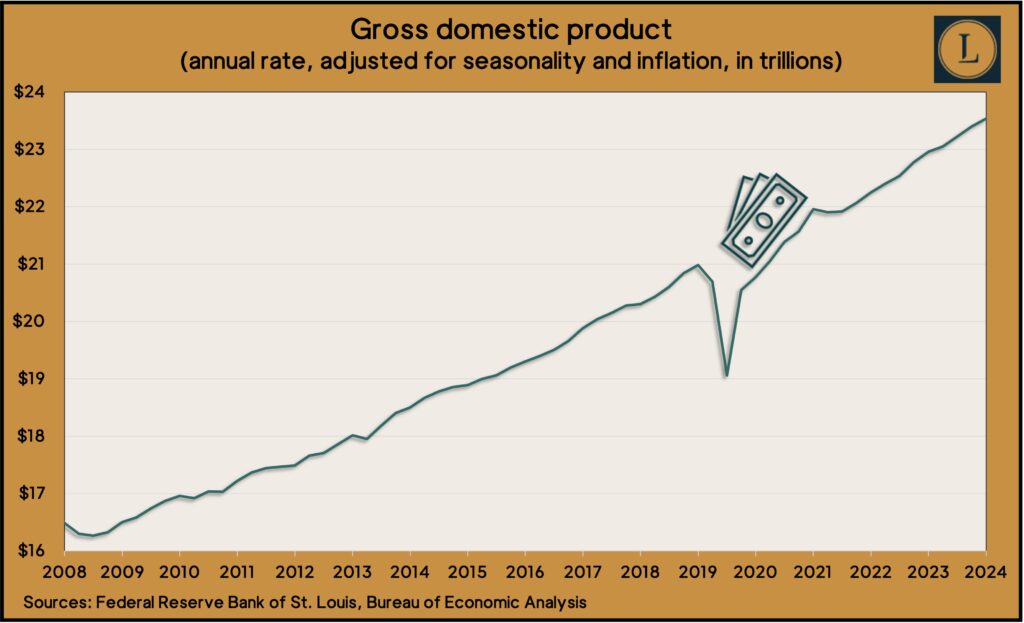

The U.S. economy grew at a 2.3% annual pace in the fourth quarter, virtually unchanged from an initial estimate, according to the Bureau of Economic Analysis. Expansion of the gross domestic product was down from 3.1% in the third quarter. The government said the updated figures included slightly slower consumer spending, which drives about 70% of economic activity. Higher-than-estimated government spending and exports helped offset the consumer slowdown.

The four-week moving average for initial unemployment claims rose for the first time in three weeks, reaching the highest level in two months. The measure continued to suggest a historically high reluctance to let workers go, staying 38% below the 58-year average. The Labor Department reported that total jobless claims grew minimally in the latest week to 2.2 million, up nearly 5% from the year before.

The Commerce Department said durable goods orders rose 3.1% in January, the first increase in three months. A surge in commercial aircraft orders accounted for the bulk of the January gain. Excluding the transportation industry, demand for long-lasting manufactured items was unchanged from December and was up 1.7% from the year before. Core capital goods orders, a proxy for business investments, rose 0.8% from December and were 2.2% ahead of January 2024.

Commitments to home ownership slipped in January to the lowest level in 24 years of data, according to the pending home sales index of the National Association of Realtors. The trade group said if extraordinary winter weather was to blame for the record lack of activity, expect a rebound in coming months. Otherwise, the group cited lack of affordability, with high prices and conventional mortgage rates hovering around 7%.

Friday

The Federal Reserve Board’s preferred measure of inflation dipped for the first time in four months to 2.5%, according to a report from the Bureau of Economic Analysis. The Personal Consumption Expenditure index reached as low as 2.1% in September following a four-decade high of 7.1% in June 2022. The rate has remained above the Fed’s long-range target of 2% since early 2021. The report also showed consumer spending declining 0.2% in January even as personal income accelerated 0.9%. As a result, the personal saving rate rose to its highest point in seven months.

Market Closings for the Week

- Nasdaq – 18847, down 677 points or 3.5%

- Standard & Poor’s 500 – 5954, down 59 points or 1.0%

- Dow Jones Industrial – 43841, up 413 points or 1.0%

- 10-year U.S. Treasury Note – 4.23%, down 0.19 point