Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Feb. 17-21, 2025)

Significant Economic Indicators & Reports

Monday

Markets closed for Presidents Day

Tuesday

No major releases

Wednesday

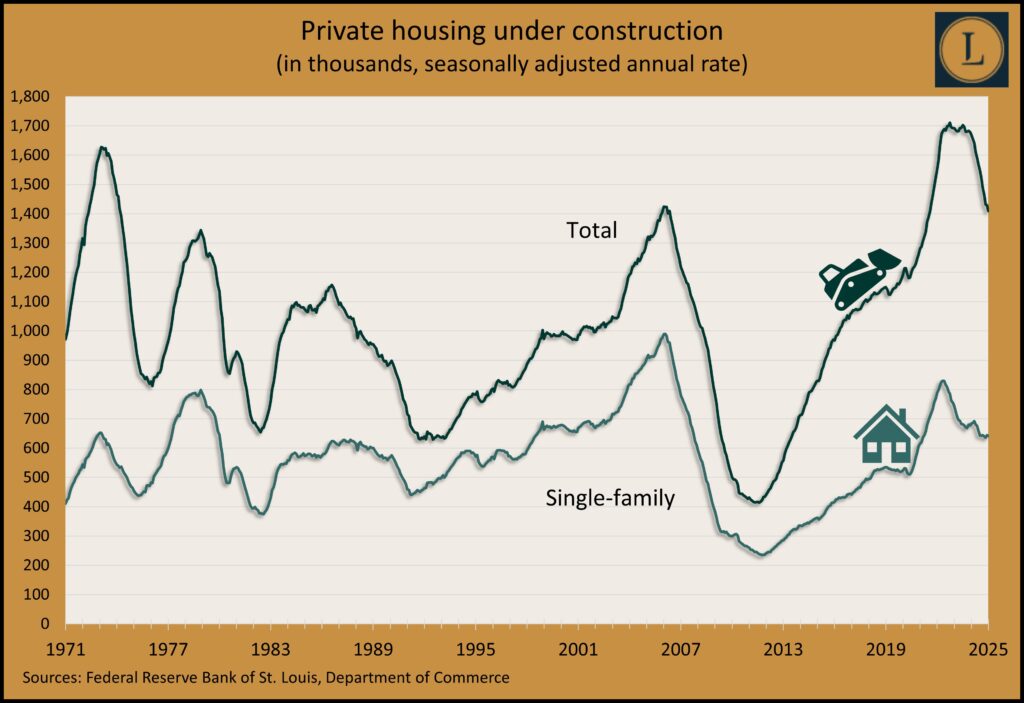

Home construction registered a setback in January, as the Commerce Department reported the annual rate of housing starts dropped nearly 10% from December. Extraordinary weather in January likely had some effect on the volatile indicator, which jumped 16% in December. Housing starts remained below their pace just before the COVID-19 pandemic, when new construction had reached the highest point since the Great Recession. The pace of housing permits, which presage future construction, rose slightly in January. The number of houses under construction declined for the 14th month in a row but was still as high as it was in mid-2006.

Thursday

The four-week moving average for initial unemployment insurance claims declined for the second week in a row and the third time in four weeks, remaining 41% below the 58-year average, according to new Labor Department data. Some 2.2 million Americans claimed jobless benefits in the latest week, down nearly 3% from the week before and up 2% from the same time in 2024.

The Conference Board reported a 0.3% decline in its index of leading economic indicators in January, led by a drop in consumer confidence and a fall in factory hours. The business research group said the yield spread made a positive contribution to the index for the first time since November 2022. Over the past six months, the index declined 0.9%, an improvement from the 1.7% fall in the previous six months. Based on its research, the Conference Board forecast 2.5% growth in U.S. gross domestic product for 2025, with the second half of the year slower than the first.

Friday

The University of Michigan reported that its consumer sentiment index sank nearly 10% in February and was almost 16% lower than the year before over broad fears that U.S. tariff policies will trigger higher inflation. Survey respondents reported a 19% decline in conditions for buying durable goods, and expectations for inflation rose the fastest since mid-2021. Economists see consumer sentiment as a precursor to consumer spending, which accounts for about two-thirds of the U.S. gross domestic product.

The National Association of Realtors said existing home sales dropped 4.9% in January after reaching a 30-year low in 2024. The annual rate of unit sales was up 2% from the year-ago pace, the fourth straight increase. And although inventory levels improved from December, the imbalance between supply and demand resulted in the 19th consecutive increase in the median sales price. Citing prices and interest rates, the trade association said there’s an affordability challenge for prospective homebuyers.

Market Closings for the Week

- Nasdaq – 19524, down 503 points or 2.5%

- Standard & Poor’s 500 – 6013, down 101 points or 1.7%

- Dow Jones Industrial – 43428, down 1118 points or 2.5%

- 10-year U.S. Treasury Note – 4.42%, down 0.05 point