Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Dec. 16-20, 2024)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

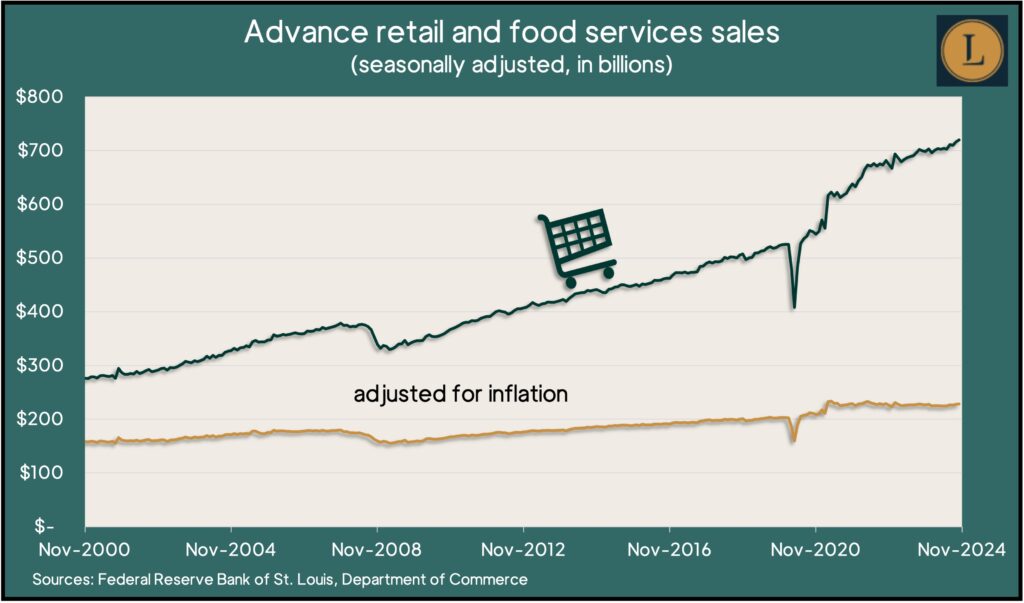

The Commerce Department reported a 0.7% increase in retail sales in November, exceeding analyst forecasts and suggesting continued economic momentum. The rise was broadly distributed: Eight of 13 major categories had higher sales in November, led by car dealers, online retailers and home-and-garden centers, which were boosted by rebuilding following hurricanes Helene and Milton. Consumer spending declined at grocery stores as well as at bars and restaurants, where sales dipped for the first time since March. About two-thirds of U.S. economic activity is driven by consumer spending.

U.S. industrial output fell 0.1% in November, its third drop in a row and the fourth in five months. Production declines in the mining industry and among utilities dampened the November numbers. The Federal Reserve reported manufacturing output rose for the first time in three months, led by automakers. Overall industrial production was 0.9% behind the same time last year; manufacturers were down 1%. The capacity utilization rate, considered an early indicator of inflationary pressure, ticked down for the third month in a row. It has been below its long-term average since April 2021.

Wednesday

The pace of housing starts continued slowing in November, the Commerce Department reported. The annual rate of new construction slipped nearly 2% from October and was about 15% below where it was in November 2023. Starts for single-family houses rose 6% but were 10% below their year-earlier pace. Authorized building permits, an indicator of future construction, rose both overall and for single-family houses. Data from the report showed most housing activity down from levels just before the pandemic, when construction had just recovered from the Great Recession.

Thursday

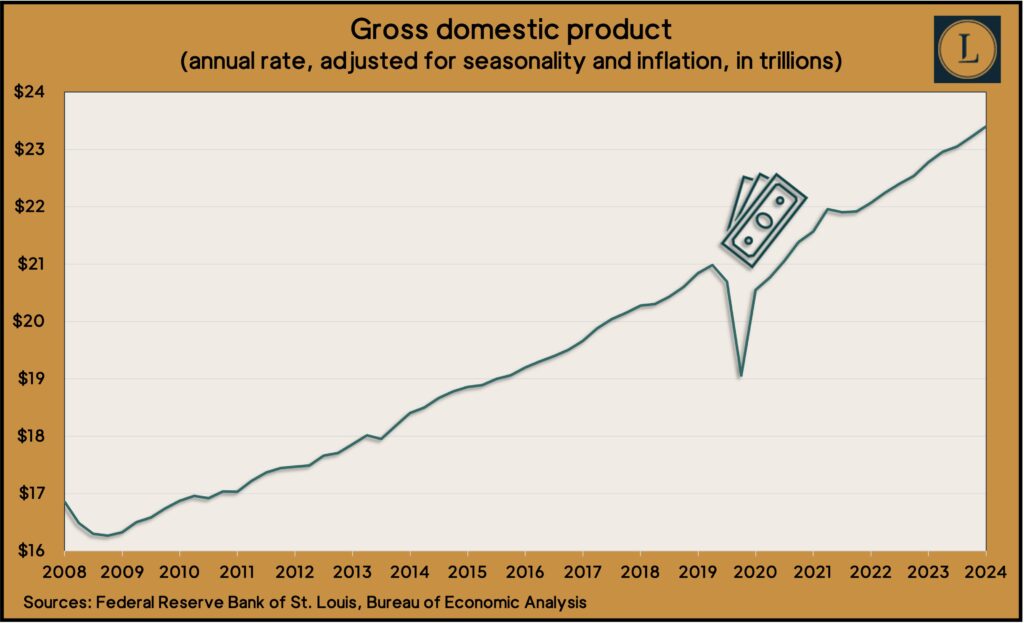

The U.S. gross domestic product grew at an annual pace of 3.1% in the third quarter of 2024, according to a final estimate by the Bureau of Economic Analysis. The economy’s growth rate was up from an initial estimate of 2.8%, as exports and consumer spending gained momentum. The revision included a lower estimate on inventory buildup as well as higher imports, which detract from GDP. Third-quarter growth improved from the second quarter rate of 3%.

The four-week moving average for initial unemployment claims rose for the third week in a row, the Labor Department reported. The gauge of employers’ willingness to release workers was 38% below the long-term average and up 8% from the low just before the COVID-19 pandemic. Total jobless claims rose 16% in the latest week to just below 2 million, up 9% from the year before.

The Conference Board’s index of leading economic indicators increased 0.3% in November, the first gain since February 2022. The index dropped 1.6% since May, narrowing a 1.9% decrease in the previous six months. The business research group said it expected the U.S. economy to finish 2024 with a 2.7% advance in GDP. It forecast a 2% growth in the economy in 2025.

Existing home sales rose 4.8% in November, edging above an annual sales rate of 4 million for the first time since March. The sales pace was up 6% from November 2023, the National Association of Realtors reported. The trade group said prospective home buyers are settling in on stagnant mortgage rates as homeowners are capitalizing on a collective $15 trillion in increased home equity in the last four years. Historically low inventories continued to push up prices. The median sales price of $406,100 was 4.7% higher than in November 2023, which marked the 17th consecutive year-to-year gain.

Friday

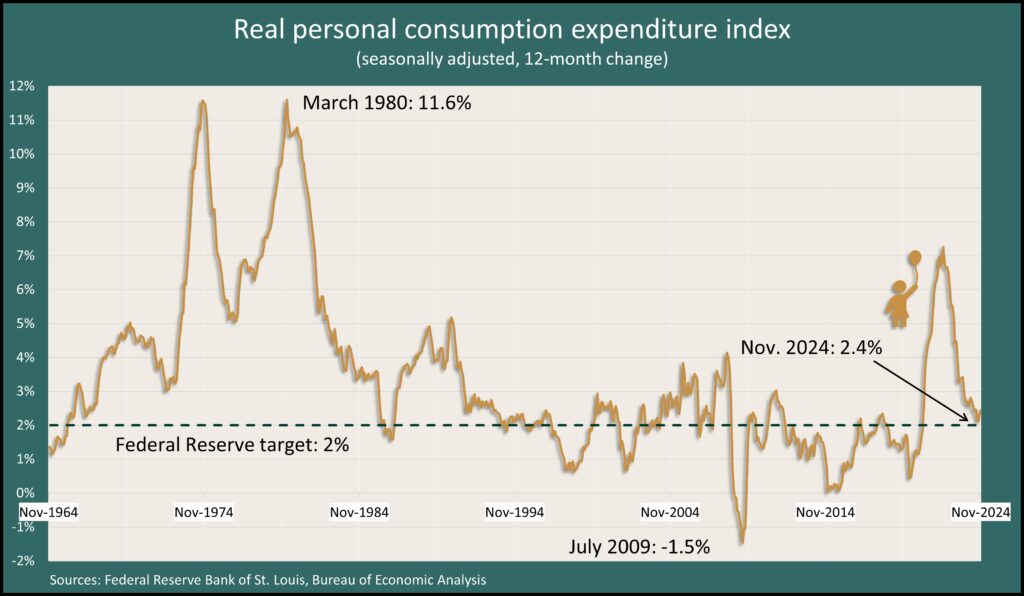

By far the biggest driver of the U.S. economy, consumer spending rose 0.4% in November, while inflation ticked up for the second month in a row. The Bureau of Economic Analysis reported that personal income rose 0.3% in November, which meant a slight gain in personal saving. The Fed’s favorite inflation gauge, the personal consumption expenditures index, rose to 2.4% from November 2023 after reaching 2.1% in September – its narrowest increase since February 2021. The Fed’s long-term target for the measure is 2%. It hit a four-decade high of 7.2% In mid-2022.

The University of Michigan’s consumer sentiment index improved for the fifth month in a row in December as households continued to acknowledge a relatively strong U.S. economy with slower inflation. The index was up 3% from November and up 6% from December 2023, landing midway between a record low in mid-2022 and where the index stood just before the pandemic. The university reported a surge in plans for large purchases based on expectations for higher prices in the near future.

Market Closings for the Week

- Nasdaq – 19573, down 354points or 1.8%

- Standard & Poor’s 500 – 5931, down 120 or 2.0%

- Dow Jones Industrial – 42839, down 989 points or 2.3%

- 10-year U.S. Treasury Note – 4.52%, up 0.13 point