Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl and Joel Dresang, engineered by Jason Scuglik)

Week in Review (Aug. 5-9, 2024)

Significant Economic Indicators & Reports

Monday

The non-manufacturing sector went into expansion mode again in July, according to the ISM Services Index. The survey-based report from the Institute for Supply Management had shown contraction in two of the three previous months. The trade group said supply managers had wait-and-see attitudes toward business activities, pending the presidential election and concerns about tariffs. They generally expected business to be flat or gradually growing with stable supply chains but higher costs.

Tuesday

The U.S. trade deficit narrowed 2.5% in June to $73.1 billion, the Bureau of Economic Analysis reported. Exports rose faster than imports. The value of outgoing goods and services increased 1.5%, led by sales of commercial aircraft and industrial supplies such as oil and gas. Imports rose 0.6% from May, led by pharmaceuticals and semiconductors, with a decline in oil and gas products. Through the first half of 2024, the trade gap expanded 5.6% from the year before with gains of 3.8% in exports and 4.2% in exports. Trade deficits detract from overall economic growth as measured by the gross domestic product.

Wednesday

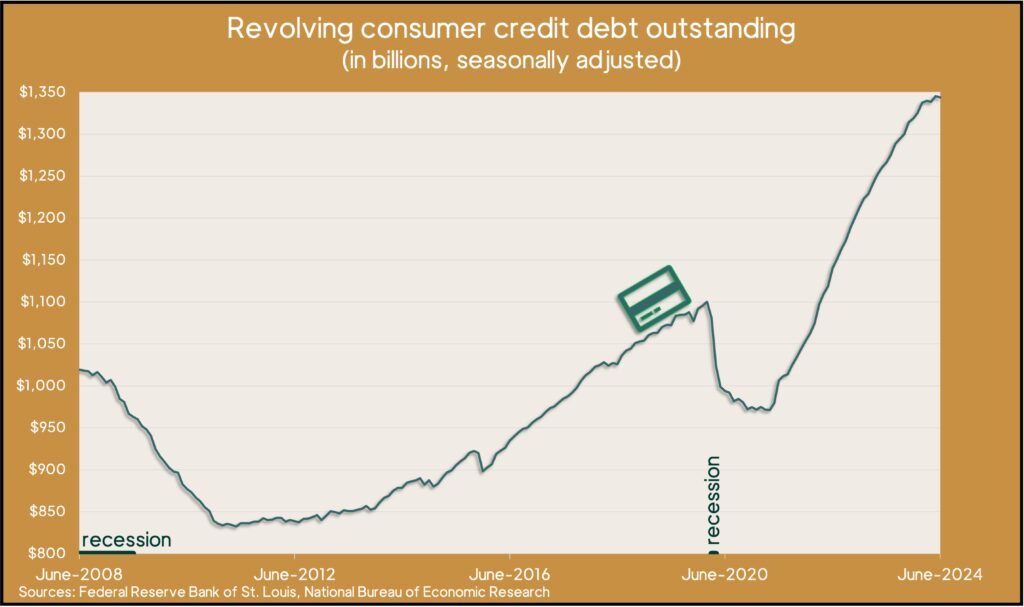

In a sign of weakening consumer spending, outstanding credit card debt receded in June. The Federal Reserve reported a 1.5% decline in the annual rate of revolving consumer debt outstanding, the second decrease in three months after 36 straight months of gains. The pace of total consumer debt rose 2.1% from May, including a 3.4% increase in non-revolving debt – mostly car financing and student loans. With nearly 70% of U.S. economic growth relying on consumer spending, the drop in credit card debt suggests a lower commitment to buying. Credit card debt grew 1.2% in the second quarter of 2024, the slowest growth since the beginning of 2021.

Thursday

The four-week moving average for initial unemployment claims rose to its highest level in 13 months, up for the fourth week in a row and the eighth time in nine weeks. The indicator of employer willingness to let workers go stayed 34% below the all-time average, according to Labor Department data. The level was 15% above where it was just before the 2020 COVID pandemic. The total number of claims rose 1.2% from the week before to nearly 2 million, which was up 5.8% from the same time last year.

Friday

No major releases

Market Closings for the Week

- Nasdaq – 16745, down 31 points or 0.2%

- Standard & Poor’s 500 – 5344, down 2 points or 0.0%

- Dow Jones Industrial – 39498, down 239 points or 0.6%

- 10-year U.S. Treasury Note – 3.94%, down 0.15 point