Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl and Joel Dresang, engineered by Jason Scuglik)

Week in Review (Aug. 19-23, 2024)

Significant Economic Indicators & Reports

Monday

The Conference Board said its index of leading economic indicators fell again in July, but the six-month decline decelerated from the previous six months, no longer signaling recession. The business research group said its index dropped 0.6% from June, led mostly by non-financial indicators. But the six-month reading was down 2.1%, compared to a dip of 3.1% in the previous six months. The Conference Board forecast that the U.S. economy will grow by an annual rate of 0.6% in the third quarter, followed by a 1% growth rate in the last three months of the year.

Tuesday

No significant releases

Wednesday

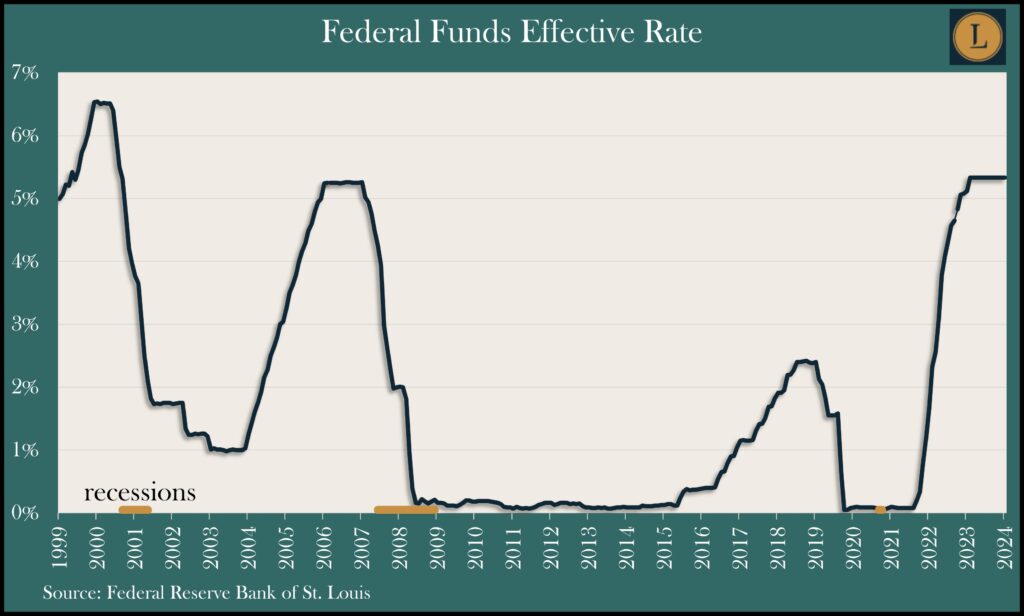

Minutes from the July meeting of the Federal Open Market Committee showed that members of the Federal Reserve’s policy group observed continued progress toward tamping down the inflation rate to a long-range target of 2%. The FOMC had raised short-term lending rates to cool the economy as inflation reached a four-decade high in mid-2022. The group is scheduled to meet again Sept. 17-18 to consider whether it’s ready to start lowering rates.

Thursday

The four-week moving average for initial unemployment insurance claims fell for the second week in a row. At 236,000 claims, the average was 35% below the 57-year average, suggesting continued reluctance by employers to let go of workers. The Labor Department reported that 1.9 million Americans claimed jobless benefits in the latest week, down 1.3% from the week before and up 3.7% from the same time last year.

The sluggish real estate market ended a four-month streak of lower sales in July as existing home sales rose 1.3%, according to the National Association of Realtors. Sales reached an annual pace of 3.95 million houses, up 1.6% from June and 2.5% below the rate in July 2023. The trade association said stubbornly low inventory ticked up compared to both the month and the year before. Affordability improved as mortgage rates declined. The median sales price was $422,600, up 4.2% from the year before, the 13th consecutive increase in prices.

Friday

Though a fraction of the overall market, the annual rate of new home sales rose 10.6% in July to its fastest pace in 14 months, the Commerce Department reported. The sales pace reached 739,000 houses, which was 4.5% ahead of where it was just before the COVID-19 pandemic. The supply of new houses on the market ebbed to a 10-month low. Meanwhile, the median sales price dipped 1.4% from the year before to $429,800.

Market Closings for the Week

- Nasdaq – 17878, up 246 points or 1.4%

- Standard & Poor’s 500 – 5635, up 80 points or 1.4%

- Dow Jones Industrial – 41175, up 515 points or 1.3%

- 10-year U.S. Treasury Note – 3.81%, down 0.09 point