Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, engineered by Jason Scuglik)

Week in Review (Aug. 12-16, 2024)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

Inflation on the wholesale level rose 0.1% in July and was up 2.2% from the year before, according to the Producer Price Index. The Bureau of Labor Statistics the price for goods increased the most in one month since February, led by a 2.8% gain in gasoline. Services prices, meanwhile, dipped the most since March 2023. The core PPI, which excludes volatile prices for food, energy and trade services, rose 0.3% from June and was up 3.3% from July 2023.

Wednesday

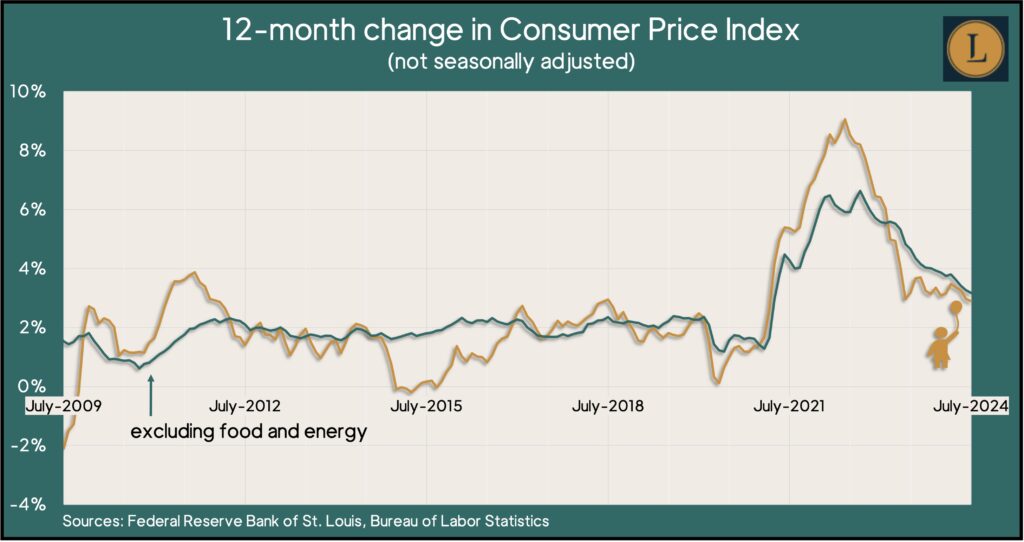

The pace of consumer inflation continued eased in July to its lowest level in more than three years. The Bureau of Labor Statistics said its Consumer Price Index rose 2.9% from July 2023. The rate was still above the Federal Reserve’s long-term target of 2%, but it was the lowest rate since March 2021 and down from a 41-year high of 9.1% in June 2022. Shelter costs accounted for 90% of the 0.2% increase in the index from June, the first monthly gain in three months. The price of gasoline was unchanged after two months of decline. Excluding volatile food and energy costs, the core CPI rose 3.2% from the year before, the lowest since April 2021.

Thursday

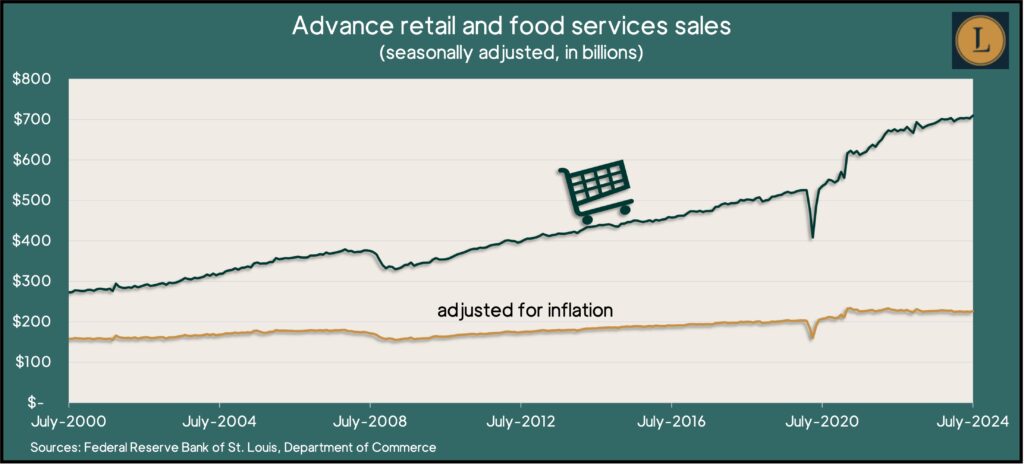

A rebound for car dealers helped boost retail sales in July. Consumers spent 1% more at stores, bars, restaurants and online in June as 10 of 13 retailer categories posted higher sales, the Commerce Department reported. Sales at car dealers rose 3.6% after falling 3.4% in June attributed to software glitches. Adjusting for inflation, total retail sales rose 0.8% in July. Economists watch the retail numbers because consumer spending makes up nearly 70% of U.S. economic activity, as measured by gross domestic product.

The Federal Reserve reported that industrial production dipped in July, citing disruptions from Hurricane Beryl and slower automotive output, possibly tied to seasonal plant shutdowns. Production fell 0.6% overall, the first decline in four months, and was down 0.2% from July 2023. Excluding the auto industry, factory production rose 0.3% from June. Industries’ capacity utilization rate shrank to 77.8%. It has stayed below the long-term average of 79.7% since the end of 2022, suggesting low pressure for inflation.

The four-week moving average for initial unemployment claims fell for the first time in five weeks. An indication of employers’ reluctance to let go of workers, the rolling average was 35% below the long-term average dating back to 1967. Total jobless claims dropped 1.4% from the week before to 1.9 million, which was up 5.3% from the same time in 2023.

Friday

The Commerce Department reported on the annual rate of building permits and housing starts for July.

The University of Michigan reported on its consumer sentiment index.

Market Closings for the Week

- Nasdaq – 17632, up 886 points or 5.3%

- Standard & Poor’s 500 – 5554, up 210 points or 3.9%

- Dow Jones Industrial – 40660, up 1162 points or 2.9%

- 10-year U.S. Treasury Note – 3.89%, down 0.05 point