Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Blake Miller)

Week in Review (March 31-April 4, 2025)

Significant Economic Indicators & Reports

Monday

No major releases

Tuesday

U.S. factories contracted in March amid “confusion” from volatile tariff policies, according to the Institute for Supply Management. The trade group said its manufacturing index sank following its first two months of expansion in more than two years. “Demand and production retreated and destaffing continued, as panelists’ companies responded to demand confusion,” said the report, which is based on supply manager surveys. The ISM said 46% of the nation’s manufacturing gross domestic product contracted in March, compared to 24% in February.

The Commerce Department said construction spending rose by 0.7% in February, the fourth gain in five months. The seasonally adjusted annual rate of spending neared $2.2 trillion, a record, not adjusting for inflation. Residential construction spending, which makes up about 43% of the total, rose 1.3% from January despite a drop in multi-family housing. Public spending, which accounts for 23% of the total, rose 0.2%.

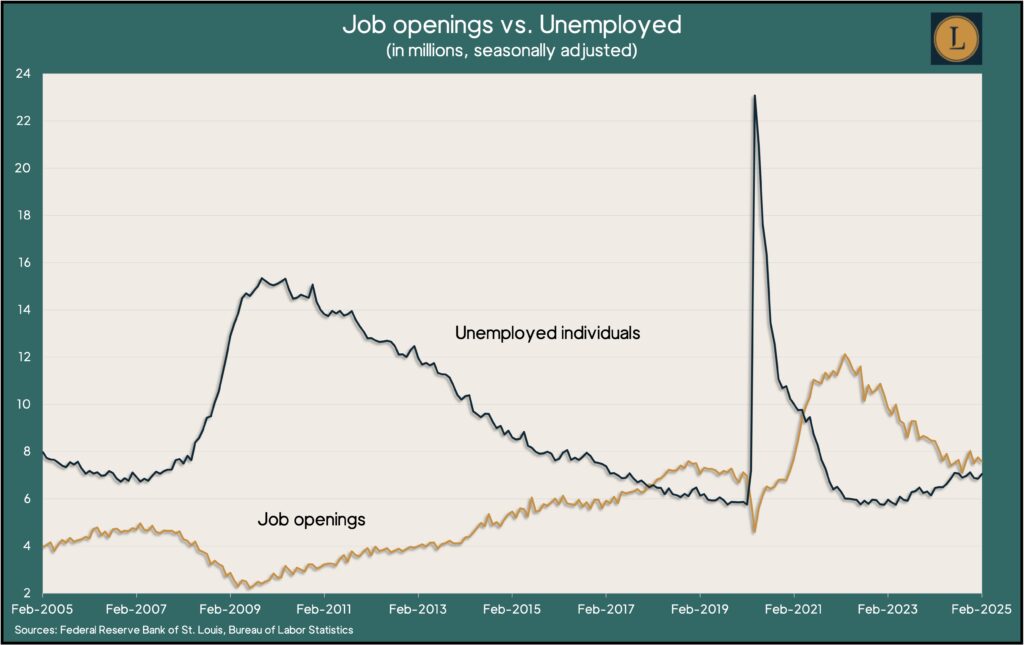

Employers posted fewer job openings in February, although demand for workers continued to outpace supply. Postings were just under 7.6 million, down from a record 12.2 million openings nearly three years ago, and still above the 7 million level just before the COVID pandemic. Both the number and rate of workers quitting their jobs – a measure of worker confidence- stayed below the pre-pandemic level, where they have been since the end of 2023.

Wednesday

The Commerce Department reported a 0.6% gain in manufacturing orders in February, the second consecutive advance. Demand for motor vehicles and parts led the increase. Excluding the volatile transportation category, factory orders rose 0.4% from January. Compared to February 2024, total orders were up 1.5% and up 0.5% excluding transportation. Core capital goods orders, a proxy for business investments, fell 0.2% for the month and were up 0.6% from the year before.

Thursday

The U.S. trade deficit fell 6% in February from its record in January. The Bureau of Economic Analysis said the gap narrowed to $122.8 billion as the value of exports rose by 2.9%, and imports stayed level. Since February 2024, the deficit widened by 86% with exports growing 4.6% and imports rising more than 21%. The trade deficit detracts from economic growth, as measured by gross domestic product.

The Labor Department reported that the four-week moving average for initial unemployment claims fell for the second week in a row. Average claims remained 39% below the 58-year average, continuing to reflect employer reluctance to let workers go. Total claims were down a little from the week before at 2.1 million, which was 3% higher than at the same time a year ago.

The U.S. services sector weakened in March, growing at its slowest rate in nine straight months of overall expansion. The Institute for Supply Management said its services index suggested the overall economy continued to expand, although not as fast. The trade group’s survey of supply managers found respondents about evenly split between optimism and pessimism for the coming months. Pessimists cited expected repercussions from trade wars.

Friday

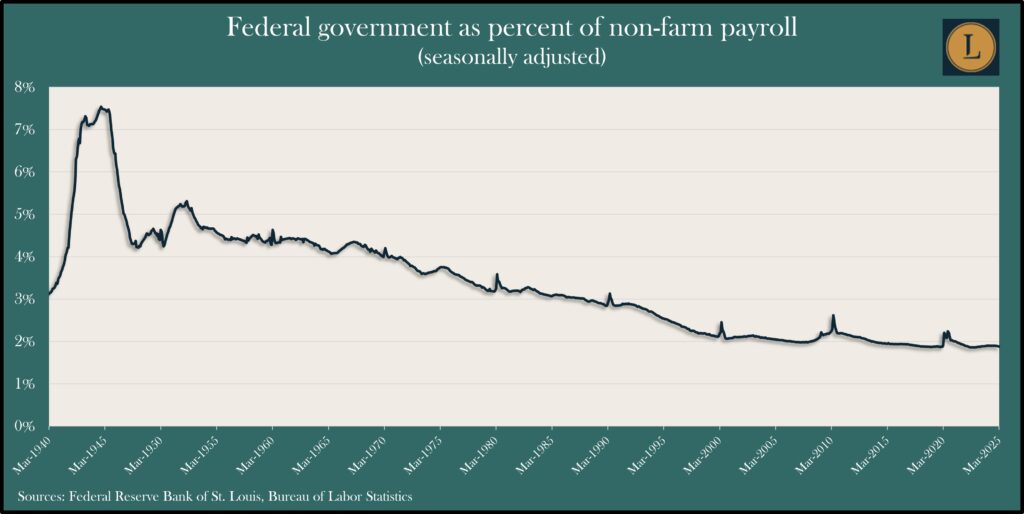

U.S. employers continued to add jobs in March – for the 51st month in a row and at a swifter pace. The jobs report from the Bureau of Labor Statistics showed 228,000 more jobs than February, up from the 12-month average of 158,000. The annual average wage gain fell to 3.8% but continued to outpace overall inflation. The number of temporary help workers stayed below the pre-pandemic level. Federal government employment declined for the second month in a row and stayed around 2% of the total work force, as it has been since 1995. Additional job seekers raised the unemployment rate to 4.2%, keeping within the 10-month range of 4% to 4.2%.

Market Closings for the Week

- Nasdaq – 15588, down 1,735 points or 10.0%

- Standard & Poor’s 500 – 5074, down 507 points or 9.1%

- Dow Jones Industrial – 38315, down 3,269 points or 7.9%

- 10-year U.S. Treasury Note – 4.16%, down 0.03 point