Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (April 14-18, 2025)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

No major announcements

Wednesday

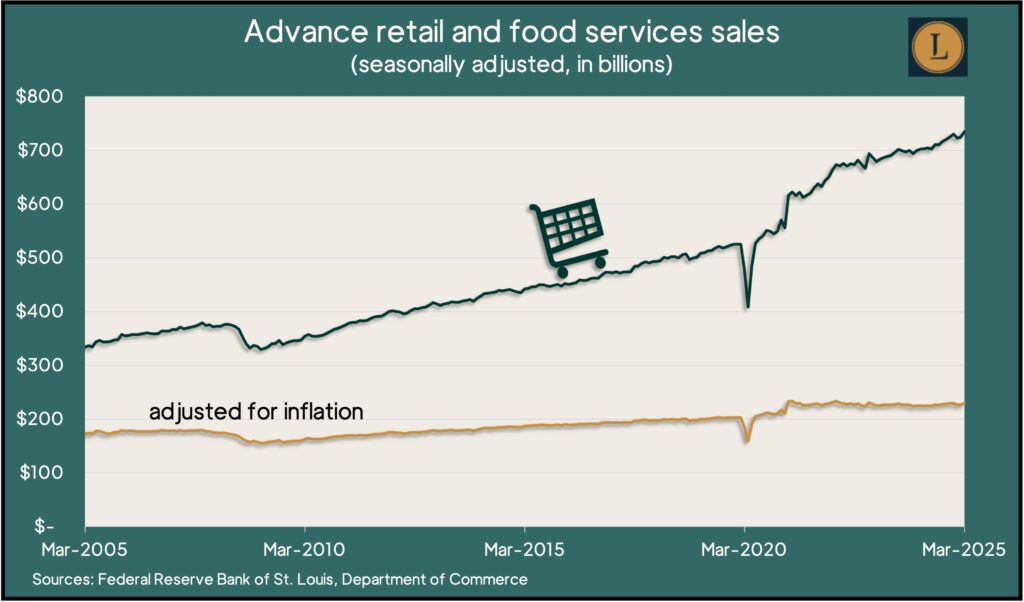

In a further sign of economic resilience, consumers continued spending at stores in March with retail sales advancing 1.4% from February. It was the sixth advance in seven months and the biggest one-month jump in more than two years. The Commerce Department reported that 11 of 13 major categories had sales increases in March, including a 5.3% gain for car dealers and a 1.8% rise for bars and restaurants. The only declines were at furniture stores and gas stations, where sales decreased in part because of lower prices. Adjusted for inflation, retail sales rose 1.5%.

Unseasonably warm weather in March resulted in decreased output from utilities, which lowered overall industrial production for the month, the Federal Reserve reported. The dip in total output was the first in four months. Still, through the first quarter of 2025, industrial production rose at a 5.5% annual pace, compared with a 1.3% increase in output since March 2024. Manufacturing production rose in March for the fifth month in a row and was up 1% from the same time last year. The same report showed the capacity utilization rate, a measure of potential inflation pressure, shrank slightly from February and stayed below the long-time average, where it has been since mid-2023.

Thursday

The four-week moving average for initial unemployment claims declined for the third time in four weeks, staying 39% below the long-term average. The measure of employers’ reluctance to let workers go continued to indicate a tight labor market. According to Labor Department data, total jobless claims fell to just above 2 million in the latest week, down 3% from the week before, though up 3% from the same time in 2024.

The U.S. housing market continued to weaken in March as housing starts stayed below the pre-pandemic pace. Figures from the Commerce Department showed new construction 11% below its pace in February, though it was on par with levels in mid-2007, prior to the Great Recession. The pace of housing permits, an indicator of commitments to future homebuilding, edged up in March and also hovered near the activity just before the pandemic and 2007. Other data showed that the rate of houses under construction stayed historically high, though it continued to recede from its 2022 peak.

Friday

Markets closed in observation of Good Friday

Market Closings for the Week

- Nasdaq – 16286, down 438 points or 2.6%

- Standard & Poor’s 500 – 5283, down 81 points or 1.5%

- Dow Jones Industrial – 39142, down 1,070 points or 2.7%

- 10-year U.S. Treasury Note – 4.33%, down 0.16 point