Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (April 7-11, 2025)

Significant Economic Indicators & Reports

Monday

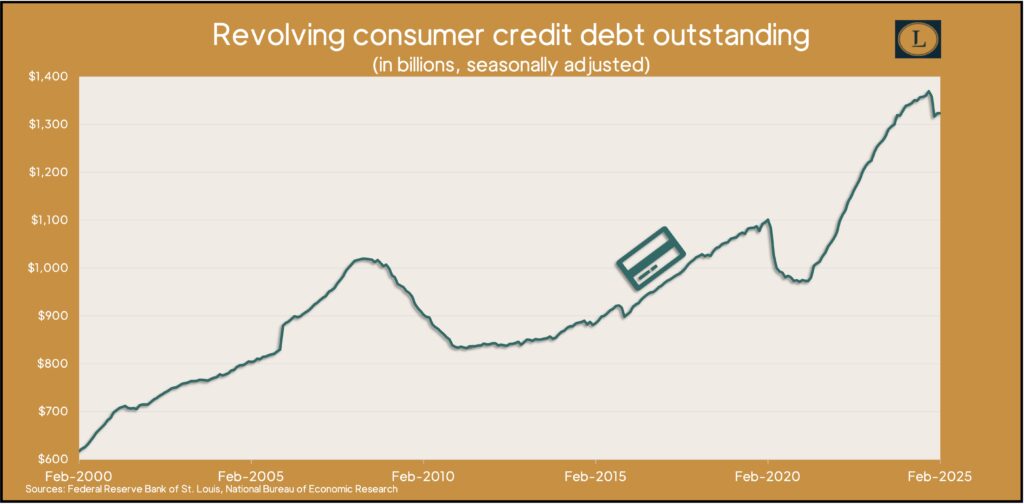

In a sign that consumers’ appetite for credit card debt is fading, the Federal Reserve reported that revolving credit debt outstanding rose at an annual rate of 0.1% in February. That was down from a pace of 6% in January, which followed back-to-back declines in November and December. The same report showed total consumer debt receded at an annual pace of 0.2% in February with falling amounts of non-revolving credit, which includes student loans and vehicle financing.

Tuesday

No major announcements

Wednesday

No major announcements

Thursday

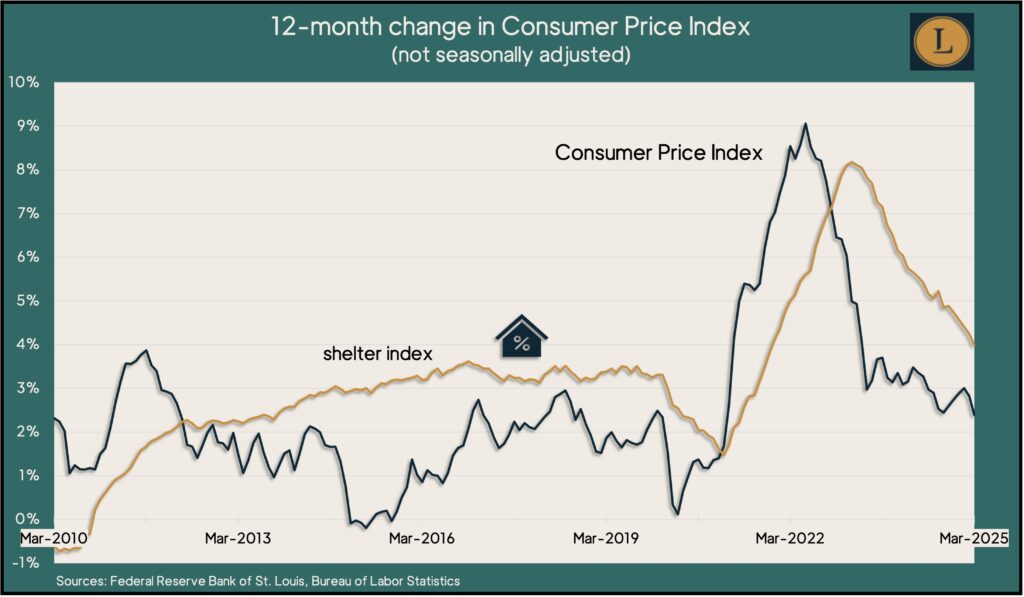

Overall inflation sank to its lowest level in four years in March. The Consumer Price Index, the broadest measure of inflation, fell 0.1% from February, thanks in part to a 6% drop in the price of gasoline. Compared to the year before, the CPI was up 2.4%, the lowest gain since February 2021. It was as high as 9.1% in June 2022. The Bureau of Labor Statistics said the cost for eggs continued rising, up nearly 6% from February and more than 60% above year-ago prices. The core CPI, excluding volatile food and energy prices, was up 2.8%, the smallest increase since March 2021.

The four-week moving average for initial unemployment claims stayed the same in the week ended April 5, remaining 39% below the long-term average since 1967. The measure of employers’ reluctance to let workers go was 8% above its level just before the COVID-19 pandemic, according to data from the Labor Department. Altogether, just under 2.1 million Americans claimed jobless benefits in the most recent week, up 0.7% from the week before but up 6% from the same time last year.

Friday

Inflation on the wholesale level sank for the first time in 15 months in March with the Producer Price Index falling 0.4%. The Bureau of Labor Statistics said lower gasoline prices accounted for two-thirds of the decline. The wholesale cost of eggs dropped 21% from February. The index gained 2.7% from March 2024. The rate had been as high as 11.7% in mid-2022, vs. 1.1% at the onset of the pandemic. The core Producer Price Index – excluding volatile prices for energy, food and trade services – rose slightly from February and was up 3.4% from the year before.

Consumer sentiment flashed warnings of recession, as Americans continued to lose faith in the economy. The University of Michigan index fell for the fourth month in a row, dropping more than 30% from where it was in December. Researchers said the preliminary April index was based on surveys before the April 2 U.S. tariff announcements. They noted that declines in sentiment were “pervasive and unanimous” across partisan and demographic groups. Among the findings were the greatest expectation of increased unemployment since 2009 and the highest expectation of inflation since 1981.

Market Closings for the Week

- Nasdaq – 16724, up 1,137 points or 7.3%

- Standard & Poor’s 500 – 5363, up 289 points or 5.7%

- Dow Jones Industrial – 40213, up 1,898 points or 5.0%

- 10-year U.S. Treasury Note – 4.50%, up 0.52 point