Podcast: Play in new window | Download

Advisors on this week’s podcast

Kyle Tetting

Adam Baley

Dave Sandstrom

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (June 17-21, 2024)

Significant Indicators & Reports

Monday

No major reports

Tuesday

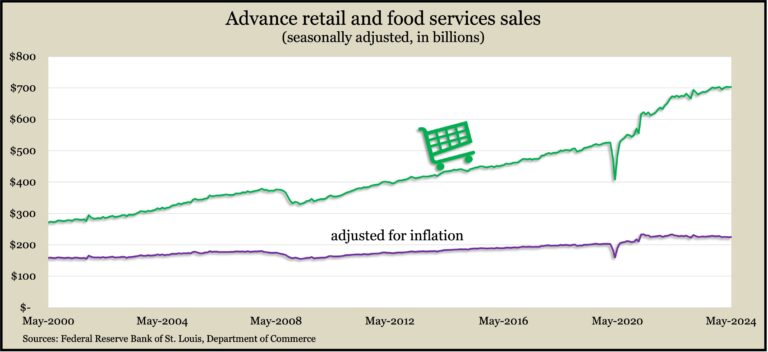

The Commerce Department said retail sales rose 0.1% in May after falling 0.2% in April. By category, sales were mixed as eight of 13 retail groups gained, including sporting goods and hobby stores, online retailers and car dealers. Among the categories showing declines were gas stations, where lower prices affected sales results. Furniture stores and home-and-garden centers reported lower sales both for the month and compared to May 2023. Retail sales measure most of the consumer spending that accounts for about two-thirds of U.S. economic activity.

U.S. industrial production rose 0.9% in May, the first gain in three months, according to the Federal Reserve. Increased output was led by a 0.9% advance in factory productions, which was broadly based, except for continued cuts in furniture making. Compared to the year before, total industrial production, including mining and utilities, was up 0.4%. Capacity utilization, considered a leading indicator of inflation, rose to 78.7% in May, the highest since November, but still below the long-term average for the 18th month in a row.

Wednesday

Markets closed in observance of Juneteenth Day

Thursday

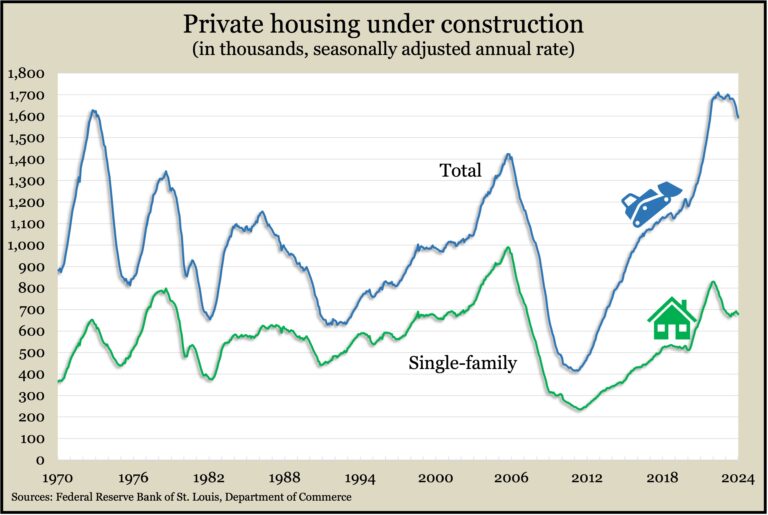

The annual pace of housing starts and building permits slowed in May to levels not seen since the COVID-19 recession. A joint report from the departments of Commerce and Housing and Urban Development showed new construction down 5% from April’s pace while permits sank 4%. Both figures reached their lowest points since June 2020. Multi-family housing was especially slowed, as permits declined to their slightest pace since April 2020. At the same time, the number of houses under construction in May continued to hover near record heights, based on data going back to 1970.

The four-week moving average for initial unemployment claims continued to rise, up for the second week in a row and the seventh time in eight weeks. The Labor Department reported that the average level of new claims was at its highest point since August. Though still 36% below the 57-year average, the measure of employer reluctance to part with workers was 11% above its low just before the pandemic. More than 1.7 million Americans claimed unemployment insurance benefits in the latest week, up 2% from the week before and up 3% from the same time last year.

Friday

The National Association of Realtors said existing home sales slipped again in May. The seasonally adjusted annual rate of 4.1 million houses sold was down 0.7% from April’s pace and 2.8% below the year before. The trade association said rising inventory should eventually encourage sales while moderating price increases. It said the number of available houses rose to the equivalent of 3.7 months’ worth at current sales rates, compared to 3.5 months in April and 3.1 in May 2023. The median sales price rose 5.8% from May 2023 to $419,300.

The Conference Board’s index of leading economic indicators fell 0.5% in May, compared to a 0.6% decline in April. The business research group cited a drop in new orders, weak consumer sentiment and a slowdown in building permits for the lower May index. Over the last six months, the index sank 2%, compared to a setback of 3.4% in the previous six months. The Conference Board forecast growth of less than 1% in the middle half of 2024.

Market Closings for the Week

- Nasdaq – 17689, No Change

- Standard & Poor’s 500 – 5465, up 33 points or 0.6%

- Dow Jones Industrial – 39150, up 560 points or 1.5%

- 10-year U.S. Treasury Note – 4.26%, up 0.04 point