By Joel Dresang

Much of the optimism for the U.S. economy is the health of American consumers.

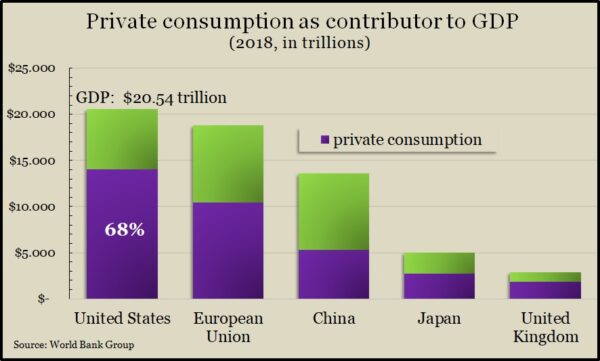

Consumers support the U.S. economy more than most other places. Consider:

- Consumer spending accounted for nearly $14 trillion or 68% of the country’s gross domestic product in 2018, vs. less than $5.3 trillion or 39% of the world’s second-largest economy, China. U.S. consumer spending exceeded China’s GDP.

- Per capita, the U.S. has one of the highest incomes: $46,350, in 2017—more than five times the worldwide average, 51% higher than the European Union, 18% higher than Japan.

- In the long, gradual recovery from the global financial crisis, American households have raised their net worth and lowered their debt payments to record levels, putting U.S. consumers in better shape than ever to continue spending.

“The fundamentals supporting household spending are solid,” Federal Reserve Board Chair Jerome Powell remarked at the end of a two-day meeting of the Federal Open Market Committee in January. The Fed routinely cites the power of consumers as a reason for confidence.

According to Powell, consumer strength outweighed an array of uncertainties, including weak exports and business investment, declining manufacturing output, sluggish growth abroad, muddled international trade and the Wuhan coronavirus.

Powell cited 50-year lows for unemployment, steady job gains, prime-age labor force participation and pay raises as supports for continued consumer spending. However, he also acknowledged a longer-range concern about income inequality by noting “the importance of sustaining the expansion so that the strong job market reaches more of those left behind.”

For all their clout, though, consumers can be capricious too.

“Consumer spending is fickle,” Bob Landaas said in a Money Talk Video. “It changes quite a bit month to month. It’s somewhat volatile.”

The testiness of consumers combined with the heft of their influence can make economic downturns nearly impossible to foretell, Bob explained.

“You’re trying to forecast a psychological reaction to a set of events. And that’s just really challenging,” Bob said. Whether it’s the domino effect of high-roller corporate bankruptcies in 2000 or the abrupt plummeting of home values in 2008, unexpected events can trigger consumer panic.

“Recessions aren’t caused by a specific data point. They’re not caused because some company goes down one morning or an index of leading economic indicators collapses,” Bob said. “They’re caused because of a crisis of confidence, and those are really challenging to predict.”

So, though consumers are a source of assurance in the continued record expansion of the U.S. economy, they’re also a reason for caution, which is another reason why, Kyle Tetting said, investors need to position themselves for the unexpected.

“It’s so important for investors to have that balanced portfolio,” Kyle said in a Money Talk Video. “because it allows them to get through those periods of uncertainty without giving up entirely and without trying to figure out when the turn is going to come.”

Joel Dresang is vice president-communications at Landaas & Company.

Learn more

Growth, value and the business cycle, a Money Talk Video with Dave Sandstrom

Talking Money; Business Cycle, by Peter May

The importance of balance for investors, a Money Talk Video

Ignore bonds at your own risk, a Money Talk Video with Kyle Tetting

Volatility: Stock market vs. your portfolio, a Money Talk Video with Kyle Tetting

(initially posted February 27, 2020)

Send us a question for our next podcast.

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.

Landaas newsletter subscribers return to the newsletter via e-mail.