By Joel Dresang

Rather than increase taxes or reduce benefits, the government decided to raise the retirement age. And French workers have revolted.

When the U.S. government made a similar move 40 years ago, no one batted an eye.

In fact, the ongoing lopsided mismatch between retirees drawing benefits longer vs. fewer workers paying into Social Security might again require moving back the goal posts.

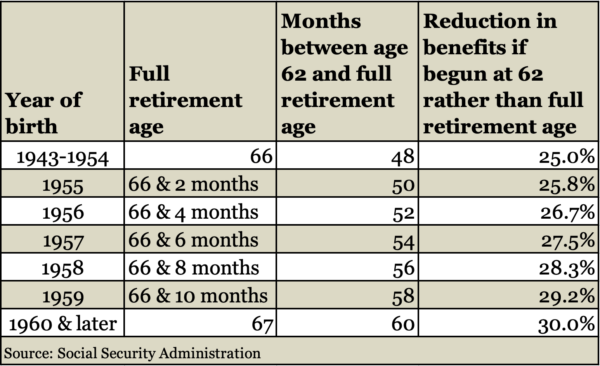

I just turned 65. My dad qualified for full retirement benefits at my age. But because Congress decided in 1983 to gradually raise the age to 67, I have to wait until I’m 66 and eight months to receive my full amount. (It’s an odd number because the older age is still phasing in. See below.)

It makes a difference. At full retirement, my monthly benefit would be $398 more than what I’d get if I started drawing Social Security right now. That’s $398 a month more for the rest of my life. I just have to wait another 20 months longer. If I wait until I’m 70, I’d get $1,421 more a month than I’d get now.

Of course, Social Security retirement benefits are just part of the calculus for when it behooves me to retire. Other factors include cash flow from investments, monthly pension payouts, my wife’s contributions and whatever we figure it will cost us to live without paychecks after more than four decades of working for a living.

All those numbers and estimates and projections we can work out with our investment advisor.

The trickier question raised by governments extending the retirement age is the non-financial quandary of when should we call it quits and begin the next phase of our lives? Semantically, it’s the difference between when can we retire and when should we.

Maybe I missed it, but I don’t recall a big to-do from American workers when Congress raised the full retirement age in 1983. Maybe that’s because lawmakers phased it in over 22 years. And they kept the minimum retirement age — when qualified workers may lock into lower monthly payments — at 62.

What’s happening in France is another story. President Emmanuel Macron tried elevating the retirement age in 2019. Then, all heck broke loose, pardon my French. The COVID-19 pandemic shifted priorities. But now, Macron has taken extraordinary measures to impose a higher age. Massive protests have occurred, and more are promised.

Other Money Talk articles from Joel Dresang

To be clear, France is raising the retirement age to 64 from 62. Until 2010, the age was 60. The U.S. Congress raised the full retirement age to 67 from 65 — where it was set initially in 1935. There’s consideration of raising it again to 69 — or 70.

More than just the age, though, French dissent appears to be a matter of pride. That’s the impression I’ve had from all that I’ve read so far, including an account from a New York Times reporter based in Paris.

“The government’s plan has struck a deep and sensitive nerve in a society that cherishes retirement and reveres a generous balance between work and leisure perhaps more than any other Western industrial country,” the article noted.

What struck a nerve with me was a reference to how long the French government estimates people will live past retirement age. That sent me looking into a 2022 report from the trustees overseeing the Social Security funds. What I found there suggests that an American male who turned 65 in 2021 could expect to live another 16.9 years on average.

Assuming that has changed little in two years, I might have another 17 years left. I’d be 82.

So that weighs into when I should retire. How long do I expect to live? My dad lived to 88. My mom made it to 94. I have three brothers whose average age at death was 64. On the other hand, my oldest brother is going strong at 81. (I’ve told him my goal is to live to be older than he gets.)

Another perspective on how long I should work came from the recent revelation that 28-year-old Giannis Antetokounmpo had thought about quitting his phenomenal run as an elite athlete. He was feeling his work take a toll on his capacity to enjoy his family and his life.

At the other end of the spectrum, there’s bickering in Washington over whether an 89-year-old with age-related impairments is fit to continue in the U.S. Senate. One in six senators is 75 or older. Meanwhile, the frontrunners for the 2024 U.S. presidential election are 80 and 76.

Such headlines highlight that deciding at what age to call it quits is not just a financial matter. My wife and I have put ourselves in a position to be able to afford retirement, more or less. But we need to keep talking about why and when we should retire.

For now, we place more value on what we give to and get from our jobs than what we imagine ourselves doing without work. And we’d be privileged to be able to decide for ourselves when to affordably retire. In a report to Congress on the retirement age, the Congressional Research Service noted that some groups are disadvantaged by having to wait longer for full retirement benefits. Life expectancy can vary by socioeconomic group, for instance, and workers in physically demanding occupations can’t necessarily work longer or afford to wait to begin drawing Social Security.

Our investment advisor helps us track the financial side, but he also has experience guiding families through other considerations on when they should retire. In the end, we’ll get to decide when to call it quits, but it’s prudent for us to include others in our conversation.

Joel Dresang is vice president-communications at Landaas & Company.

Learn more

Knowing when to tap Social Security, by Joel Dresang

Working longer to fatten Social Security, A Money Talk Video with Lisa Lewitzke

When Should I …check my Social Security Statement?

When to start receiving retirement benefits, from the Social Security Administration

Benefits calculators, from the Social Security Administration

Frequently Asked Questions, from the Social Security Administration

7 lessons from my Social Security Statement, by Joel Dresang

Retirement insurance at 75, by Joel Dresang

(initially posted April 27, 2023)

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.