By Bob Landaas

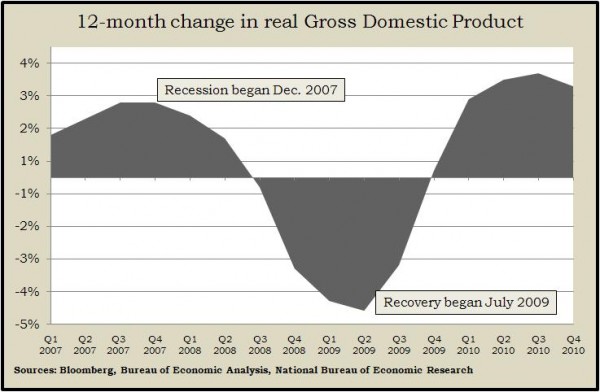

Last summer, we still were talking of the potential for a double-dip. But later in August, it became apparent we weren’t going to go back into recession, and we turned the corner before the end of this past year, transitioning from an economic recovery to an expansion.

The typical business cycle lasts four to five years. We’re about halfway through this one, but we’re knee-deep in the expansion phase.

And what interests me is the fact that there’s very little upward pressure on interest rates. That typically is what derails expansionary phases in the business cycle, as the Fed starts raising rates just enough to break the camel’s back, and the cycle starts all over again.

“It’s wrong for people to manage their affairs as if inflation is imminent.”

I’m encouraged by the fact that there doesn’t appear to be much upward pressure on rates. Everybody’s been talking about that for a while.

But the latest reports show core inflation continuing to be under 2%. It’s going to be pretty difficult for inflation to rear its ugly head in the near future.

Officials from the Federal Reserve keep saying the firmness in commodities prices and the oil price spike would be short-lived, and that they don’t anticipate inflation rising.

It’s not that inflation can’t go up, and it’s not that it even won’t go up. But I think it’s wrong for people to manage their affairs as if inflation is imminent.

Frankly, I don’t see how it can be with the economy as weak as it is still.

I’ve been at this so long that I can cite chapter and verse on everybody’s worries as you go through the business cycle.

- Let’s start with recessions. The worriers of the world think we’re going to hell in a hand basket. “This time it’s going to be different. We’re not going to recover.”

- So as the recovery gradually takes hold, the worries change to “No, no, no. We’re going to fall back in the hole. We’re going to double-dip.”

- And as we start entering into the expansionary phase of the cycle, everybody starts meowing about how higher inflation and higher interest rates are going to derail the recovery. It’s like a stopped clock. It’s right twice a day. And ultimately, they’re right: The higher rate does derail the recovery. But it’s years into the future.

The reason why I’m going down this road is it’s becoming more and more apparent that rising rates will not be an in-your-face type of issue.

So I don’t know that we have a lot to worry about in the bond market short-term. And I don’t know that we have a whole lot to worry about in the stock market, relative to the Fed derailing the expansion. There just isn’t measurable inflation beyond the Fed’s comfort zone that’s going to get in our way.

Bob Landaas is president of Landaas & Company.

initially posted April 20, 2011