By Steven Giles

When to start claiming Social Security benefits is an essential decision in retirement planning. The answer depends on personal circumstances, and it’s something that I help clients determine.

On average, retirees 65 and older rely on Social Security for 30% of their income. When you begin benefits makes a difference on how much you receive – for the rest of your life.

While there is no wrong answer, deciding what is best for a retiree must be done with care.

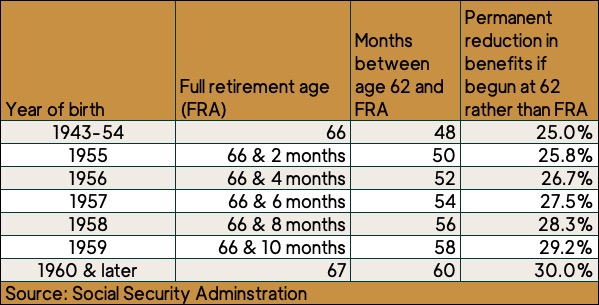

To aid discussions and decision making, here are some pros and cons of taking Social Security benefits sooner (as early as age 62) or later (up to age 70). In between is the full retirement age (FRA), which varies by birth year (See below.), and is 67 for anyone born in 1960 or later.

SOONER

Age 62 to full retirement age (FRA)

Pros:

__Immediate income – Useful if you need funds to cover expenses

__More years of benefits – You’ll receive payments for a longer period.

__Flexibility – Allows you to retire earlier and enjoy life while still healthy.

__Preserving investments – Lets you rely less on investments for income, allowing them to appreciate more, possibly leaving more assets to heirs.

__Lower break-even point – If you have a shorter life expectancy, you may receive more in total by taking benefits early.

Cons:

__Reduced monthly benefits – You will get 25% to 30% less per month – for as long as you receive benefits – vs. waiting until FRA.

__Earnings penalty – If you work while collecting before FRA, your benefits may be temporarily reduced.

__Lower survivor benefits – If you pass away, your spouse may receive lower benefits.

__Long-term financial impact – If you live long, you may receive less total lifetime benefits than if you had waited.

LATER

From FRA up to age 70

Pros:

__Higher monthly benefits – Your check increases by about 8% per year past FRA until age 70.

__Increased lifetime payout – If you live longer, you’ll receive more total benefits.

__Higher survivor benefits – Your spouse may receive more if you pass away.

__No earnings penalty – Once you reach FRA, you’re allowed to work without benefits being reduced.

Cons:

__Delayed access to funds – You wait longer to receive benefits, which may be difficult if you need income sooner.

__Break-even point – If you don’t live past your late 70s or early 80s, you might not benefit from the delayed payments.

__Risk of policy changes – Future Social Security adjustments could impact benefit.

Learn more

Social Security benefits not going away, by Joel Dresang

Knowing when to tap Social Security, by Joel Dresang

Get online with Social Security, by Joel Dresang

Planning retirement via Social Security, a Money Talk Video with Lisa Lewitzke

Key considerations:

- Health and life expectancy – If you have health concerns, claiming earlier may be wiser. If you expect to live longer, delaying may be better.

- Financial need – If you need income to cover living expenses, taking Social Security early might be necessary.

- Employment status – If you plan to work, waiting can help avoid penalties and maximize benefits.

- Spousal and survivor benefits – Coordinating with a spouse’s benefits can optimize long-term financial security.

Your monthly Social Security benefits can make a difference on what you can afford in retirement and how you allocate your investments. When to start claiming benefits matters. Be sure to weigh the pros and cons of that decision with your family as well as your advisor.

Steve Giles is a senior vice president and investment advisor at Landaas & Company, LLC.