Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (March 10-14, 2025)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

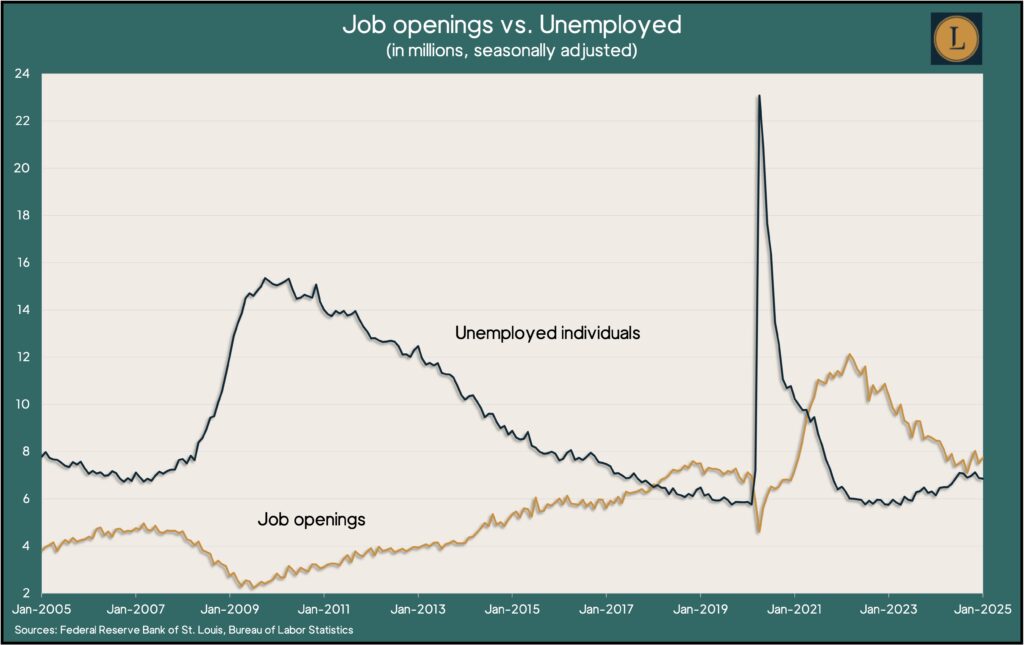

U.S. employers posted 7.7 million job openings in January, up marginally from December but down nearly 9% from the year before, the Bureau of Labor Statistics reported. Demand for workers continued to outstrip supply, but the gap narrowed. Openings had eclipsed 12 million in March 2022 and have trended lower ever since. They were barely 7 million just prior to the COVID-19 pandemic. Measures of hiring and dismissals showed little change, but voluntary quitting – an indication of worker confidence – was below pre-pandemic levels for the 13th month in a row.

Wednesday

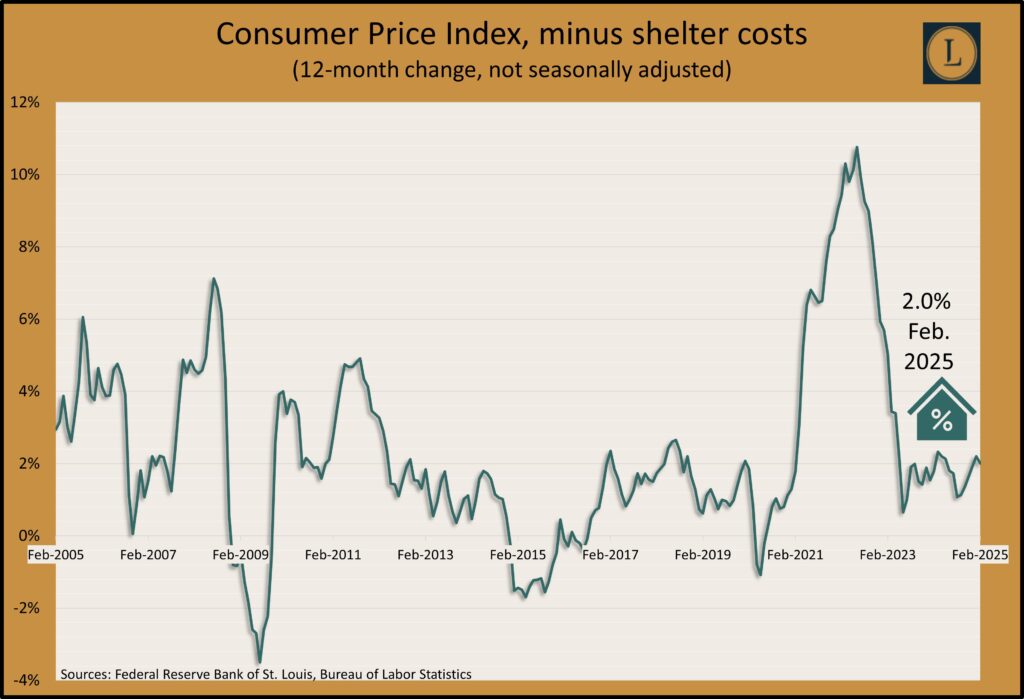

The broadest measure of inflation declined slightly in February. The Bureau of Labor Statistics reported the Consumer Price Index rose 2.8% from February 2024, unadjusted for inflation. That was the lowest rate since November, down from a four-decade high of 9.1% in 2022, though still higher than the Federal Reserve’s long-term target of 2%. Shelter costs accounted for nearly half of the monthly rise in inflation, offset by declines in air fares and gasoline. The price of eggs gained 10% from January and was up 59% from February 2024. The core CPI, excluding volatile food and energy costs, was up 3.1% from the year before. Shelter costs rose 4.2% from the year before, the smallest 12-month increase in more than three years. Absent shelter prices, inflation in February rose 2% from the year before.

Thursday

Wholesale inflation was unchanged in February, as higher prices for goods, led by food, offset lower prices for services. The Bureau of Labor Statistics said its Producer Price Index stayed even after rising 0.6% in January. Excluding volatile prices for food, energy and trade services, the core PPI rose 0.2% from January. Year to year, the headline PPI rose 3.2% in February, down from 3.5% in January, the first deceleration in five months. The core PPI was up 3.3%, the lowest rate since April.

The four-week moving average for initial unemployment claims rose for the third week in a row, reaching the highest level since December. Data from the Labor Department continued to suggest a tight job market in which employers are reluctant to let workers go. The four-week number was 38% below the 58-year average. Some 2.2 million individuals were receiving jobless benefits in the latest week, up 3% from the week before and up nearly 6% from the year before.

Friday

The University of Michigan said consumer sentiment fell another 10.5% since February, the third consecutive decline, a setback of 22% since December. The preliminary March measure of consumers’ moods showed heightened gloom “consistently across groups” with survey respondents citing uncertainty amid “frequent gyrations in economic policies.” Consumers surveyed said they expected inflation to reach 4.9% in a year, the highest forecast since November 2022. The one-month jump in longer term expectations for inflation was the biggest since 1993. Economists watch sentiment as an indicator of consumers’ appetite for spending, which drives about 70% of the U.S. economy.

Market Closings for the Week

- Nasdaq – 17754, down 442 points or 2.4%

- Standard & Poor’s 500 – 5639, down 131 points or 2.3%

- Dow Jones Industrial – 41488, down 1314 points or 3.1%

- 10-year U.S. Treasury Note – 4.31%, up 0.01 point