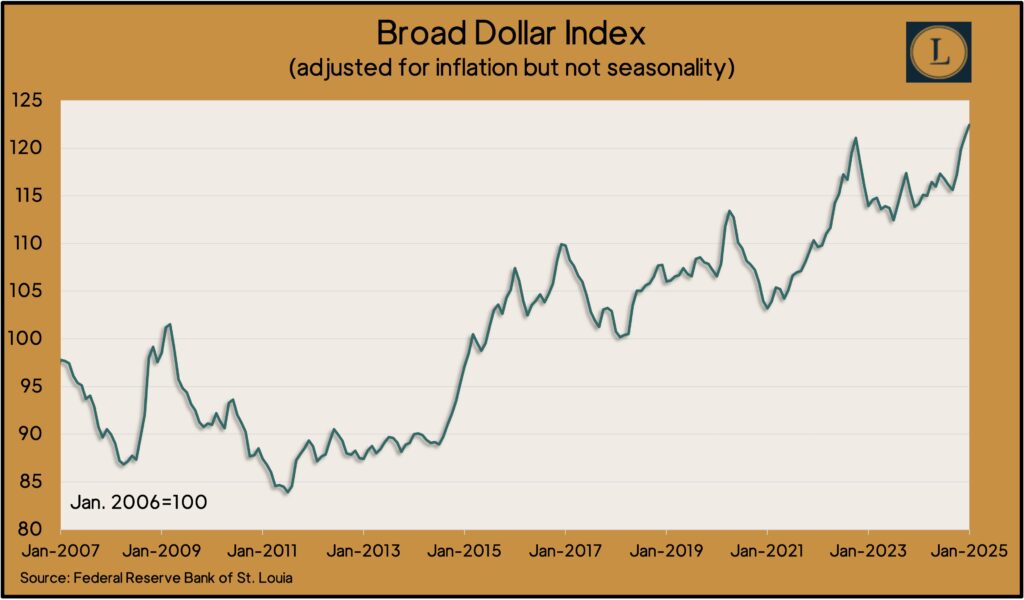

(A Federal Reserve gauge against other major currencies shows the U.S. dollar reaching an all-time high in January, even adjusting for inflation.)

By Steve Giles

The law of gravity suggests that when something reaches a peak, it would be prudent to consider what might happen when it falls. With the U.S. dollar reaching record levels, it’s a good time for investors to think about their portfolios’ international exposure.

A weakening dollar could reshape investment landscapes, which means international diversification may be essential for maximizing returns and managing risk.

Historically, when the U.S. dollar weakens, international investing becomes an attractive strategy for American investors. A weaker dollar means that foreign assets and revenues, when converted back into dollars, become more valuable. That dynamic creates several key advantages, should dollar weakness unfold:

Learn more

International investment opportunities,a 2015 Money Talk Video with Steve Giles

Over there: Investing in a global economy, a Money Talk Video with Kyle Tetting

International Investing, from the Securities and Exchange Commission

How to Use International Stocks in Your Portfolios, by Morningstar

1. Currency diversification and hedging

A declining dollar reduces purchasing power domestically, but investing in foreign markets provides a hedge. Assets denominated in stronger foreign currencies appreciate when converted back into U.S. dollars, offering protection against inflation and currency depreciation.

2. Higher growth opportunities

Some countries represent emerging markets and rising economies that outpace U.S. economic growth. Investing internationally provides more direct access to those markets and faster-growing sectors, such as technology, infrastructure and consumer goods.

3. Attractive valuations

With U.S. stocks historically expensive compared to international markets, weaker dollar conditions may drive capital toward undervalued foreign equities. Investors may be able to capitalize on lower price-to-earnings ratios and higher dividend yields in European and Asian markets.

4. Stronger performance of multinational companies

U.S. companies with significant international revenue benefit from a weaker dollar, as their foreign earnings increase in value through the currency exchange. Investing in global companies, both domestic and international, can amplify portfolio gains.

5. Reduced dependence on U.S. economy

A well-diversified portfolio mitigates risks associated with possible U.S. economic downturns, political instability or rising debt concerns. Exposure to global markets enhances resilience against domestic financial shocks.

Geographical considerations are just one of many aspects involved in allocating investment assets. Working with your advisor can help you come up with the right overall mix for you.

Steve Giles is a senior vice president and investment advisor at Landaas & Company, LLC.