Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl and Joel Dresang, engineered by Jason Scuglik)

Week in Review (Feb. 10-14, 2025)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

No major announcements

Wednesday

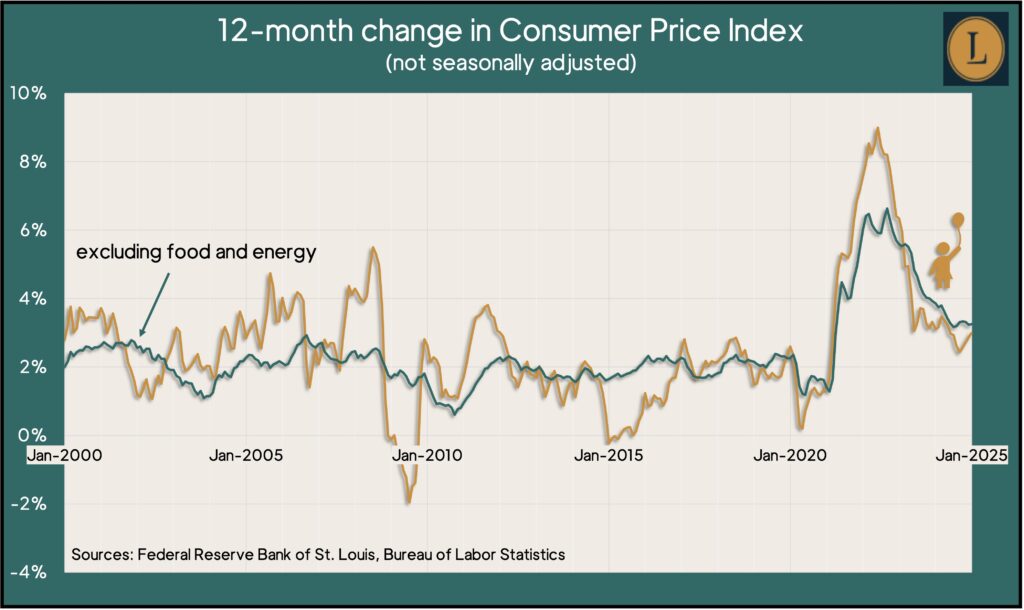

Housing and eggs continued to push inflation in January. The Bureau of Labor Statistics said its Consumer Price Index rose 0.5% from December, with 30% of the increase attributed to shelter costs. Food prices gained 0.4%, over two-thirds of it coming from a 15% advance in egg prices. Compared to January 2023, the broadest measure of inflation rose 3%, the fourth consecutive increase and the highest rate since May. Inflation stayed above the Federal Reserve’s long-term target of 2% and was down from a four-decade high of 9.1% in June 2022. Shelter costs were up 4.4% from the year before, the lowest increase in three years.

Thursday

Inflation on the wholesale level rose slightly in January, supporting the Fed’s pause on interest rate cuts. The Bureau of Labor Statistics said the Producer Price Index increased 0.4% from December, with goods costs rising faster than services. Compared to the year before, the wholesale inflation rate remained at 3.5%, down from a peak of 11.6% in March 2022. Amid Fed increases in interest rates, the rate got as low as 0.3% in mid-2023. The core PPI, which excludes volatile prices for food, energy and trade services, rose 3.4% from January 2024, slowing for the second month in a row.

The four-week moving average for initial unemployment claims fell for the second time in three weeks. An indication of employers’ reluctance to let go of workers, the rolling average stayed 41% below the long-term average. Total jobless claims rose nearly 4% from the week before, reaching 2.3 million, which was up more than 5% from the same time in 2024.

Friday

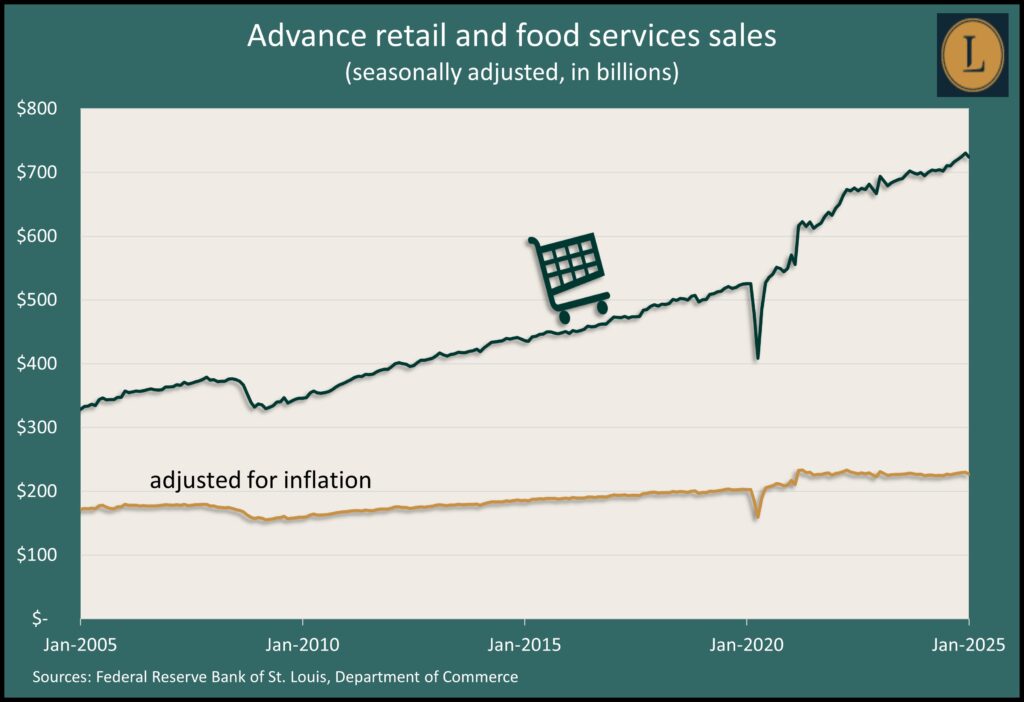

Harsh weather and a fall-off from holiday shopping helped lower retail sales in January. The value of goods and services sold dropped 0.9% from December, the first decline in five months and the biggest in nearly two years. Nine of 13 retail categories posted lower sales, the Commerce Department reported, including car dealers and online retailers. Sales at gas stations rose because of higher prices. Bars and restaurants also improved. Adjusted for inflation, retail sales declined by 1.3% in January, the most since February 2023.

The Federal Reserve reported that industrial production rose in January for the second month in a row after three months of decline. Increased aircraft production led the way, following resumed work after a strike settlement at Boeing. Utilities increased production by 7.8% because of extraordinarily cold weather. Output for the automotive industry fell by more than 5%. Industries’ capacity utilization rate rose slightly in January but stayed below the 52-year average for the 21st month in a row. High capacity rates can indicate potential pressure for inflation.

Market Closings for the Week

- Nasdaq – 20027, up 503 points or 2.6%

- Standard & Poor’s 500 – 6115, up 89 points or 1.5%

- Dow Jones Industrial – 44546, up 243 points or 0.5%

- 10-year U.S. Treasury Note – 4.47%, down 0.01 point