Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Jan. 6-10, 2025)

Significant Economic Indicators & Reports

Monday

A report from the Commerce Department showed manufacturing orders sinking in November for the third time in four months. The value of orders retreated 0.4% from October and was 0.1% ahead of November 2023. Excluding volatile orders for transportation equipment – most notably commercial aircraft, orders rose 0.2% for the month and gained 1.3% from November 2023. A proxy for business investments was up 0.4% from October and 0.4% from the year before.

Tuesday

The U.S. trade deficit widened by 6.2% in November to $78.2 billion, a result of imports outpacing exports. According to the Bureau of Economic Analysis, exports rose by 2.7% from October, led by sales of industrial supplies and automotive products. Imports gained 3.4%, led by increased U.S. purchases from abroad of semiconductors and automotive products. Through the first 11 months of 2024, the deficit – which detracts from gross domestic product – widened 13%; exports gained 4%, and imports rose 3.4%.

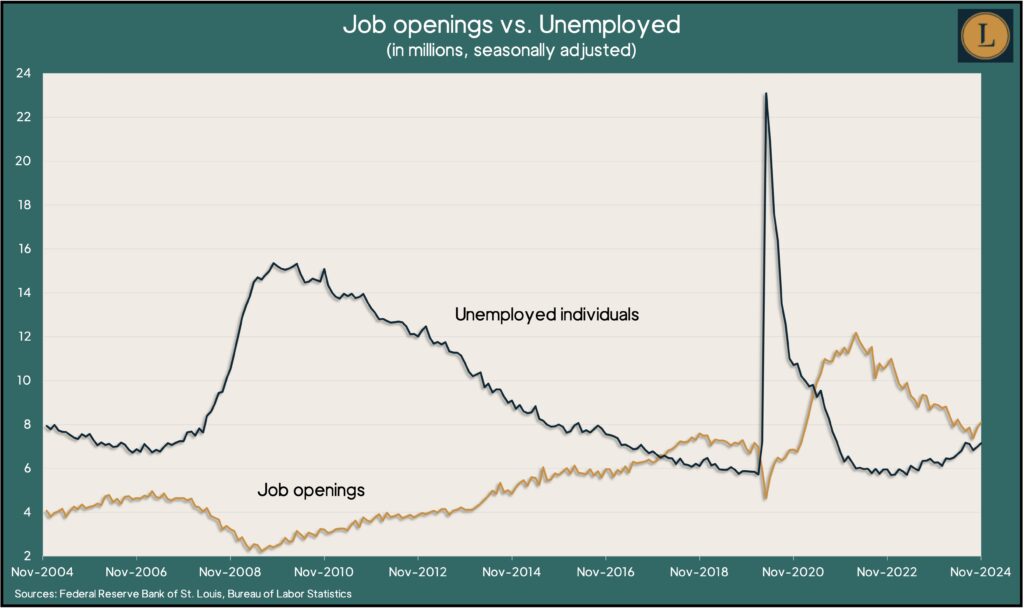

U.S. employers posted 8.1 million job openings in November, the most since May. Openings reached a record high of 12.2 million in March 2022 and remained above the pre-pandemic level of about 7 million. The Bureau of Labor Statistics said the number of hires continued to barely outpace separations in November. The proportion of workers quitting their jobs – an indicator of worker confidence – stayed below the pre-pandemic level for the 13th month in a row. Job openings remained greater than the number of unemployed job seekers, showing a continued gap between the demand and supply of workers.

The U.S. services sector grew again in December, gaining for the sixth month in a row, and at a faster pace, according to the Institute for Supply Management. The trade group’s services index showed new orders and supplier deliveries accelerating while hiring slowed from November. Supply managers told the ISM they’re generally confident about business conditions but have concerns about U.S. plans to increase tariffs.

Wednesday

The four-week moving average for initial unemployment claims fell for the second week in row to its lowest level since late April, 41% below the all-time average and 2% above where it was just before the COVID-19 pandemic. Data from the Labor Department showed just under 1.9 million Americans were claiming unemployment benefits in the latest week. That was down 4% from the week before and down 3% from the same time last year.

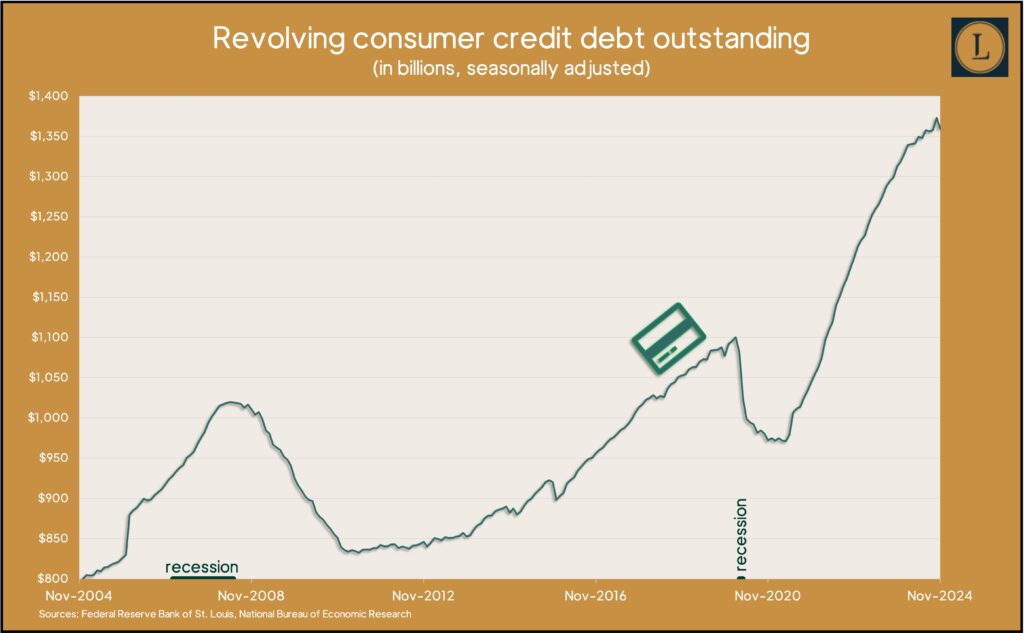

In a possible sign of wavering consumer conviction, credit card debt sank in November at the fastest pace since the pandemic. The Federal Reserve Board reported that revolving consumer debt outstanding declined at an annual pace of 12%. The decrease amounted to $13.8 billion. Consumer spending accounts for about two-thirds of U.S. economic output, as measured by the gross domestic product. Credit card debt partly reflects the confidence of consumers to keep spending.

Thursday

Stock market and government offices closed for President Carter funeral

Friday

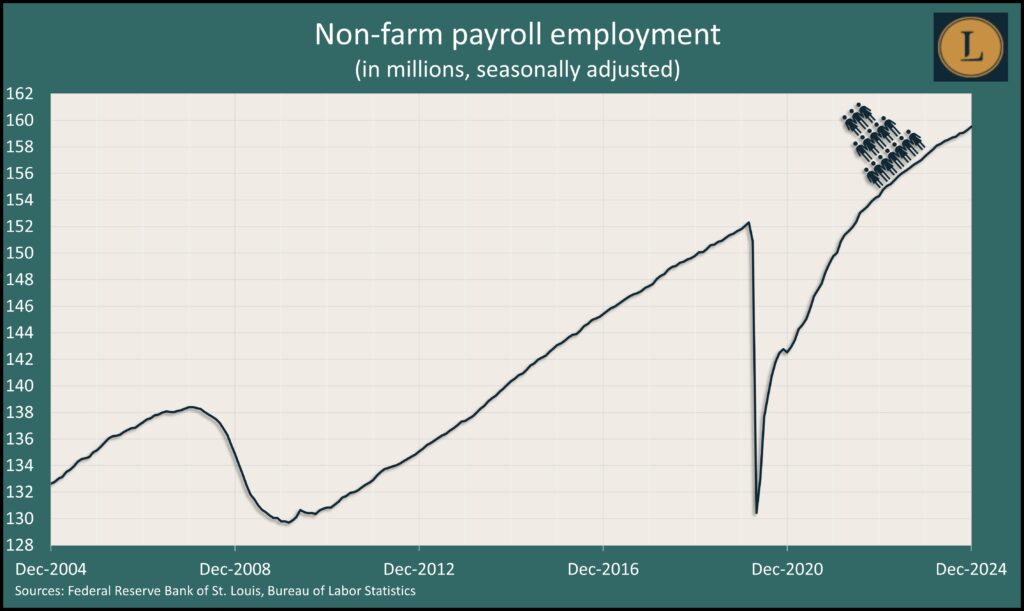

U.S. employers added 256,000 jobs in December, higher than the monthly average for 2024 (186,000) but below 2023 (251,000). Other data from the Bureau of Labor Statistics report suggests a continued strong employment market with signs of cooling. Temporary help jobs – considered a harbinger of overall hiring trends – dropped to the lowest number in more than four years and remained below the pre-pandemic level for the 17th month in a row. The average hourly wage rose 3.9% from December 2023, suggesting low pressure on inflation. The same report showed the unemployment rate at 4.1%, the seventh month in a row it has been either 4.1% or 4.2%. The labor force participation rate, indicating the portion of potential workers either employed or looking for a job, also remained within a narrow range.

The University of Michigan said its preliminary January measure of consumer sentiment showed a surge in uncertainty about inflation at the same time survey respondents felt better about current financial conditions. The index overall fell marginally from November and was down more than 7% from January 2024. In its report, the university said, “January’s divergence in views of the present and the future reflects easing concerns over the current cost of living this month, but surging worries over the future path of inflation.”

Market Closings for the Week

- Nasdaq – 19162, down 460 points or 2.3%

- Standard & Poor’s 500 – 5827, down 115 points or 1.9%

- Dow Jones Industrial – 41938, down 794 points or 1.9%

- 10-year U.S. Treasury Note – 4.78%, up 0.18 point