Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl,Joel Dresang, engineered by Jason Scuglik)

Week in Review (Dec. 30, 2024-Jan. 3, 2025)

Significant Economic Indicators & Reports

Monday

The National Association of Realtors reported increased demand for housing in November for the fourth month in a row. The trade group reported its pending home sales index rose 2.2% in November and was up nearly 7% from the year before. It was the highest reading since February 2023, though still 21% below the index benchmark set in 2001. The Realtors said homebuyer demand should continue growing as housing shifts from a sellers’ market. The group said homebuyers are lowering expectations for reductions in mortgage rates. Despite recent interest rate cuts by the Federal Reserve, conventional mortgage rates have stayed around 6% for the last two years.

Tuesday

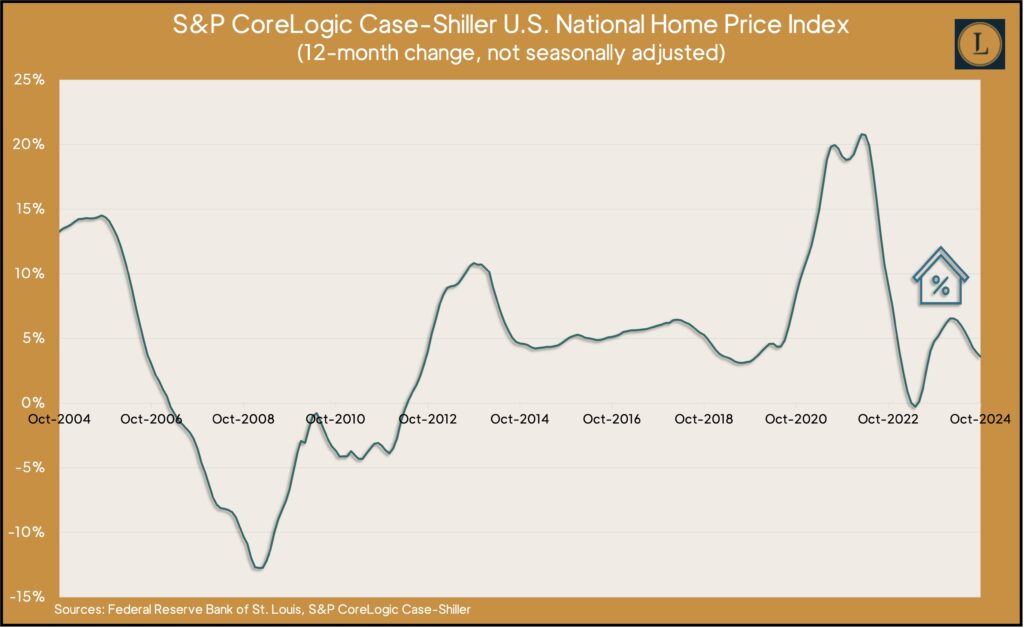

Housing inflation continued to ease in October, though it still outpaced overall inflation. The S&P CoreLogic Case-Shiller national index rose 3.6% from its year-earlier measure. October marked the seventh consecutive deceleration in price increases and the lowest gain in 13 months. Seasonally adjusted, the index hit its 17th all-time high, though a representative for the measure noted that the pace of increases was “well short of the annualized gains experienced this decade.”

Wednesday

Markets and government offices closed for New Year’s

Thursday

The four-week moving average for initial unemployment claims fell for the first time in five weeks, suggesting ongoing strength in the labor market. The indicator of employers’ willingness to let workers go was 39% below its 57-year average, according to Labor Department data. Total claims – including ongoing cases – numbered nearly 2 million in the latest week, up 4.3% from the previous week and up 6% from where it stood at the same time in 2024.

U.S. construction spending was unchanged in November. Data from the Commerce Department showed the seasonally adjusted annual rate of construction expenditures leveling off since reaching a record high of nearly $2.2 trillion in May. Construction spending was 3% ahead of its pace in November 2023. Spending on residential construction – accounting for 43% of the total – also increased 3% from the year-ago pace.

Friday

The Institute for Supply Management reported that its manufacturing index signaled contraction in December for the ninth month in a row and the 25th time in 26 months. Based on surveys of supply managers, the index showed the industry slumping slightly less than in November. With expansion in key components such as new orders and production, the index was the closest to registering overall growth since March. The trade group said its index suggested the overall economy was growing at an annual rate of 1.9%.

Market Closings for the Week

- Nasdaq – 19622, down 100 points or 0.5%

- Standard & Poor’s 500 – 5942, down 28 points or 0.5%

- Dow Jones Industrial – 42732, down 260 points or 0.6%

- 10-year U.S. Treasury Note – 4.59%, down 0.03 point