Podcast: Play in new window | Download

Advisors on This Week’s Show

(with Max Hoelzl, and Joel Dresang, engineered by Jason Scuglik)

Week in Review (October 7-11, 2024)

Significant Economic Indicators & Reports

Monday

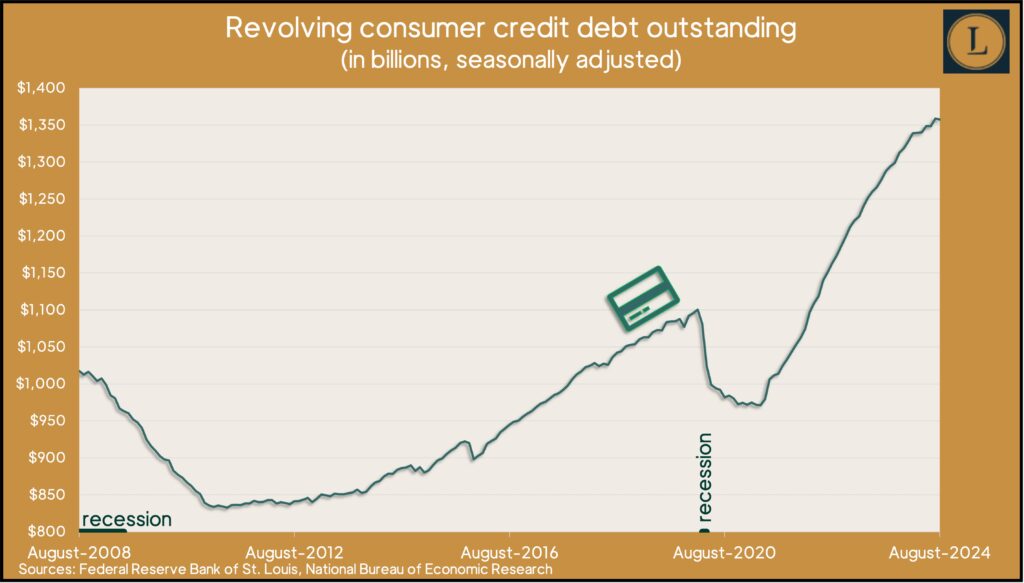

Consumers showed more caution about spending in August, as the amount of credit card debt outstanding fell for the second time in three months. The Federal Reserve Board reported that so-called revolving debt declined at an annual rate of 1.2% from July. The rate sank 0.4% in June. But in July, credit card debt rose over 9%. Economists watch revolving debt as a sign of confidence among consumers, whose spending accounts for about two-thirds of gross domestic product. Total consumer debt outstanding, including car financing and student loans, rose in August at a 2.1% annual rate.

Tuesday

The U.S. trade deficit shrank by nearly 11% in August to $70.4 billion, the Bureau of Economic Analysis reported. The gap between imported goods and services and the value of goods and services the U.S. sells elsewhere detracts from overall economic output. Compared to July, U.S. exports rose 2% and imports declined by 0.9%. Through the first eight months of the year, the trade gap widened nearly 9% from the year before, with exports up 4% and imports up 5%.

Wednesday

No major announcements

Thursday

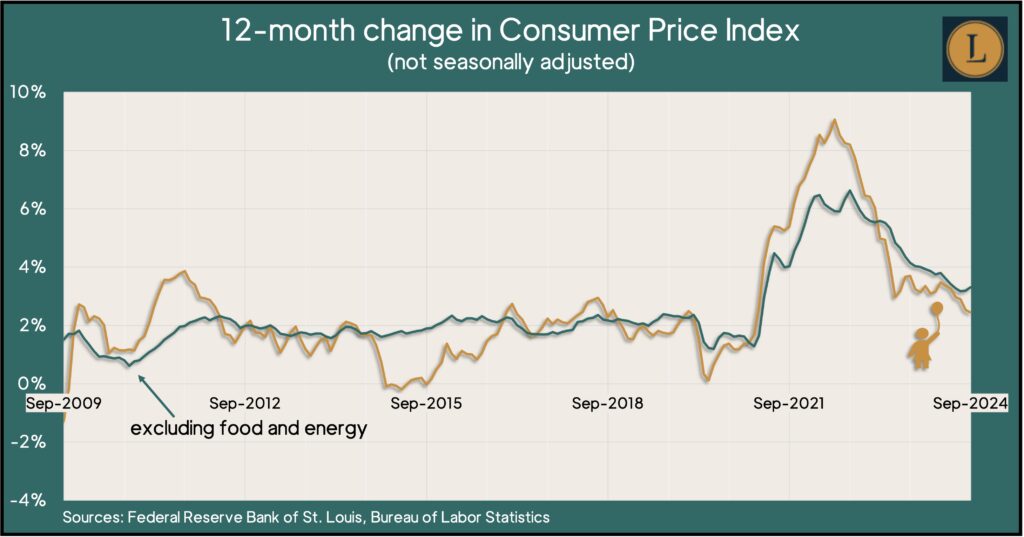

Shelter costs and food accounted for 75% of the 0.2% increase in inflation in September, as the 12-month pace of prices slowed to its lowest level since early 2021. The Bureau of Labor Statistics said the government’s broadest measure of inflation, the Consumer Price Index, rose 2.4% from the year before. The index was down from a four-decade high of 9.1% in mid-2022. The monthly gain included continued price increases for shelter costs and higher food prices, featuring an 8% jump in egg prices. Gas prices dropped 4% in September. The core CPI, which strips out volatile costs for food and energy, rose 0.3% from August and 3.3% from September 2023. Shelter contributed 65% of the core’s one-year increase.

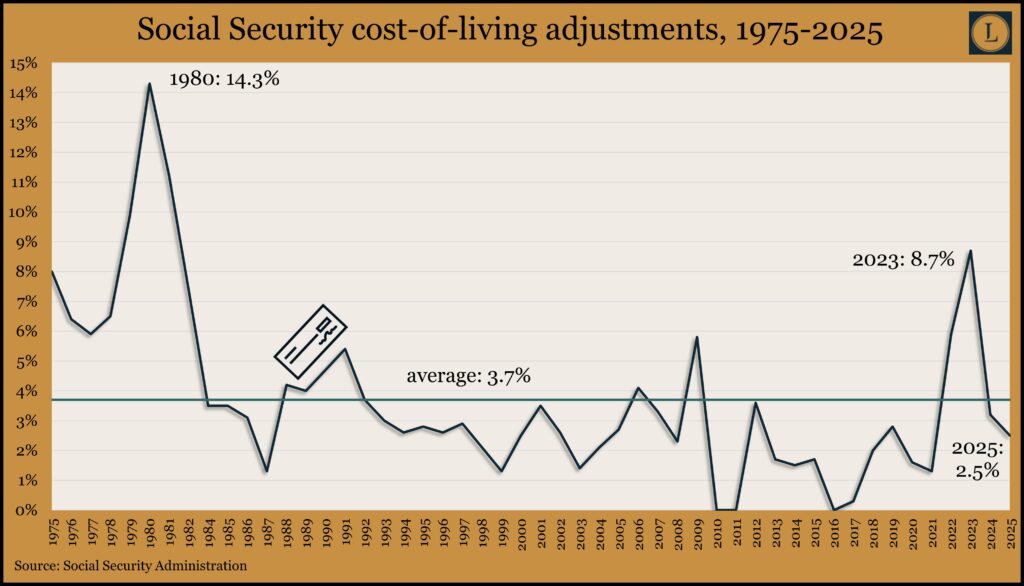

Based on CPI data, the Social Security Administration announced a 2.5% adjustment to benefits in 2025. That was a drop from 3.2% in 2024 and 8.7% in 2023, the biggest raise for Social Security recipients since 1981. The average cost-of-living adjustment since Social Security began adjusting benefits to inflation in 1976: 3.7%. Social Security said the average recipient can expect an added $50 or so in their benefit checks, beginning in January.

The four-week moving average for initial unemployment claims rose for the first time in four weeks but continued to reflect a historically tight labor market. The average was 37% below the all-time average, begun in 1967, according to data from the Labor Department. More than 1.6 million Americans claimed jobless benefits in the most recent week, down 0.9% from the week before but up nearly 2% from the same time last year.

Friday

Prices on the wholesale level were unchanged overall in September and rose at their lowest annual rate since February. The Bureau of Labor Statistics said its Producer Price Index stayed even with August in part because of a 3% dip in energy costs. Demand for goods declined at the same margin as the increase in demand for services. Since September 2023, the PPI rose 1.8%, the slightest rate in seven months. Excluding volatile prices for food, energy and trade services, the core PPI advanced 0.1% for the month and was up 3.2% from the year before, which was the lowest in three months.

A preliminary reading of consumer sentiment in October showed lower confidence than September but within the margin of error, according to the University of Michigan. The longstanding survey-based index was 8% ahead of where it was in October 2023 and 40% above the all-time low in mid-2022. Over the year, consumers have raised expectations on lower fears of inflation, but they have become less approving of current conditions because of higher prices. A university researcher added: “With the upcoming election on the horizon, some consumers appear to be withholding judgment about the longer term trajectory of the economy.”

Market Closings for the Week

- Nasdaq – 18343, up 205 points or 1.1%

- Standard & Poor’s 500 – 5815, up 64 points or 1.1%

- Dow Jones Industrial – 42864, up 511 points or 1.2%

- 10-year U.S. Treasury Note – 4.08%, up 0.09 point