Podcast: Play in new window | Download

Advisors on This Week’s Show

Kyle Tetting

Dave Sandstrom

Tom Pappenfus

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (June 10-14, 2024)

Significant Economic Indicators & Reports

Monday

No major reports

Tuesday

No major reports

Wednesday

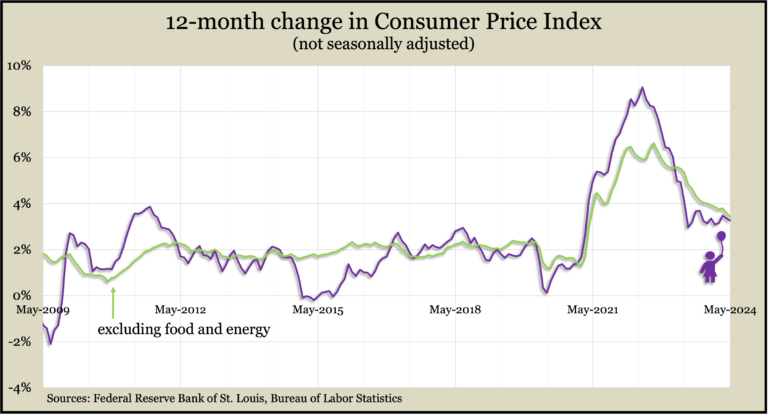

The broadest measure of inflation slowed for the second month in a row, suggesting progress in the Federal Reserve’s efforts to control the cost of living. The Consumer Price Index rose 3.3% in the 12 months ended in May, down from a decades-high 9.1% in June 2022 but still well ahead of the Fed’s long-range target of 2%. According to the Bureau of Labor Statistics, inflation made no change from April as gas prices declined 3.6% and shelter costs rose 0.4% for the fourth month in a row. Shelter costs were up 5.4% from the year before, the smallest gain in two years. Excluding volatile prices for food and energy, the so-called core CPI rose 3.4% from May 2023, the slimmest increase since April 2021.

Thursday

Lower gas prices also helped slow inflation on the wholesale level in May. The Bureau of Labor Statistics said the Producer Price Index declined 0.2% from April, falling for the second time in three months. Gas prices dropped 7%, accounting for about 60% of the drop in the cost of goods. Excluding volatile prices for food, energy and trade services, the core PPI was unchanged from April. Compared to 12 months earlier, wholesale inflation rose 2.2% in May, the first deceleration in the rate in four months. That compared to more than 11% in June 2022. Core PPI was up 3.2% from May 2023.

The four-week moving average for initial unemployment claims rose for the fifth time in six weeks to its highest level since September. Still, the indicator of employers’ willingness to let workers go remained 38% below its 57-year average. According to the Labor Department, total claims for jobless benefits reached nearly 1.7 million, up slightly from the week before and up 4.6% from the same time last year.

Friday

The University of Michigan reported no significant change in its consumer sentiment index from May. A preliminary June reading of the longstanding survey-based indicator showed optimism up 31% from historic lows two years ago, though still below average historically. Consumer expectations for inflation remained steady at 3.3% for the next year and 3.1% longer term. Respondents expressed slightly rising concerns about higher prices and limited incomes. Economists see consumers’ sentiment as a predictor of their spending, which generates two-thirds of U.S. economic growth.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 17689, up 556 points or 3.2%

- Standard & Poor’s 500 – 5432, up 85 points or 1.6%

- Dow Jones Industrial – 38589, down 210 points or 0.5%

- 10-year U.S. Treasury Note – 4.21%, down 0.22 point