Podcast: Play in new window | Download

Landaas & Company newsletter December edition now available.

Advisors on This Week’s Show

Steve Giles

Dave Sandstrom

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (Dec. 11-15, 2023)

Significant Economic Indicators & Reports

Monday

No major announcements

Tuesday

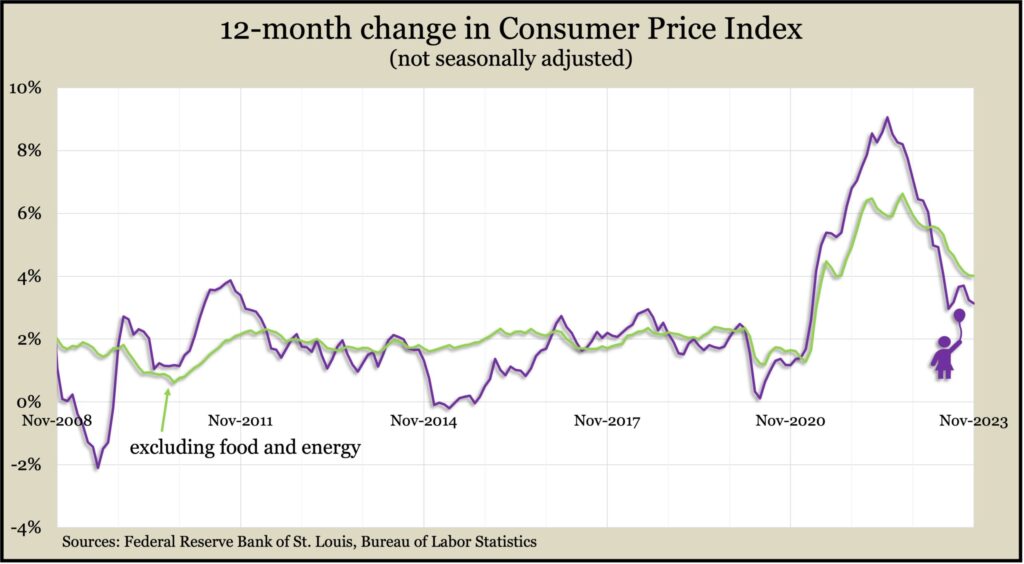

The broadest measure of inflation continued to ease in November, declining on a year-to-year rate to 3.1%. The Bureau of Labor Statistics reported that the Consumer Price Index was still above the long-range Federal Reserve target of 2%, but it was down from a four-decade high of 9.1% in June 2022. For the month, the CPI added 0.1% from October as shelter costs edged up and gas prices declined. Excluding volatile costs for energy and food, the core 12-month inflation rate was 4%, tied with October as the lowest since August 2021.

Wednesday

Inflation on the wholesale level flattened in November, as the Producer Price Index remained unchanged following a 0.4% decline in October. Compared to the year before, the PPI rose 0.9%, the lowest since June, which was the slimmest advance since the early months of the COVID-19 pandemic. Excluding food, energy and trade, the core PPI rose 0.1% for the month and was up 2.5% from Nov. 2022.

The policy-making committee of the Federal Reserve Board held steady on short-term interest rates, deciding not to change the cost of short-term borrowing for its third meeting since July. Since March 2022, the Fed had raised rates 10 times to their highest level in 22 years in an effort to control four-decade high inflation. The Federal Open Market Committee projected this week that it would lower borrowing costs by three-quarters of a percentage point by the end of 2024,

Thursday

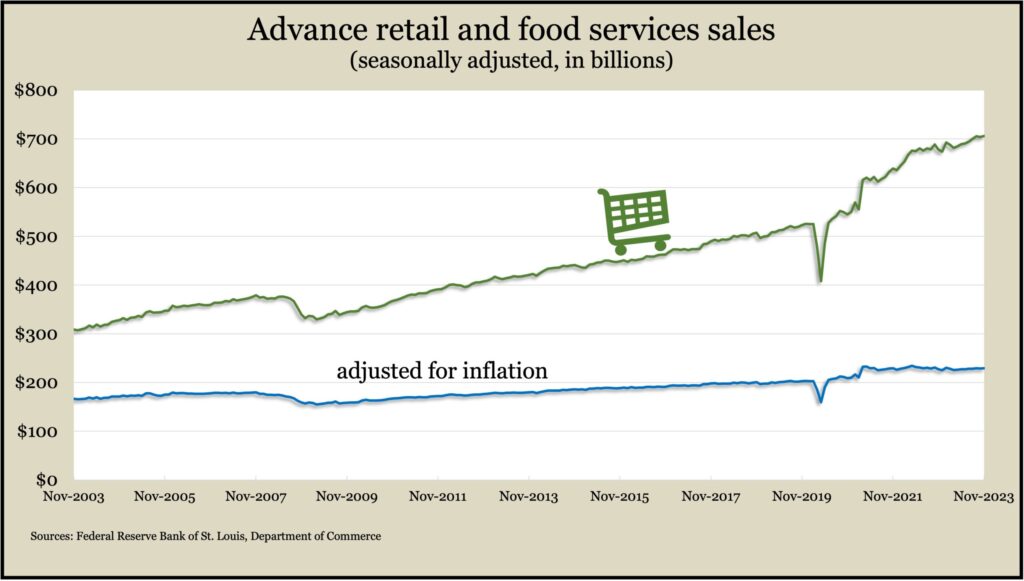

The Commerce Department reported a 0.3% increase in retail sales in November, more than reversing a decline of 0.3% in October. The rise was broadly distributed: Eight of 13 major categories had higher sales in November, excluding gas stations, where lower prices cut into revenue. Consumer spending notably rose at bars and restaurants, often an indicator of consumer confidence. About two-thirds of U.S. economic activity is driven by consumer spending. Compared to November 2022, only two retail categories had lower sales, besides gas stations: Furniture stores and home-and-garden centers.

The four-week moving average for initial unemployment claims fell for the third time in four weeks, dipping to 42% below its 56-year average. Although data can be marginally affected by seasonal downtime, including around Thanksgiving, the Labor Department reported total claims rising 18% from the week before to nearly 1.9 million. That’s also up about 18% from where it stood the year before but still suggested employers’ reluctance to let workers go.

Friday

The return of striking autoworkers helped boost industrial production in November, according to the Federal Reserve. Total industrial output rose 0.2% in November, though it lagged 0.4% from the year before. Manufacturing production was up 0.3% from October but was down 0.2% excluding automotive. Capacity utilization rate, an early indicator of inflation pressure, rose marginally to 78.8% in November, staying below the 50-year average of 79.7%.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 14814, up 410 points or 2.8%

- Standard & Poor’s 500 – 4719, up 115 points or 2.5%

- Dow Jones Industrial – 37309, up 1061 points or 2.9%

- 10-year U.S. Treasury Note – 3.93%, down 0.32 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.