Podcast: Play in new window | Download

Landaas & Company newsletter October edition now available.

Advisors on This Week’s Show

KYLE TETTING

STEVE GILES

KENDALL BAUER

(with Max Hoelzl, and Joel Dresang, engineered by Jason Scuglik)

Week in Review (Oct. 23-27)

Significant Economic Indicators & Reports

Monday

No major releases

Tuesday

No major releases

Wednesday

The annual rate of new home sales jumped 12% in September to its fastest pace since February 2022, just before the Federal Reserve began raising interest rates. The volatile indicator from the Commerce Department was 34% ahead of its pace in September 2022 and above the level just before the COVID pandemic. The supply of new houses available for sale reached its lowest level in a year and a half, though it remained higher than just before the pandemic. The median sale price was $418,800, down 12% from the year before.

Thursday

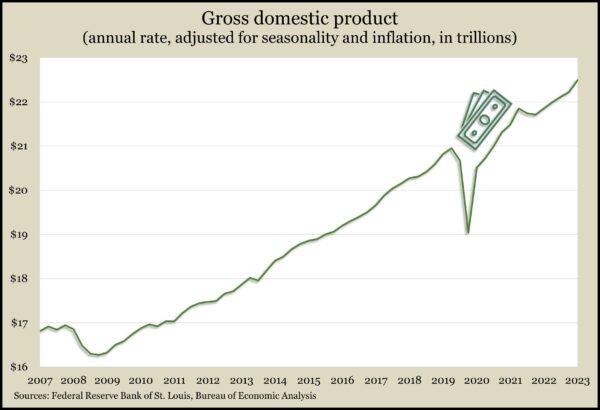

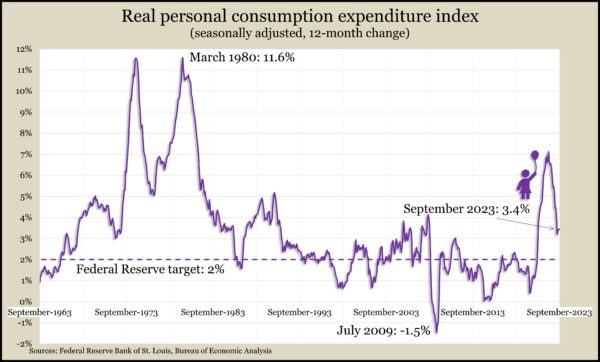

The U.S. economy rose at an annual pace of 4.9% in the third quarter, the fastest rate in seven quarters. Adjusted for inflation, gross domestic product reached a record $22.2 trillion and was up 2.9% from the year before, according to the Bureau of Economic Analysis. Consumer spending, which generates about 70% of economic activity, advanced at a 4% annual rate, also the highest since the end of 2021. Spending on housing increased for the first time in 10 quarters. The Federal Reserve Board’s preferred measure of inflation rose 3.4% from the third quarter of 2022, down from a four-decade high of 6.8% in mid-2022. The Fed’s long-range target is 2%.

Demand for long-lasting manufactured products rose 4.7% in September, the first gain in three months. The Commerce Department said durable goods orders through the first nine months of 2021 were up 4.4% from the same time in 2022. Orders for commercial aircraft led the monthly increase, but excluding the volatile transportation category, orders rose just 0.5% from August. Year to year, orders excluding transportation also rose 0.5%. Core capital goods orders, a proxy for business investment, rose 0.6% from August and were up 1.9% from September 2022.

The four-week moving average for initial unemployment claims rose for the first time in eight weeks. Data from the Labor Department showed the new-claim average was still 43% below the 56-year average, a reminder of the relatively tight labor market. In the latest week, just below 1.6 million Americans claimed jobless benefits, down 0.8% from the week before but up 25% from the year before.

The National Association of Realtors said its pending home sales index rose 1.1% in September, though it was still down 11% from the year before. The trade association blamed 20-year high mortgage rates and tight inventories for keeping prices high and dampening demand. The group forecast a 17.5% decline in home sales for 2023 to 4.15 million units. It projected a 13.5% rebound in 2024 to 4.71 million. The Realtors estimated the median sales price to reach $389,500 in 2024, which would be a 0.7% increase from their projection for 2023.

Friday

The Bureau of Economic Analysis said consumer spending rose 0.7% in September, as personal income gained 0.3%, lowering the personal saving rate to 3.4% of disposable income, the lowest since December. Consumer spending increased both in goods (led by new cars) and services (led by international travel). The personal consumption expenditures index, the Federal Reserve’s favorite measure for inflation, stayed at a year-to-year rate of 3.4% for the third month in a row. That’s down from a 20-year high of 7.1% in June 2022 and still up from the Fed’s long-run target of 2%.

Often a pre-cursor to spending, consumer sentiment sank in October but stayed above year-ago levels, which were near all-time lows. The University of Michigan reported that its survey-based index declined because of ongoing concern over inflation as well as uncertainty over domestic and international headlines. Consumers with higher incomes and heavier stock holdings drove the decline. Survey respondents expected inflation to reach 4.2% next October, the highest forecast since May. Long-term expectations stayed in the 2.9% to 3.1% range.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 12643, down 341 points or 2.6%

- Standard & Poor’s 500 – 4117, down 107 points or 2.5%

- Dow Jones Industrial – 32418, down 710 points or 2.1%

- 10-year U.S. Treasury Note – 4.85%, down 0.08 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.