Podcast: Play in new window | Download

Landaas & Company newsletter July edition now available.

Advisors on This Week’s Show

Kyle Tetting

Steve Giles

Tom Pappenfus

(with Max Hoelzl and Joel Dresang, engineered by Jason Scuglik)

Week in Review (July 17-21, 2023)

Significant economic indicators & reports

Monday

No major releases

Tuesday

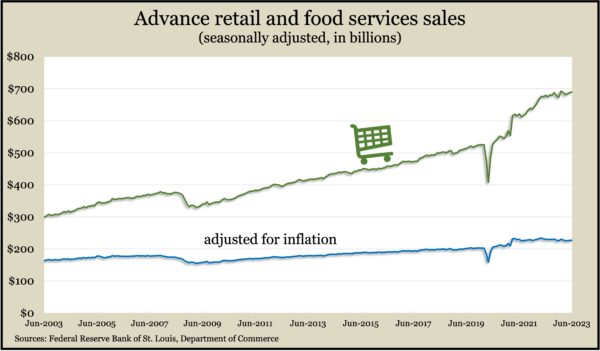

A key measure of consumer spending showed signs of slowing in June. Retail sales rose 0.2% from May, but only seven of 13 categories gained, with lower sales reported among gas stations, grocery stores, home-and-garden centers and others. Noting that retail sales represent about two-thirds of consumer spending, which is the prime driver of U.S. economic growth, the Commerce Department reported that sales were up 1.5% from June 2022. Adjusted for inflation, sales were unchanged from May and down nearly 2% from the year before.

The Federal Reserve said industrial production weakened in June, declining for the second month in a row. Output from manufacturing, mining and utilities was down 0.4% from June 2022. In particular, the production of long-lasting consumer goods dropped off in June but still posted a positive second quarter. Industrial capacity use declined to 78.9%, the second month in a row below its 50-year average of 79.7%. A high usage rate can signal rising inflation.

Wednesday

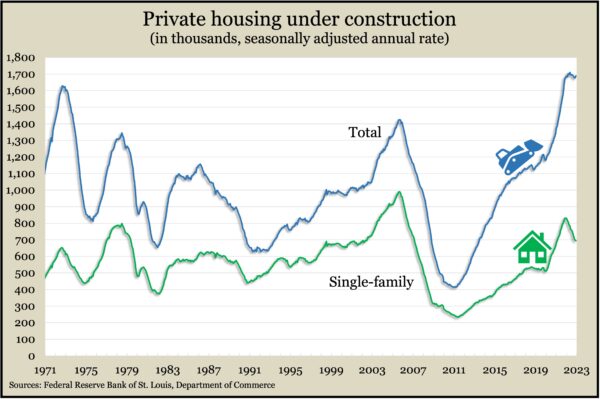

The U.S. housing market continued to weaken in June following a year of higher mortgage rates. The annual pace for both housing starts and building permits declined from May and lagged the June 2022 level as well. The Commerce Department report showed housing under construction remaining near an all-time peak, although the pace of construction for single-family houses kept trending lower.

Thursday

The pace of existing home sales continued to slow in June, dipping 3% from May and remaining 19% behind the rate in June 2022. The National Association of Realtors said through the first half of the year, sales were down 23% from the same time last year. An ongoing concern: Inventory. The supply of houses for sale in June remained about the same as in May but was down 14% from the year before and only about half the level the market could absorb, the trade group said. The median price of a house sold in June was $410,200, slightly below the record high set in June 2022.

The four-week moving average for initial unemployment claims fell for the third week in a row, reflecting employers’ reluctance to let workers go in an historically tight labor market. Average claims dropped 35% below the all-time average dating back to 1967, according to the Labor Department. In the latest week, total claims dropped 0.9% to 1.7 million, up 29% from the year before but down from 12.6 million at the same time in 2021.

The Conference Board said its index of leading economic indicators continued to point to a U.S. recession. The index from the business research group fell 0.7% in June, its 15th consecutive deceleration, which is the longest streak since the months leading up to the Great Recession. The group said the index fell 4.2% in the first half of 2023, compared to a decline of 3.8% in the second half of 2022. The Conference Board forecast a recession from the current quarter to the first quarter of 2024. It cited inflation, interest rates, tighter lending and reduced government spending as forces to further slow the economy.

Friday

No major announcements

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 14033, down 81 points or 0.6%

- Standard & Poor’s 500 – 4536, up 31 points or 0.7%

- Dow Jones Industrial – 34228, up 719 points or 2.1%

- 10-year U.S. Treasury Note – 3.91%, up 0.09 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.