Podcast: Play in new window | Download

Landaas & Company newsletter April edition now available.

Advisors on This Week’s Show

Kyle Tetting

Adam Baley

Dave Sandstrom

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (April 3-7, 2023)

SIGNIFICANT ECONOMIC INDICATORS & REPORTS

Monday

U.S. factories remained in a slump in March, according to the Institute for Supply Management. The trade group said its manufacturing index suggested the sector contracted for the fifth month in a row, hitting its lowest reading since May 2020, amid the COVID pandemic lockdown. Based on past trends, the ISM said, the index suggested the gross domestic product sank in March at an annual rate of 0.9%.

The Commerce Department said construction spending declined by 0.1% in February to a seasonally adjusted annual rate exceeding $1.8 billion. The pace was 5% ahead of the year before. Spending on residential construction, which accounts for nearly half of the total, fell by 0.6% from January and was down more than 5% from February 2022. Economists have blamed higher mortgage rates for dampening demand in housing.

Tuesday

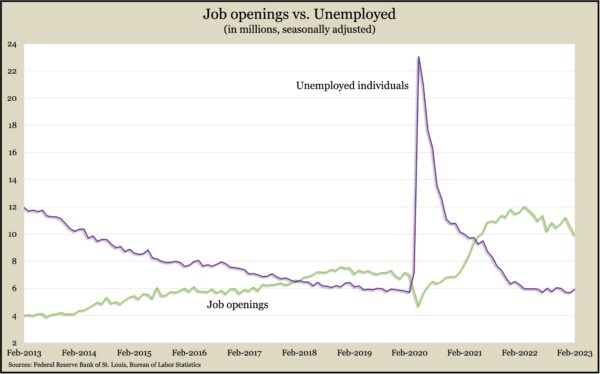

Employers posted fewer job openings in February, but the labor market remained relatively tight. Postings dropped to 9.9 million, the lowest since May 2021, after reaching a record 12 million openings last March. Still, job openings outnumbered the 7 million just before the COVID pandemic and was 4 million more than the number of unemployed job seekers in February. Other signs of a stronger employment market: Layoffs and firings fell slightly, and slightly more people quit their jobs, a sign of worker confidence.

The Commerce Department reported a 0.7% decline in manufacturing orders in February, the third setback in four months. Demand for aircraft led the declines. Excluding the volatile transportation category, factory orders fell 0.3% from January. Compared to February 2022, total orders were up 3% and up 3.1% excluding transportation. Core capital goods orders, a proxy for business investments, fell 0.1% for the month and were up 4.3% from the year before.

Wednesday

The U.S. services sector expanded in March, though at a slower rate, according to the Institute for Supply Management. The trade group’s services index indicated the third month in a row of growth. Except for a setback in December, the service sector has expanded in 33 of the last 34 months. Based on surveys with purchasing managers, the index showed orders for services cooling while hiring conditions were mixed and supplier deliveries remained at the swiftest pace in 14 years. Overall, survey respondents expressed optimism about current business conditions.

The U.S. trade deficit in February grew to its widest gap in four months as exports shrank more than imports. The Bureau of Economic Analysis said the deficit expanded nearly 3% to $70.5 billion. A 2.7% decline in exports was led by lower demand abroad for U.S.-produced pharmaceuticals, industrial supplies and cars. Imports fell 1.5%, led by cell phones, cars and trucks. The trade deficit detracts from economic growth, as measured by gross domestic product.

Thursday

After the Labor Department updated calculation methods to better reflect seasonal fluctuations, the four-week moving average for initial unemployment claims fell for the first time in nine weeks. Average claims reached 237,750 in the week ended April 1, up 11% from the year before and down 35% from the 56-year average. Total claims fell less than 1% in the latest week to 1.9 million, up from 1.7 million at the same time last year.

Friday

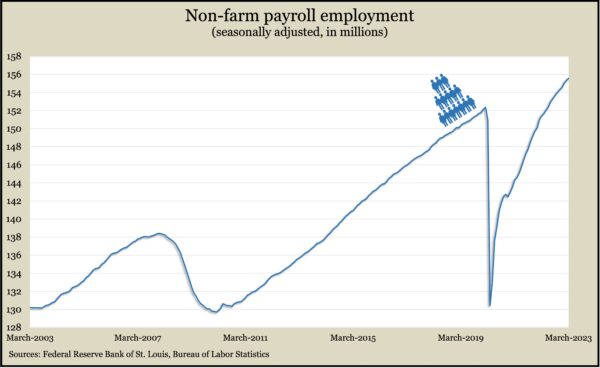

U.S. employers continued to add jobs in March but at the slowest pace in more than two years. The jobs report from the Bureau of Labor Statistics showed 236,000 more jobs in March, down from the six-month average of 334,000 and the lowest since a decline in December 2020. The payroll count rose 2.2% above its level in February 2020, just before the COVID pandemic. The leisure and hospitality industry accounted for 30% of the gain in March, although making up less than 10% of total U.S. employment. Average hourly wages rose 4.2% from the year before, the smallest gain since June 2021. The unemployment rate was 3.5%, down from 3.6% in February. Unemployment has been hovering near 54-year lows since early last year.

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 12088, down 134 points or 1.1%

- Standard & Poor’s 500 – 4105, down 4 points or 0.1%

- Dow Jones Industrial – 33485, up 211 points or 0.6%

- 10-year U.S. Treasury Note – 3.29%, down 0.21 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.