Podcast: Play in new window | Download

Landaas & Company newsletter March edition now available.

Advisors on This Week’s Show

Kyle Tetting

Steve Giles

Kendall Bauer

(with Max Hoelzl, Joel Dresang, engineered by Jason Scuglik)

Week in Review (March 13-17, 2023)

SIGNIFICANT ECONOMIC INDICATORS & REPORTS

Monday

No major announcements

Tuesday

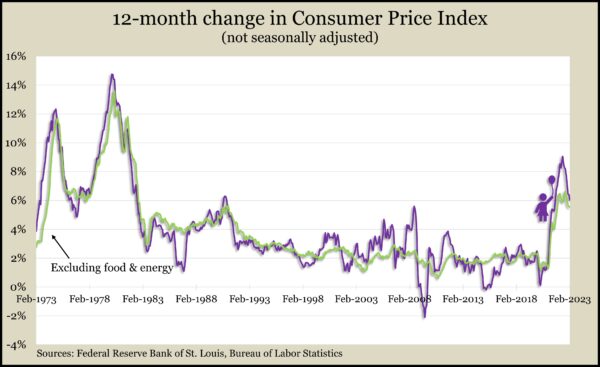

The broadest measure of inflation continued narrowing in February but remained far above the 2% long-range target of the Federal Reserve. The Consumer Price Index rose 6% from February 2022, unadjusted for inflation. That was down from 6.4% in January and the lowest rate since September 2021. The annual rate decelerated for the eighth month in a row after exceeding 9% last June. The Bureau of Labor Statistics said shelter costs accounted for 70% of the monthly gain in the price index while higher food costs offset lower prices overall. The core CPI, which excludes volatile food and energy costs, rose 5.5% from the year before, the lowest rate since December 2021.

Wednesday

Signs of moderation appeared in wholesale inflation numbers for February. The Bureau of Labor Statistics said its Producer Price Index sank 0.1% from January, the second contraction in three months. Prices for goods led the decline, but service costs also went down. Excluding food, energy and trade services, the core PPI rose 0.2% from January. Year to year, unadjusted for inflation, the headline PPI rose 4.6% in February, slowing for the eighth month in a row, down from 11.6% last March. The core PPI rose 4.4% from the year before, unchanged from January.

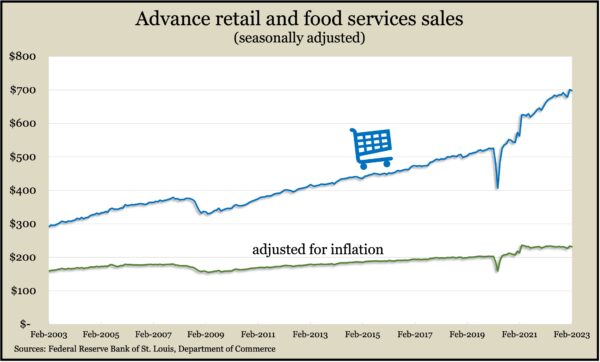

U.S. consumer spending dipped in February, as retail sales fell 0.4%, according to the Commerce Department. That was down from a gain of 3.2% in January. Sales declined in eight of 13 retail categories, led by bars and restaurants, furniture stores, car dealers and gas stations. Adjusting for inflation, retail sales slipped by 0.8% in February, the third decline in four months. Economists watch retail sales for signs of consumer spending, which drives about two-thirds of the gross domestic product.

Thursday

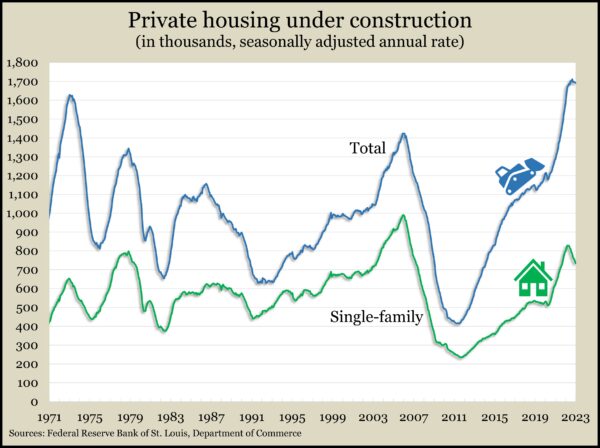

The pace in housing starts rose 9.8% in February, though it was down 18% from the year earlier and 16% below the pace just before the pandemic. The Commerce Department and Department of Housing and Urban Development reported that multi-family residences continued to outpace single-family structures. The disparity was particularly noticeable in the pace of housing under construction, where single-family units have been dropping for eight months straight. Though building permits were down from February 2022, they were ahead of the pre-pandemic level and close to their level in early 2007.

The four-week moving average for initial unemployment claims fell for the first time in four weeks, reaching 47% below the 56-year average. Data from the Labor Department continued to suggest a tight job market in which employers are reluctant to let workers go. Some 2 million individuals were claiming jobless benefits in the latest week, up 4% from the week before and up 2% from the year before that.

Friday

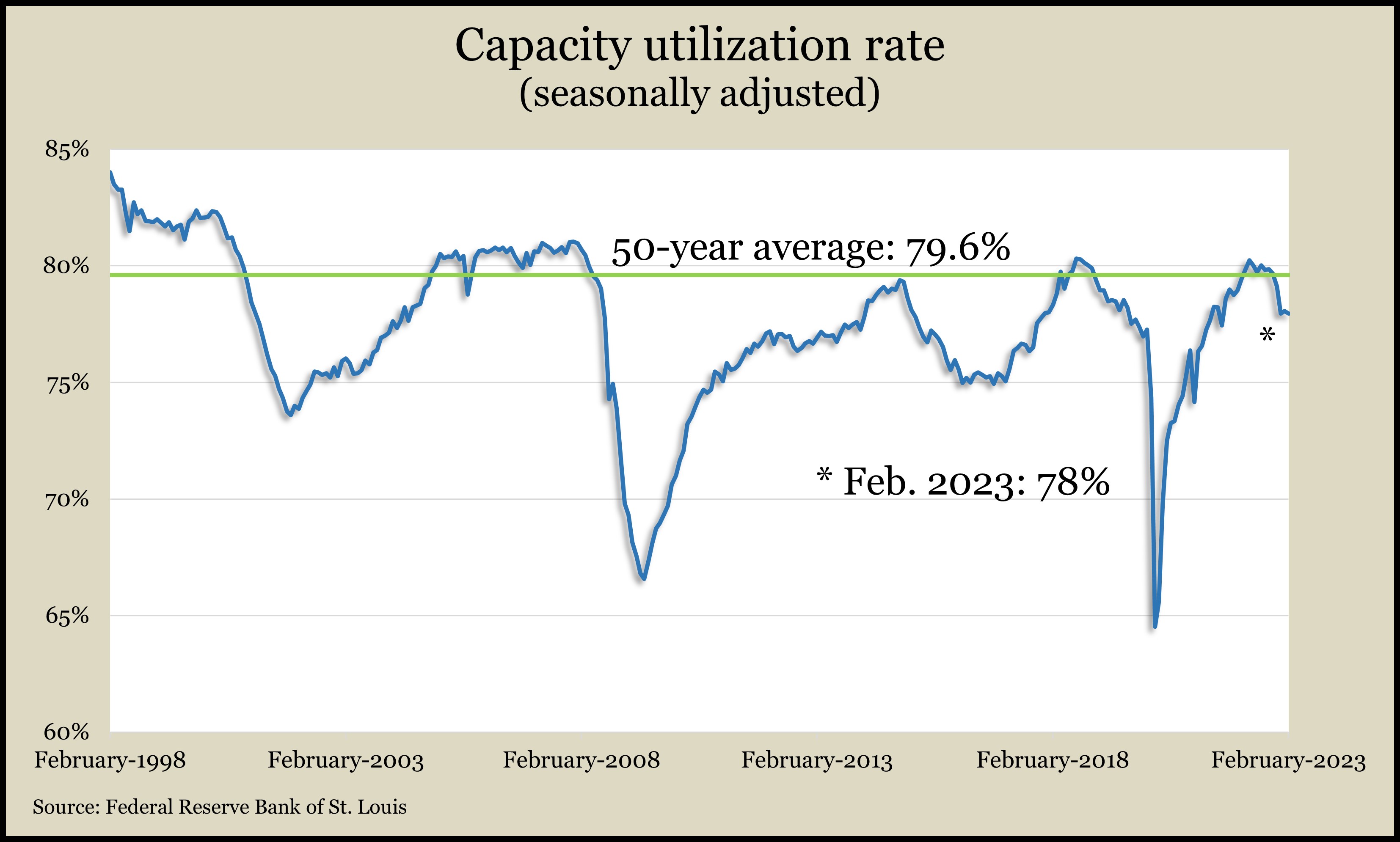

U.S. industrial output was unchanged in February after a slight gain in January, its first expansion in four months. Total production declined 0.2% from the year before. The Federal Reserve reported that manufacturing production increased slightly for the second month in a row but was down 1% from February 2022. Capacity utilization—considered a leading indicator of inflation—also was unchanged from January and remained below the 50-year average for the fourth month in a row.

Both current economic conditions and expectations scored lower in a preliminary March reading of consumer sentiment. The University of Michigan said its longstanding survey showed consumers downgrading the economy for the first time in four months–mostly among respondents who were young with low levels of education and income. Expectations for inflation edged down from recent months, but the survey director said sentiment should remain volatile.

The Conference Board’s index of leading economic indicators dropped 0.3% in February, with only stock prices and building permits slightly offsetting negative or flat contributions from eight other components. The decline was the 11th in a row for the index, which fell 3.6% since August, vs. a 3% setback over the previous six months. The business research group said rising interest rates and tightening consumer spending are likely to send the economy into a recession “in the near term.”

MARKET CLOSINGS FOR THE WEEK

- Nasdaq – 11631, up 492 points or 4.4%

- Standard & Poor’s 500 – 3917, up 55 points or 1.4%

- Dow Jones Industrial – 31859, down 51 points or 0.2%

- 10-year U.S. Treasury Note – 3.40%, down 0.30 point

Not a Landaas & Company client yet? Click here to learn more.

More information and insight from Money Talk

Money Talk Videos

Follow us on Twitter.