Learn more

Volatility: Stock market vs. your portfolio, a Money Talk Video with Kyle Tetting

The case for active funds amid volatility, a Money Talk Video with Kyle Tetting

By Joel Dresang

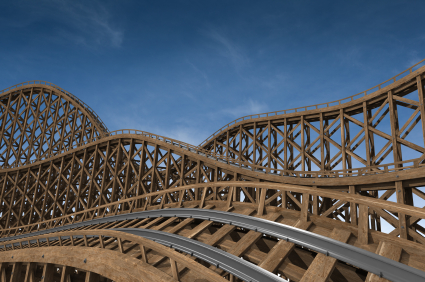

The word “volatility” describes stock prices taking off then plummeting, soaring like an eagle, then diving like a loon.

Volatility imposes itself on investors as a risk factor. Frequent flying high then plunging low can be nerve-racking for stock market watchers. Consider these observations from Money Talk Videos:

- “Understand that markets bounce around. It’s what they do,” Kyle Tetting says. “There is a risk to investing, there are uncertainties as part of investing, and that leads to price movement.”

- “As prices go up and down more frequently and in bigger chunks,” Marc Amateis explains, “investors might become more inclined to want to just do something. And that’s dangerous. Volatility in itself doesn’t hurt you. It’s how you react to the volatility that can hurt you.”

- “Volatility has a tendency to introduce those two things that are our worst enemy—fear and greed,” says Dave Sandstrom. “We have to be careful in those deep sell-offs not to get afraid and sell out at the absolutely worst time. And we also have to be careful about seeing the markets go higher and higher, have that fear of missing out, and then buy in at the absolute top.”

Volatility involves both the rise and fall of investment values, although it’s the downward movement that gets the most attention.

Which is curious because the word “volatility” comes from a one-direction trip upward. Merriam-Webster notes that “volatile” derives from the French voler—”to fly,” which originated in the Latin volatilis—“winged.” (A hit Italian pop song from 1958 was best known as “Volare.”)

In A Dictionary of the English Language, from 1755, Samuel Johnson defined “volatile” only as “a winged animal.” Over the years, the word transformed into a reference to unstable liquids such as alcohol and ether that easily turn to gas. Based on the “frequency and breadth of usage,” Merriam-Webster explains, the meaning of “volatile” changed over time.

In his American Dictionary of the English Language, from 1828, Noah Webster included “lively” and “fickle” in the definition of “volatile.” By the 1850s, American newspapers were using the expression “volatile stock market,” that is so common to investors today.

So, as modern usage suggests volatile markets are flighty, savvy investors know not to take flight from volatility.

Joel Dresang is vice president-communications at Landaas & Company.

For What It’s Worth is an occasional look at the meanings and origins of words and expressions investors may encounter.

(initially posted February 27, 2020)