By Adam Baley

Retirement savings accounts such as IRAs offer tax advantages that can boost your investment returns. Understanding the differences between traditional IRAs and Roth IRAs will help you plan for retirement.

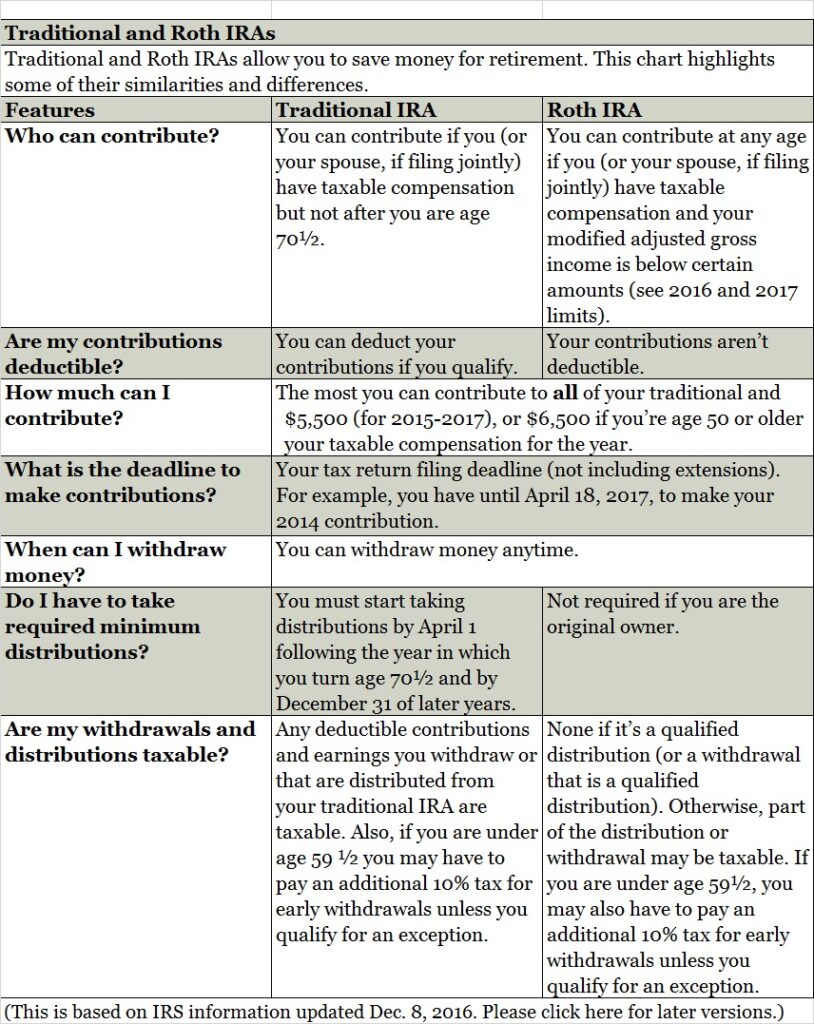

Both traditional and Roth IRAs allow you to contribute earned income up to an annual contribution limit. In general, the contribution limit for 2015 is $5,500 – or, if you are 50 years or older, $6,500. Essentially, traditional IRAs are funded with earnings contributed before they’re taxed, so the withdrawals are taxable; Roth IRAs, meanwhile, are funded with after-tax contributions and can produce tax-free withdrawals.

Comparing IRAs

Traditional IRAs

Contributions may be tax-deductible and can grow tax-deferred. After you’re 59½, distributions from traditional IRAs are treated as taxable income and taxed at your marginal tax rate. The Internal Revenue Service requires you to distribute a minimum amount each year once you reach 70½ years old.

Roth IRAs

Contributions are not deductible and subject to income limitations but grow tax-free. You can withdraw your Roth contributions after five years or after you’re 59½ without penalty or tax. Once in retirement, withdrawals are not taxed, and you are not required to distribute from the account. Your heirs can receive tax-free withdrawals, though they will be required to take minimum distributions.

Understanding the differences between traditional and Roth IRAs opens up planning opportunities and helps you find the right combination of investment vehicles for your retirement plan.

Comparing your tax brackets

One of the most important factors to consider when comparing the two types of IRAs is whether you expect your current marginal income tax rate to be different when you retire.

A traditional IRA makes sense when you expect your marginal income tax rate to be lower in retirement. This can be the case for people who are in their peak earning years. Contributing to a traditional IRA at your peak earnings allows you to defer taxes on your savings until you take withdrawals in retirement, when your tax rate could be lower.

A Roth IRA makes more sense when you expect your marginal income tax rate to be higher in retirement than it is today. This is likely the case for younger workers who are not yet at their peak earnings or if you experience a temporary drop in income. The tax-free compounding of a Roth IRA is particularly beneficial for younger investors who have a long time horizon.

Recent research from the Investment Company Institute shows that nearly one-third of Roth IRA investors are under the age of 40.

Consult with your tax professional to get an idea of how your tax bracket might change in retirement, but also consider diversifying your options. More than 60% of all households with Roth IRAs also own traditional IRAs, according to the ICI study.

Contributing to both

Having “tax diversification” is just as important as investment diversification. Consider all your savings options and, if possible, use both a traditional IRA and a Roth.

Typically, workers save for retirement through employer-sponsored plans such as 401(k)s, which are similar to a traditional IRA. But many also contribute to an individual Roth. Owning both provides a form of tax diversification, which allows some flexibility in retirement.

Consider this example. You are 68, retired and need $20,000 from your savings to replace a car. Your marginal tax rate is 20%.

1. You own a traditional IRA.

To get that $20,000 car, you would withdraw $25,000 from your IRA and pay $5,000 in taxes (25%). That $20,000 car just cost you $25,000. It also increased your taxable income for that year by $25,000. Depending on your other sources of income, you may have unknowingly moved into a higher tax bracket.

2. You own both a traditional IRA and a Roth.

To purchase the $20,000 car, you have a choice to withdraw from the traditional IRA, the Roth or a combination of the two. If you take it all from the Roth, $20,000 is disbursed tax-free, and your taxable income remains unchanged.

Having different tax-status accounts provides flexibility in choosing how much income – and tax – you want to incur in retirement.

Roth can be for more than just retirement

For young savers, especially those with children, a Roth IRA can help save for retirement while simultaneously setting aside money for other life expenses, such as college education.

Learn more

- When Roth Conversions Make Sense, by Art Rothschild

- An overview of IRAs from the Internal Revenue Service

A Roth IRA allows you to withdraw your contributions without taxes or penalties anytime. However, to take out earnings, you face a 10% early withdrawal penalty before age 59½. The penalty can be waived if you withdraw earnings to pay for qualified education expenses.

Your Roth will not be counted as an asset when determining your child’s eligibility for financial aid. However, Roth withdrawals can impact the child’s financial aid considerations in the year following the distribution.

Remember that your Roth IRA is first and foremost retirement money, but if your savings objectives change, the flexibility of a Roth allows you to be ready for other life events.

As you save for retirement, understand the key features of traditional and Roth IRAs. Determine where they fit into your savings plans and how they might provide tax diversification and spending flexibility.

As always, include your tax professional in your decision making.

Adam Baley is a registered representative and investment advisor at Landaas & Company.

(initially posted July 27, 2015; updated Jan. 2017)